Ethereum ETF Approval Ignites Market Excitement in the MENA Region

The much-anticipated launch of Ethereum exchange-traded funds (ETFs) has finally arrived, generating significant buzz within the cryptocurrency community and beyond.

Ethereum ETFs Debut on Major Exchanges

As of July 23, 2024, investors can now purchase Ethereum through traditional stock exchanges, marking a pivotal moment for both Wall Street and retail investors.

A total of nine Ethereum ETFs are debuting, with five launching on the Chicago Board Options Exchange and the remainder expected to follow suit on Nasdaq and NYSE Arca. This development follows the successful introduction of Bitcoin ETFs earlier this year, which initially caused market volatility before stabilizing and leading to a steady price increase.

Ethereum: The New Bitcoin?

The introduction of Ethereum ETFs presents unique dynamics. However, unlike Bitcoin, Ethereum underpins decentralized finance (DeFi) and non-fungible tokens (NFTs), potentially leading to different market reactions. Expert predictions vary widely, with some anticipating Ethereum prices to surge to $5,000 by year-end, while others remain cautious.

Impact on Traditional Financial Institutions

Nonetheless, the significance of Ethereum ETFs extends beyond price movements. Their presence could enhance Ethereum’s legitimacy among traditional financial institutions and simplify the process of buying and selling the cryptocurrency. In fact, the anticipated inflow of funds into these ETFs is projected to range from $3 billion to $45 billion in the first year, potentially driving Ethereum’s price upward, according to CoinMarketCap.

Competitive Landscape of Ethereum ETFs

Competition among the Ethereum ETFs is expected to be fierce. With multiple similar offerings entering the market simultaneously, these funds may engage in a race to lower fees, benefiting investors through reduced costs.

Industry Leaders Speak Their Mind

With this in mind, UNLOCK Blockchain sought insights from industry leaders in the MENA region to gather their perspectives on this development.

Talal Tabaa, CEO of CoinMENA, explained, “Blackrock’s Bitcoin ETF is the most successful launch of any financial product, so traditional finance players have tasted the upside of crypto and there is no going back. If ETH does nearly as good as the Bitcoin ETF, it would be a win. An underrated point is ETFs allow fund managers to invest in crypto on behalf of their clients, so expect Bitcoin and ETH ETFs to become a bigger part of managed portfolios.”

Walid Benothman, Managing Director of Bitpanda, commented, “The SEC’s approval of ETH ETFs is a significant milestone that further solidifies the crypto market’s trajectory. Building upon the momentum generated by the successful launch of BTC ETFs, this decision highlights the growing institutional acceptance of digital assets. Ethereum, as the backbone of decentralized finance and smart contracts, is poised to benefit immensely from increased accessibility through traditional investment channels. We anticipate this development to be a catalyst for further innovation and adoption within the crypto ecosystem.”

Mo Ali Yusuf, CEO and Co-Founder of Fuze, said, “The ETH ETF marks a significant milestone underlining the demand in digital assets and the confidence in Ethereum. This will enable a range of new investors in the US market to participate in this asset class in a regulated manner. However, there’s an issue for investors as the SEC has excluded staking. This means that investors looking to hold ETH miss out on more than 3% in rewards, which is a bit like saying to a shareholder of a company, you can invest but you can’t receive the dividend. All things considered, we will probably see more of a gradual uptake than with Bitcoin ETFs, with initial interest driven more by liquidity, accessibility, and portfolio diversification. Most importantly, it’s another positive step in the right direction for regulated digital assets adoption.”

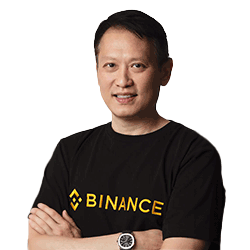

Richard Teng, CEO of Binance, explained, “The launch of ETH spot ETF trading in the US marks yet another significant milestone for Ethereum and the broader digital asset market. This development builds on the positive momentum we have witnessed in the digital asset market this year, further solidifying the legitimacy and accessibility of cryptocurrencies.

While we anticipate a steady capital deployment into these ETFs, it is unlikely to be dramatic initially and will fluctuate based on various macroeconomic factors. However, I believe that the potential for ETF liquidity to grow exponentially is significant. With SEC approval and listing, these ETFs can now be invested in by institutions, which typically have a long-term investment horizon. This institutional involvement could provide a stable and substantial influx of capital over time.”

Christian Borel, Senior Executive Officer and Branch Manager at AMINA BANK AG ADGM (earlier known as SEBA BANK), also commented, “The right step into the future of finance with Ethereum ETFs, where innovation meets accessibility, transforming how we invest in digital assets and go mainstream.”

Stefan Kimmel, CEO of M2, expressed, “The major breakthrough of the ETH ETF is not so much its potential impact on price. The real significance is that it factually is the SEC’s acceptance of Ethereum as a tradable asset. By extension, this means the acceptance of most PoS chains.”

The Future of Ethereum and Its Ecosystem

The approval of Ethereum ETFs is more than just a financial milestone; it highlights the fundamental role Ethereum plays in the blockchain ecosystem. Ethereum is not merely a store of value like Bitcoin; it is the backbone of decentralized finance, smart contracts, and a myriad of other innovations. The exclusion of staking in these ETFs is a missed opportunity for investors, as it prevents them from earning staking rewards, similar to dividends in traditional stocks. However, investing in Ethereum means supporting the leading blockchain infrastructure that has continually driven industry innovation.

Ethereum’s transition to proof-of-stake has made it more ESG responsible, attracting a broad and active community of developers and users. While Bitcoin is often seen as the ‘gold’ of crypto, untouchable and stable, Ethereum represents the future, with its potential limited only by the extent of our imagination.