FTX’s Share Liquidation: Insights Behind Grayscale Bitcoin Trust’s BTC Sale

The recent shift in Grayscale’s Bitcoin Trust (GBTC) has captured attention as investors have withdrawn over $2 billion since its transformation into an exchange-traded fund (ETF). A significant portion of this movement is attributed to FTX’s bankruptcy estate, which strategically liquidated 22 million shares to meet financial obligations.

FTX’s Strategic Capitalization on Disparity

Highlighting FTX’s strategic play, the exchange capitalized on the price difference between Grayscale trust shares and the net asset value of the underlying bitcoin in the fund. As reported by Coindesk, Holding 22.3 million GBTC shares valued at $597 million as of October 25, 2023, FTX leveraged this position. By the first day of Grayscale’s bitcoin ETF trading on NYSE Arca on January 11, the value of FTX’s GBTC holding surged to around $900 million, closing the session at $40.69.

Clear Motivation: Liquidation of FTX Shares

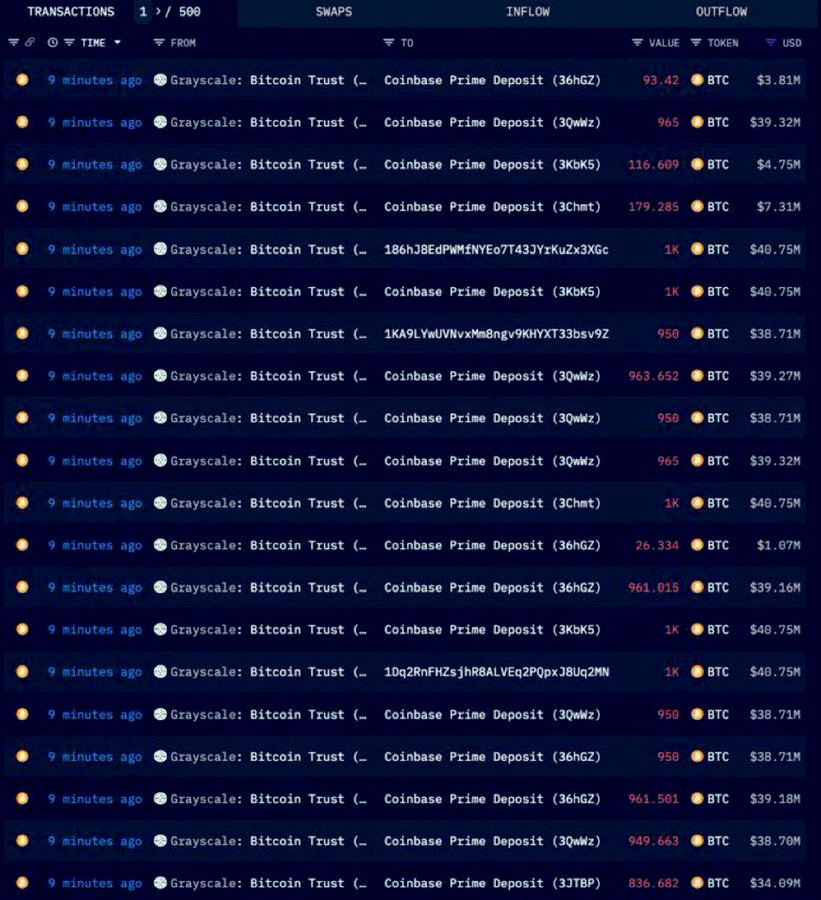

The recent move by Grayscale, transferring 900,000,000 worth of BTC to Coinbase, aimed at selling them, aligns with a clear motivation – the liquidation of FTX shares. This calculated strategy allowed FTX to sell its GBTC holdings at an opportune time and at an advantageous price point.

Market Impact Contextualized

While these actions may seem dramatic at first glance, it’s crucial to contextualize the market impact. Grayscale’s decision to sell BTC is driven by a strategic financial move, specifically tied to the liquidation of FTX shares. This pragmatic approach by both Grayscale and FTX reflects a calculated response to market conditions, with FTX taking advantage of the valuation disparities within the crypto investment landscape.

Positive ETF Trends

In the midst of these strategic maneuvers, the broader market showcases positive trends with ongoing inflows into ETFs. Commencing with a combined total holding of 621,844, these ETFs now hold a collective 647,056 BTC, translating to a market value of approximately $27 billion USD. This underscores the continuing confidence and interest in the cryptocurrency space, highlighting the adaptability and strategic thinking of major players even amidst nuanced market shifts.

In the dynamic world of cryptocurrency investments, Grayscale’s recent strategic move involving the liquidation of FTX shares and subsequent bitcoin transfers should be viewed through a lens of financial pragmatism. The correlation between FTX’s share liquidation and Grayscale’s BTC movements is not a dramatic event but rather a calculated response to capitalize on market conditions. The positive inflows into ETFs further emphasize the resilience and dynamism inherent in the cryptocurrency investment ecosystem.