Crypto Industry Sees 23% Decrease in Hacking and Fraud Losses in Q1 2024

In the first quarter of 2024, the crypto industry witnessed a notable decrease of 23.12% in losses from hacking and scams compared to the same period in 2023, as per a research report by blockchain security firm Immunefi released on March 28.

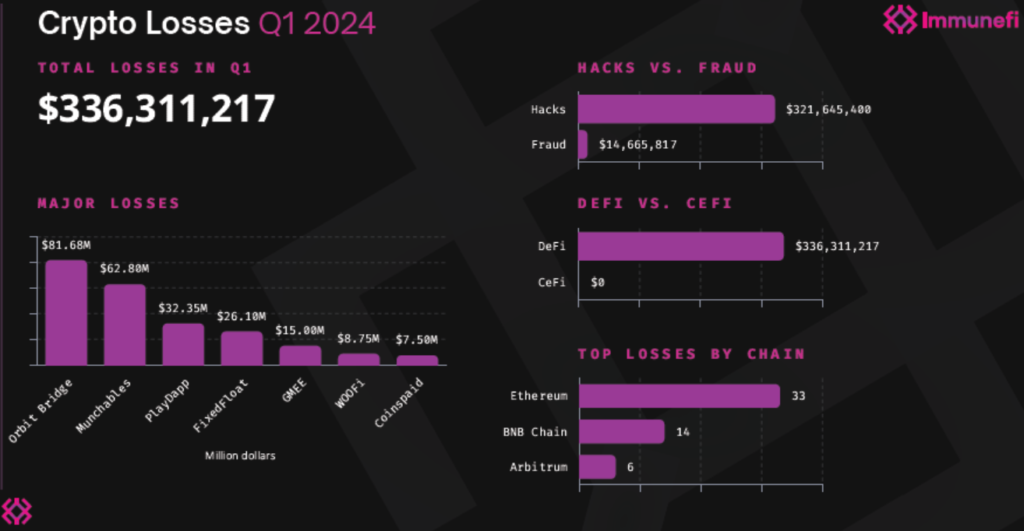

During Q1 2024, losses due to hacking and fraudulent activities totaled $336,311,217 down from $437,483,543 in Q1 2023. The report highlights 46 hacking incidents and 15 cases of fraud.

Decentralized finance (DeFi) platforms, with nearly $100 billion in total value locked in Web3 protocols, remain prime targets for hackers, comprising 100% of exploits identified by Immunefi in Q1, compared to zero for centralized (CeFi) platforms.

The bulk of the losses in the crypto industry, totaling $144,480,000 came from two projects, accounting for 43% of the total amount. Notably, the largest attack, amounting to $81.7 million, targeted the cross-chain bridge protocol Orbit Bridge on January 1, 2024. January marked the month with the highest losses in Q1, totaling $133 million.

Mitchell Amador, CEO of Immunefi, emphasized the vulnerability of DeFi platforms to private key breaches, stressing the urgent need for enhanced security measures across code and protocol infrastructure.

Despite this, the second-largest attack, involving a $62 million exploit on the Blast-based NFT game Munchables, was swiftly resolved within 24 hours as the hacker surrendered the private keys to the wallet containing Munchables’ assets.

In total, $73,885,000 (22%) of stolen funds from seven exploits in Q1 were recovered. The number of attacks also decreased by 17.6%, from 74 in Q1 2023 to 61 this year.

Hacking incidents dominated losses in Q1, constituting 95.6% ($321,645,600) across 46 incidents, while fraud, scams, and rug pulls accounted for 4.4% ($14,665,817) over 15 incidents.

Ethereum regained its status as the most targeted chain, surpassing BNB Chain, with both networks combining for 73% of total losses. Specifically, Ethereum faced 33 incidents, representing 51% of the losses, while BNB Chain experienced 12 attacks, accounting for 22% of the exploited funds. Other incidents occurred on Arbitrum, Solana, Optimism, Bitcoin, Blast, Polygon, Conflux Network, and Base.