Shapella Hard Fork Successfully Implemented on Ethereum Mainnet, Brings Platform Closer to Full PoS System

The Shapella hard fork has been successfully implemented on the Ethereum mainnet, enabling Ethereum validators to withdraw their staked Ether (ETH) from the Beacon Chain.

This highly anticipated upgrade took effect precisely at 10:27 pm UTC on April 12.

Within the first hour of the hard fork, beaconchai.in, an Ethereum block explorer, reported a total of 12,859 Ether unlocked in 4,333 withdrawals. This development caused a decline in the ticker value of Ether, which fell to $1,912.

At present, nearly 44% of validators, which equates to 248,043 out of a total of 559,549 active validators, can opt for either a partial or full withdrawal.

The majority of withdrawals at the moment fall between 2.8 to 3.2 ETH, which indicates that it’s primarily staking rewards that are being withdrawn. These withdrawals coincide with only 3,996 validators signing up for the exit queue just before the implementation of the Shapella hard fork, as indicated by data from Rated Network Explorer.

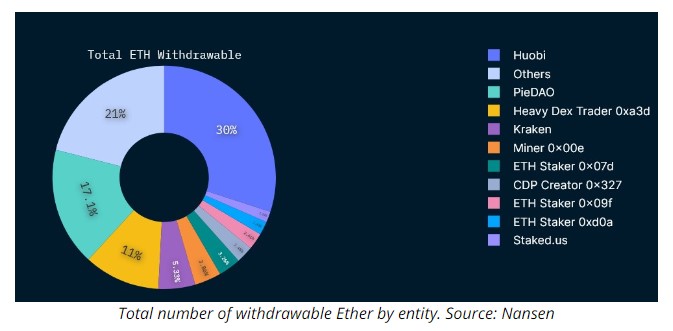

According to Cointelegraph, crypto exchange Huobi owns the largest share of the total amount of withdrawable Ether at 30%, while the decentralized autonomous organization PieDAO holds 17.7%.

The data also shows that a total of 284,622 Ether is available for full withdrawal from 7,948 validators. Despite the potential influx of Ether hitting the market, the price of Ether, currently at $1,920, has remained relatively stable in the first hour of the hard fork, as predicted by blockchain intelligence platform Glassnode in an April 11 report.

The Shapella hard fork could theoretically unlock 18.1 million Ether on the Beacon Chain, which amounts to over $34.8 billion. However, the Ethereum Foundation has implemented several mechanisms to prevent a sudden surge of ETH on the market.

According to a report by Glassnode, it is estimated that less than 1% of the total staked Ether would be released within the first week, and the 12,859 Ether withdrawn in the first hour only accounts for 0.07% of the total Ether staked in the Beacon Chain.

Withdrawals became possible through the Ethereum Investment Proposal EIP-4895, which moved staked Ether from the Beacon Chain to the Ethereum Virtual Machine (EVM), also known as the execution layer.

The Shapella Hard Fork: What You Need to Know

The Ethereum network has undergone the Shapella hard fork, which combines the Shanghai and Capella upgrades to improve the consensus and execution layers. This upgrade enables validators and users to withdraw their staked Ether, which was previously a one-way system. The key feature of the upgrade is EIP-4895, allowing validator staking withdrawals on the network, while also optimizing transaction fees for specific activities on the network. The upgrade aims to move Ethereum towards a fully functional proof-of-stake system

The Shapella upgrade brings two types of withdrawals: partial and full, with partial withdrawals allowing validators to access the excess balance and full withdrawals enabling them to exit their stake and receive their full ETH balance. However, there is a limit on the number of validators that can withdraw each day, and the queue system ensures a gradual and stable withdrawal process to maintain the stability of Ethereum.

According to Pooja Ranjan, the founder of EtherWorld.co, full withdrawals and partial withdrawals allow for approximately 57,600 ETH ($109 million) per day to be withdrawn. Before the implementation of Shapella, validators were able to join the unstaking queue, but only 1,622 validators had left the network as of April 9.

Developers delayed Ether unstaking to reduce complications and risks associated with The Merge, allowing them to test each upgrade properly and ensure its proper functionality. Ethereum’s security and proof-of-stake consensus mechanism were maintained by delaying withdrawals through a more controlled environment during the transition.

The Shapella upgrade has now allowed Ethereum users to access previously locked assets and withdraw their staked Ether on the network, increasing flexibility.

While there may be short-term price fluctuations and selling pressure, the hard fork is unlikely to have a significant impact on Ether’s price as mechanisms are in place to prevent excessive supply, and many depositors are not in profit.