Abu Dhabi Bans Cryptocurrency Mining on Farms

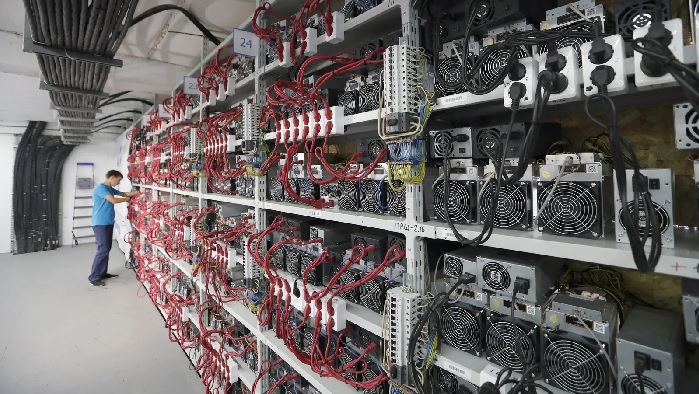

Abu Dhabi authorities have declared that farms cannot be utilized for cryptocurrency mining activities. Cryptocurrency mining involves verifying transactions and generating new coins using highly advanced computers that consume substantial energy. While blockchain-related endeavors are permitted in the UAE, stringent regulations are enforced.

The Abu Dhabi Agriculture and Food Safety Authority (Adafsa) issued a directive to farmers on Thursday, emphasizing that cryptocurrency mining on farms is not permissible due to the potential escalation of electricity bills. Adafsa deemed this activity as a misuse of farm resources for unintended purposes.

Individuals found engaging in crypto mining on farms may incur fines of up to Dh10,000, as per Adafsa’s announcement.

Despite this prohibition, the UAE has emerged as a supportive jurisdiction for Bitcoin mining. In a momentous debut on December 5, 2023, Phoenix Group PLC, a leading figure in cryptocurrency mining, technology, and blockchain, experienced a remarkable 44% surge in its share price upon listing on the Abu Dhabi Exchange (ADX). This significant event marks the inaugural public listing of a crypto mining and blockchain technology company in the Middle East, indicative of the region’s rapidly expanding tech and fintech sectors.

Previously, Phoenix Group had an exclusive sales partnership for Bitmain’s mining hardware in the Middle East. While maintaining the use of Bitmain equipment at their Abu Dhabi facility, the company secured a landmark $650 million order for additional mining rigs with Bitmain in November 2021. Their recent agreement with Whatsminer further broadens Phoenix Group’s strategic alliances and diversifies its mining hardware portfolio, cementing its status as a major player in the global mining industry.

UAE’s venture into mining commenced in 2021 when its sovereign wealth fund Zero Two (formerly known as FS Innovation) collaborated with local miner Phoenix Technologies on a 200 MW hydro-cooled facility.

Moreover, the UAE forged a $400 million partnership with U.S. miner Marathon Digital to establish two sites with a combined 250 MW capacity in Abu Dhabi. The emirate’s dedication to transitioning from dependence on oil and gas reserves towards increased adoption of solar and nuclear energy presents lucrative opportunities for Bitcoin miners. The excess energy resulting from this transition can be harnessed by miners, introducing a sustainable dimension to their operations.

In 2023, data from Hashrate Index revealed that the UAE accounted for approximately 400 megawatts of Bitcoin mining capacity, constituting 4% of the global hash rate. This establishes the UAE as a prominent Bitcoin mining hub in the Middle East, showcasing a conducive environment for cryptocurrency activities beyond agricultural settings.

Additionally, the UAE’s fluctuating electricity demands often result in wasted energy. By accommodating Bitcoin miners, this surplus electricity can be effectively utilized, enhancing the overall efficiency of the national energy market.

One of the standout factors driving the UAE’s growing popularity as a mining destination is its favorable tax system. The nation imposes zero corporate tax, value-added tax, and import duties on Bitcoin mining operations. This tax-friendly environment, coupled with the nation’s pro-Web3 stance, strengthens the UAE’s attractiveness for crypto miners, positioning it as an increasingly coveted destination in the global Bitcoin mining arena.