SEC X Breach Raises Concerns About Investor Safety as Crypto Community Rages

In an unexpected turn of events, U.S. lawyers and senators and the crypto community have raised alarm bells, urging Congress to launch an immediate probe into the U.S. Securities and Exchange Commission (SEC) following a reported breach of its official X account.

In fact, the compromised account disseminated false news regarding the approval of spot Bitcoin exchange-traded funds (ETFs), causing significant market turbulence.

Bitcoin advocate Layah Heilpern decried the incident as blatant market manipulation, underscoring that the false post persisted for 20 minutes, amassing over 4.4 million views before removal.

U.S. Senator Bill Hagerty minced no words, condemning the incident as utterly unacceptable, insisting that Congress demand answers regarding the accountability expected from public corporations in similar scenarios. Moreover, Senator Cynthia Lummis joined the chorus, urging the SEC to shed light on the sequence of events leading to the dissemination of the erroneous post.

Market experts, such as Bloomberg ETF analyst James Seyffart, predicted a severe fallout within the SEC, suggesting that Chair Gary Gensler would seek accountability from the responsible staff member.

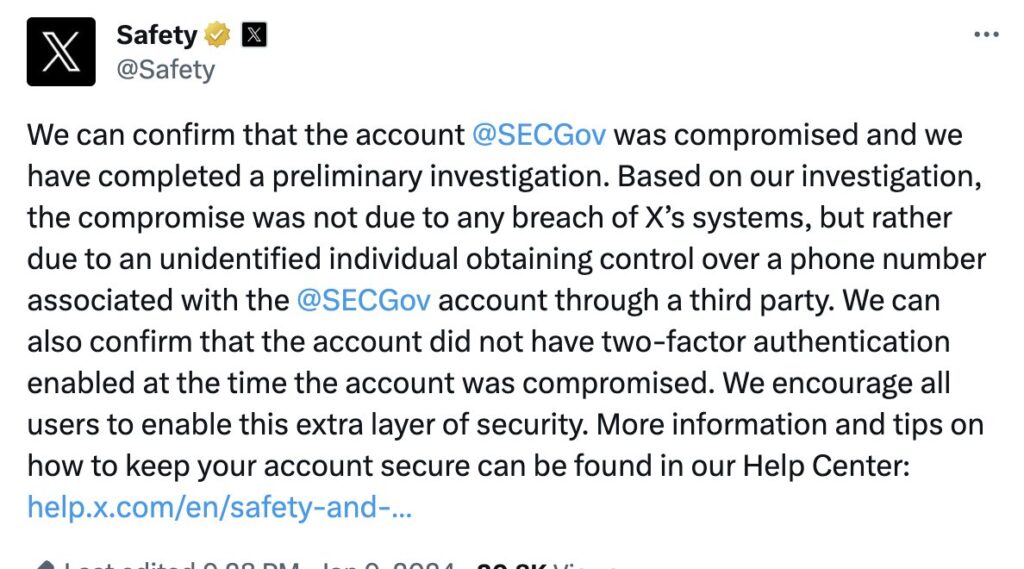

Subsequent investigations conducted by X Safety, an account managed by X, confirmed the SEC’s Twitter account had been compromised through unauthorized access to a linked phone number via a third party. It was disclosed that the account lacked two-factor authentication at the time of the breach.

On another note, the SEC has announced its commitment to collaborate with law enforcement in investigating the hack that resulted in the dissemination of a false approval post for a Bitcoin ETF.

The recent breach of the SEC’s Twitter account raises significant concerns about its ability to safeguard the investments and assets of countless individuals. If an institution tasked with overseeing financial markets struggles to secure something as fundamental as its social media presence, doubts inevitably arise regarding its capacity to protect investors and their valuable assets.

This incident stands as a stark testament to the SEC’s vulnerabilities, leaving lingering doubts about its efficacy in upholding investor confidence and market integrity.