Bank of Canada Analyzes DeFi Growth and Urges Regulation for Financial Market Stability

The Bank of Canada released a staff analytical note examining the rise of decentralized finance (DeFi) and the potential paths for broader market regulations. Issued on October 17, the note delineates the evolution of the cryptocurrency market, its advantages, challenges faced by traditional finance, risks, and potential impacts on financial markets, along with regulatory considerations.

According to the report, crypto assets were initially introduced as a blockchain-based payment system, later expanding into various realms of financial services.

Pursuing decentralization, they utilize smart contracts to facilitate transactions without the need for intermediaries, leading to a market cap surge to $2.9 trillion, subsequent platform collapses, and regulatory challenges causing a price slump.

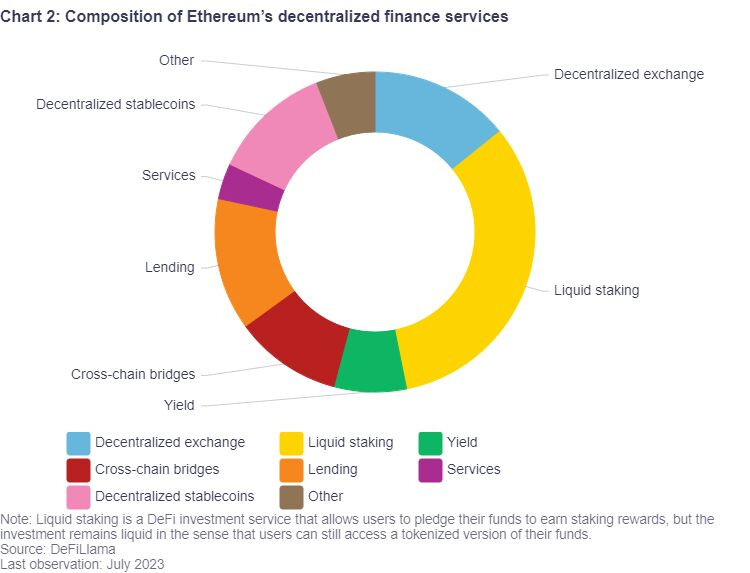

The emergence of non-fungible tokens, decentralized stablecoins, and other services has ushered in a new sector alongside fresh risks in the current market landscape.

The Bank of Canada underscores the benefits of the DeFi ecosystem, particularly emphasizing the ease of creating services through the composability of smart contracts. Open-source code facilitates collaborative development on existing networks. Increased service offerings, heightened competition, and enhanced transparency render the DeFi ecosystem more appealing compared to traditional financial products.

In an effort to dismantle financial monopolies, cross-border payments facilitate transactions between countries, and interoperability allows users seamless experiences across various platforms. DeFi also addresses frictions in financial markets characterized by limited and opaque transactions, leveraging blockchain technology to reduce reliance on potentially corrupt intermediaries, thereby empowering customers.

Despite the advantages, decentralized finance poses risks to global financial markets, including limited tokenization, excessive concentration, and the presence of unregulated centralized entities. The note underscores the importance of regulating all facets of the industry to curb the activities of bad actors and ensure harmonious interactions with traditional finance.

Recently, Canada’s securities regulators clarified stablecoin regulations, aiming to govern their issuance and trading without entangling them within securities regulations.