Unsealed Hinman Documents Challenge SEC’s Role in Digital Asset Governance and Demand Investigation Into Regulatory Misconduct

On June 13th, the eagerly anticipated Hinman documents were finally made public, unveiling valuable insights from a significant speech delivered by Bill Hinman, former director of the United States Securities and Exchange Commission’s (SEC) corporation finance division, in 2018.

During this speech, Hinman expressed his viewpoint that Ether (ETH), one of the leading cryptocurrencies, should not be classified as a security.

The unsealed Hinman documents comprise internal communications within the SEC, offering a comprehensive glimpse into the agency’s deliberations and considerations before and after Hinman’s speech.

Following the release of these documents, Cointelegraph conducted an interview with John Deaton, a crypto lawyer and the founder of CryptoLaw, to shed light on their significance.

Deaton underscored that the documents provide support for Ripple, Coinbase, and other entities that he believes have been unjustly targeted by regulators. He suggested that these documents could not only influence public perception but also shape legislative discussions in Congress by raising concerns about regulatory conduct and the interpretation of existing laws.

In Deaton’s words, “The documents align with my expectations in two ways. Firstly, they offer assistance to Ripple, Coinbase, and others who have been unfairly targeted by regulators acting in disregard of the law they have sworn to uphold. While the extent of their impact in court remains to be seen, they certainly bolster public opinion and discussions within Congress. Secondly, the documents expose significant conflicts of interest and troubling appearances of impropriety involving William Hinman and Jay Clayton.”

Jay Clayton, an American attorney, previously served as the chairman of the SEC from May 4, 2017, until December 23, 2020.

Regarding the specific impact on the ongoing legal battle between Ripple and the SEC, Deaton emphasized that the unsealed documents themselves do not directly affect the judge’s analysis of whether XRP was offered or sold by Ripple as an investment contract, nor do they impact XRP’s status in the secondary markets. However, they do strengthen Ripple’s argument that Hinman’s speech caused market confusion and hindered participants’ understanding of what was prohibited under existing regulations.

Deaton stated, “The documents assist Ripple (and others) in arguing that the speech created more confusion in the markets, leaving market participants without sufficient notice of what was prohibited by existing law.”

Furthermore, he highlighted the potential consequences for Ether and ERC-20 tokens, suggesting that the documents may support Ether’s position in avoiding classification as a security by the SEC. This could also benefit ERC-20 tokens such as Dragonchain, as they are governed by the Ethereum blockchain and may have a stronger fair notice argument than Ripple.

In response to the broader implications of the documents, Deaton expressed the belief that they underscore the necessity for Congress to intervene and provide clear regulations for digital assets. He proposed that the SEC may not be the appropriate agency to oversee the crypto industry due to the apparent conflicts of interest and impropriety highlighted in the documents.

Deaton shared, “The documents further reinforce the call for Congress to step in and provide clarity, as the SEC is not the right entity to govern digital assets.”

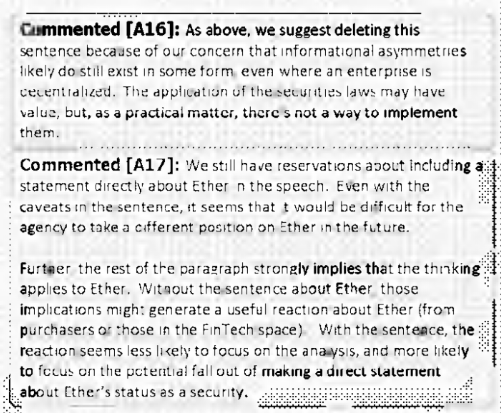

Moreover, Deaton called for an inspector general investigation into why Hinman persisted in delivering the speech despite warnings from the SEC’s Office of the General Counsel and the director of trading markets. The reference to the speech as the “Ether Speech” raised questions about potential biases and motivations.

Deaton suggested, “The documents call for an IG investigation into why William Hinman insisted on giving the speech. The Office of General Counsel advised against favoring Ether, and the director of trading markets specifically stated that the speech would create greater confusion in the market. However, Hinman was determined to deliver it, as indicated in his email where he referred to the speech as the ‘Ether Speech.'”

Deaton’s stance on the need for an investigation is shared by Stuart Alderoty, Ripple’s chief legal officer, who expressed similar sentiments on his Twitter account.

Alderoty called for an investigation to understand the factors that influenced Hinman, why conflicts of interest or appearances of conflicts were disregarded, and why the SEC promoted the speech despite knowing it would create “greater confusion.”

The revelations from the unsealed documents have sparked discussions and raised important questions about the actions and motivations surrounding Hinman’s speech, as Gensler has previously suggested that, apart from Bitcoin, he considers all other cryptocurrencies as securities. For this reason, advocating for a thorough investigation of the situation and emphasizing the importance of openness is crucial at this point.