The third quarter of 2023 was anything but ordinary in the world of cryptocurrency. This period was defined by a stark division, spurred by a significant market downturn that cleaved Q3 into two distinct halves.

In the midst of limited liquidity on cryptocurrency exchanges, Bitcoin (BTC) bore the brunt of this financial turbulence, with its value plunging from approximately $29,000 to a mere $26,000 within a single day, notably on August 17. This sharp decline also rippled across the broader cryptocurrency market, causing the total market capitalization to slide from a robust $1.2 trillion to $1.1 trillion.

What makes this downturn even more intriguing is the conspicuous absence of any major market-related news or catalyst on that particular August day. It seemed as though traders were gently winding down their activities, perhaps preparing for a leisurely end to the summer.

Despite the crypto space being the backdrop for several noteworthy events and developments over the course of those three months, one overarching theme prevailed – the market appeared to lack the vital momentum that had characterized previous quarters.

CoinGecko’s new report provides insights into various aspects of the crypto landscape, including market capitalization, stablecoins, Real World Asset (RWA) tokens, non-fungible tokens (NFTs), and centralized and decentralized exchanges. Nevertheless, here are the highlights:

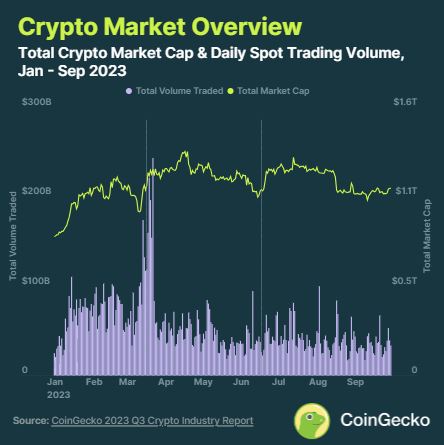

Total Crypto Market Capitalization Declined by 10% in Q3, But Still Up 35% Year-to-date

In the third quarter of 2023, the total crypto market capitalization witnessed a decline of nearly 10%, amounting to a loss of $119.1 billion. This drop marks a 16.3% decrease from the local peak observed on April 17. Trading volumes have also been on a downward trend, with average daily trading volume in Q3 at $39.1 billion, reflecting an 11.5% decline from Q2.

Notable changes in the top 30 cryptocurrencies included Solana‘s rise from 10th to 7th place, TrueUSD‘s move from 23rd to 19th place, and the decline of Litecoin from 9th to 14th place, as well as the shifting positions of Avalanche and Binance USD.

Stablecoins Experienced a 3.8% Contraction, with TrueUSD as the Sole Gainer

In Q3, the top 15 stablecoins collectively shrank by 3.8%, translating to a $4.8 billion decrease in market capitalization. TrueUSD was the only gainer among the top five, with a 12.8% increase in market capitalization. Notable new entrants outside the top five included First Digital USD, crvUSD, and PayPal’s PYUSD. However, USD Coin and Binance USD saw significant declines in market capitalization.

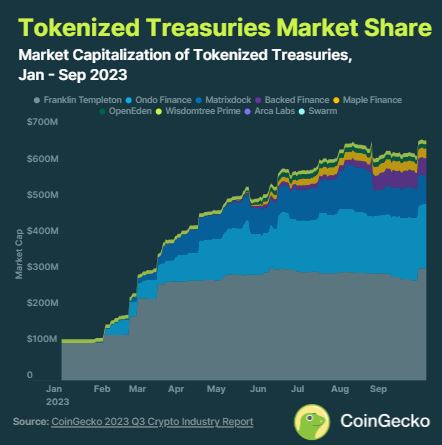

Tokenized T-Bills Drove Growth in On-Chain RWA Assets

The Real World Asset (RWA) sector experienced growth in 2023, particularly in the tokenized US Treasury bills. The market cap for these tokenized T-bills increased from $114.0 million in January to $665.0 million by the end of September, marking a 5.84x gain.

Traditional financial institutions, led by Franklin Templeton and Ondo Finance, played a significant role in this growth. The majority of RWA protocols are Ethereum-based, with Stellar as the runner-up.

NFT Trading Volume Decreased by 55.6%

NFT trading volumes registered a substantial decline of 55.6% from Q2 to Q3, dropping from $3.67 billion to $1.63 billion. Ethereum continued to dominate the NFT market with an 83.2% share. ImmutableX NFTs emerged as a strong performer in Q3, with monthly trading volume averaging over $20 million, partly due to the trading card game Gods Unchained.

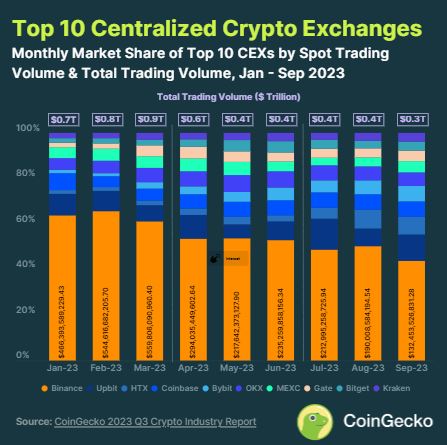

Spot Trading Volume on Centralized Exchanges Fell by 20.1%

Spot trading volume on centralized crypto exchanges experienced a decline of 20.1% in Q3. Binance, in particular, faced regulatory pressures and saw its market share drop to a yearly low of 44%. Other exchanges such as HTX, Upbit, and Bybit made gains, while Kucoin slipped out of the top 10.

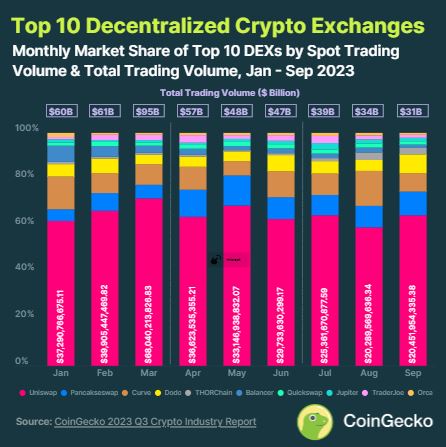

Spot Trading Volume on Decentralized Exchanges Declined by 31.2%

Spot trading volume on decentralized exchanges fell by 31.2% in Q3.

THORchain emerged as the largest gainer, with a volume increase of 113%. However, this surge could be attributed to illicit transfers. Sushi dropped out of the top 10, replaced by Orca.

In conclusion, Q3 2023 presented a mixed picture for the crypto market, with challenges and opportunities in various sectors. Market capitalization and trading volumes fluctuated, stablecoins saw a contraction, RWAs grew, NFT trading decreased, and both centralized and decentralized exchanges faced changes in market share. This shows that the crypto industry remains dynamic and subject to evolving trends and regulatory developments. However, numerous crypto enthusiasts and investors anticipate an imminent bullish market. Is that projection likely to materialize?