Bitcoin ETFs: Unveiling the Numbers and Navigating the Supply Squeeze

BTC held by ETFs to 670,540 BTC

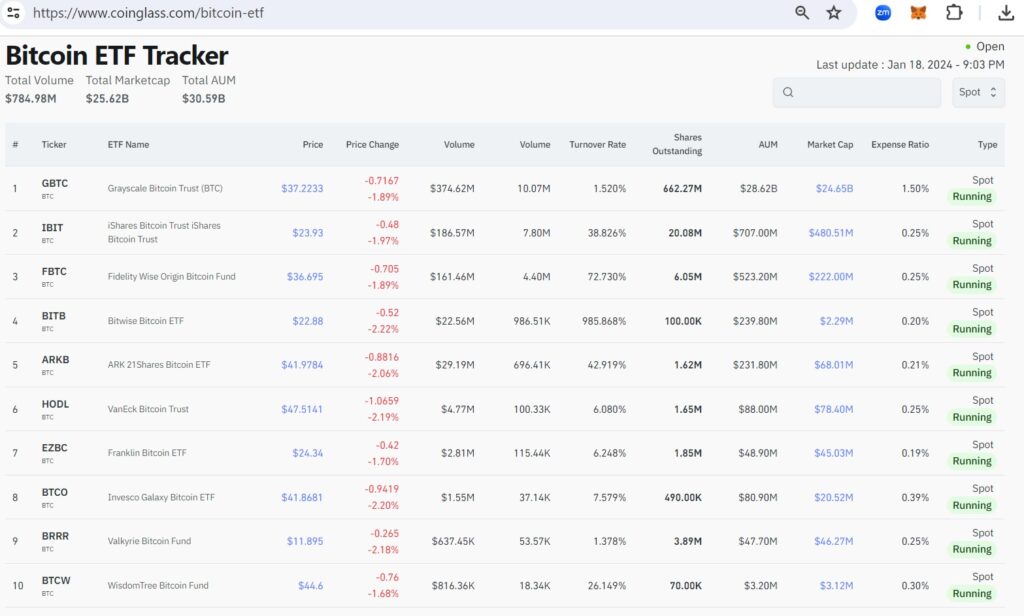

The recent green light from the U.S. Securities and Exchange Commission (SEC) for 11 Bitcoin spot ETFs has set the cryptocurrency market abuzz. These ETFs offer investors a regulated and accessible pathway to Bitcoin exposure, sans the need to directly hold the digital asset. With a combined market capitalization exceeding 26 billion USD and total assets under management (AUM) reaching 30.59 billion USD, these ETFs have undeniably become major players in the crypto investment landscape.

The Current Landscape: ETF Holdings and Market Dynamics

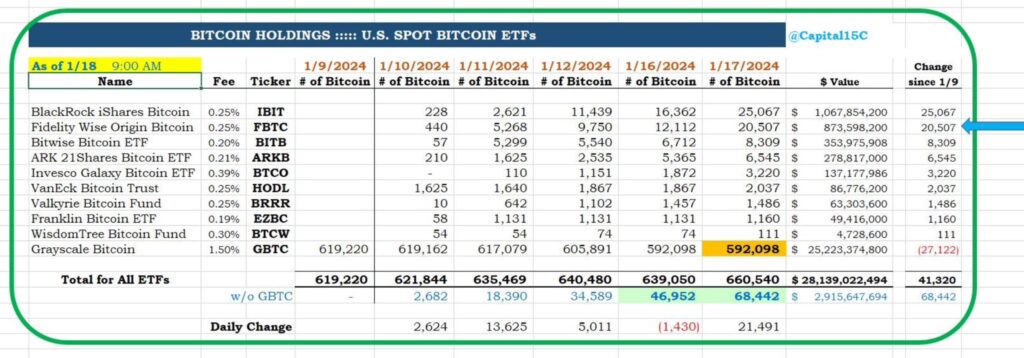

Capital15C‘s recent report reveals that ETF funds currently hold an aggregate of approximately 660,540 BTC. An interesting trend emerges as all ETFs, with one exception, have been actively increasing their Bitcoin holdings over the past seven days.

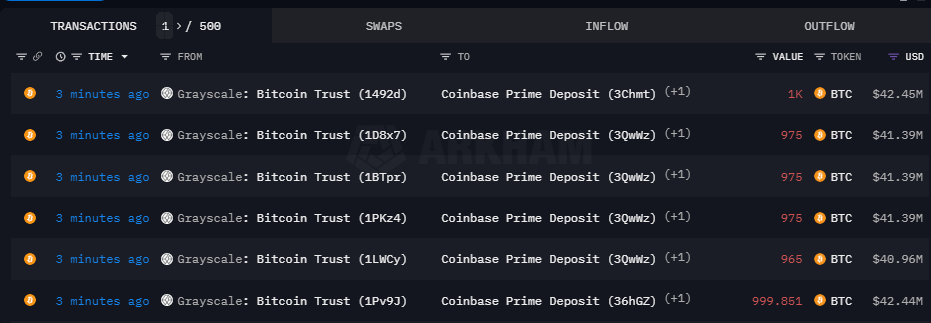

Notably, Grayscale, a prominent player in the crypto investment space, has been the outlier, reducing its holdings from 619,220 BTC to 592,098 BTC by the close of trading on January 17th. However, a recent move sees Grayscale depositing an additional 10,000 BTC with Coinbase, boosting its holdings to 602,098 BTC and raising the total BTC held by ETFs to 670,540 BTC. (Around 3.42 % from the total circulating supply of BTC)

Among the leading Bitcoin ETFs, Blackrock iShares Bitcoin secures second place with 25,067 BTC, closely trailed by Fidelity in third with 20,507 BTC. Noteworthy is Coinbase, the primary custodian, safeguarding around 638,000 BTC, while Fidelity has initiated its own custody services.

The Need for Bitcoin ETFs and the Impending Halving

The rise of Bitcoin ETFs has been driven by a growing demand for exposure to the digital asset in a regulated and accessible manner. As these ETFs continue to accumulate Bitcoin, a significant event looms on the horizon—the Bitcoin halving, set to occur in the next 90 days.

The Bitcoin halving, a programmed event occurring roughly every four years, will cut the reward for miners in half, reducing the new supply of Bitcoin entering the market. The imminent scarcity of fresh Bitcoin has historically led to substantial price rallies. In the context of Bitcoin ETFs aggressively accumulating Bitcoin, this impending supply squeeze becomes particularly significant.

As ETFs continue their buying spree, the restricted supply of new Bitcoin due to the halving could create a squeeze in available inventory. Historically, such supply-demand imbalances during halving events have led to upward price pressures. In the case of Bitcoin ETFs, this scenario becomes intriguing as the funds, holding a substantial portion of available Bitcoin, may experience heightened demand for their shares.

Conclusion: Navigating the Intersection

As we approach the Bitcoin halving, the dynamics between institutional demand, supply scarcity, and market sentiment are poised to define the narrative for both Bitcoin and Bitcoin ETFs. Investors and market participants should closely monitor these developments, as the interplay between aggressive ETF acquisitions and the upcoming halving event is likely to shape short to medium-term price dynamics.

In light of recent market trends, we would like to emphasize a crucial point to retail holders: amid fluctuating market conditions, consider holding onto your Bitcoin. Despite short-term uncertainties, the bigger picture reveals a scenario where significant players are strategically acquiring Bitcoin, possibly from smaller investors and retailers during market downturns. By holding strong, retail holders contribute to maintaining a robust and decentralized Bitcoin ecosystem, resisting the allure of selling in challenging times. As the narrative unfolds at the dynamic intersection of Bitcoin ETFs, institutional investment, and the evolving crypto market, the resilience of retail holders becomes a pivotal force in shaping the future of digital assets.