BlackRock Officially Files for Bitcoin ETF, Expanding Crypto Investment Options

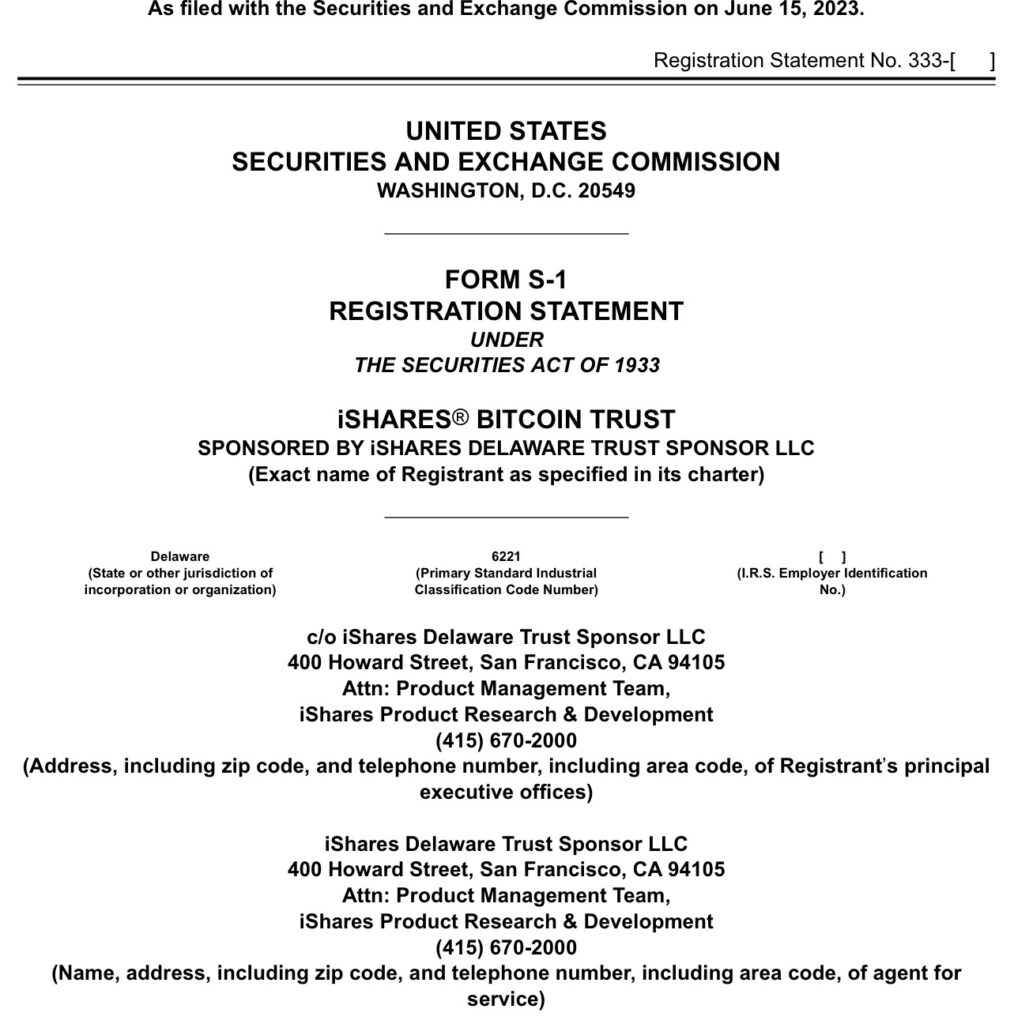

BlackRock, the world’s largest asset manager, has officially filed an application for a bitcoin exchange-traded fund (ETF), according to recent reports. CoinDesk initially reported that BlackRock was close to filing for the ETF, citing an anonymous source familiar with the matter. The ETF will utilize Coinbase Custody, an offline storage solution for digital assets, and rely on the spot market data from Coinbase for pricing.

This development occurs during a period when the global cryptocurrency industry is facing increased scrutiny from the U.S. securities regulator due to alleged violations of securities laws. In recent lawsuits, the regulator has taken legal action against major exchanges Coinbase and Binance, causing significant impact within the digital assets industry.

ETF stands for Exchange-Traded Fund, which is a type of investment fund and exchange-traded product (ETP) that can be traded on stock exchanges. ETFs provide investors with the ability to gain exposure to a diversified portfolio of assets, such as stocks, bonds, or in this case, bitcoin, without directly owning the underlying asset.