Crypto Careers on the Rise: Seizing Opportunities in the Digital Asset Boom

The crypto job market is undergoing an unprecedented boom, driven by increasing investment, mainstream adoption, and a growing institutional interest in digital assets. As the industry evolves, the demand for skilled professionals, especially in product and marketing roles, is rising, highlighting both opportunities and significant challenges.

The Surge in Demand for Crypto Jobs

The rapid expansion of Web3 technologies has led to a significant uptick in job openings within the crypto and blockchain sectors. According to Crypto Jobs List, there were approximately 600 new crypto and blockchain job listings in July 2024 alone. This surge is largely attributed to a rebound from a prolonged bear market and the influx of venture capital (VC), which is now fueling a hiring spree.

Adding to this momentum, Binance Holdings Ltd. is on track to hire 1,000 people this year, with a significant number earmarked for compliance roles, CEO Richard Teng told Bloomberg. This comes as Binance ramps up its spending to meet regulatory requirements, which now exceeds $200 million annually. Binance plans to expand its compliance workforce to 700 by the end of 2024, a substantial increase from the current 500. This hiring spree underscores the growing importance of regulatory compliance in the crypto industry, as Binance continues to face scrutiny from US regulators.

In the UAE, the job market mirrors this trend. The fintech sector is projected to grow at a CAGR of over 15%, positioning the UAE as a prime destination for fintech startups, investors, and professionals. The convergence of fintech and crypto in this region offers a fertile ground for career growth, particularly in roles that blend financial expertise with blockchain technology.

Institutional Interest and the Future of Crypto Jobs

The growing interest from financial institutions in digital assets is reshaping the crypto job market. Major players like Goldman Sachs, JPMorgan, and HSBC are quietly building their digital asset and blockchain teams, signaling a gradual shift towards broader institutional adoption. This trend is mirrored in the UAE fintech sector, where traditional banks are increasingly collaborating with fintech companies to drive innovation.

As institutional participation increases, the demand for professionals who can navigate the complexities of blockchain technology and regulatory frameworks will continue to rise. This presents an exciting opportunity for job seekers with the right mix of skills to carve out a niche in this evolving industry.

The Talent Gap: A Double-Edged Sword

Despite the booming job market, there is a conspicuous shortage of seasoned professionals in product and marketing roles within the crypto industry. This talent gap is further exacerbated by the industry’s nascent nature, where many candidates lack the necessary experience and deep technical expertise in blockchain. While eager candidates flood the market, finding individuals who can strategically drive product development and marketing efforts remains a challenge.

This shortage is not unique to the crypto industry. The UAE fintech sector faces similar challenges, particularly in sourcing specialized skills in AI, blockchain, and regulatory compliance. The rapid technological advancements and the evolving nature of fintech demand a hybrid skill set—one that combines technical prowess with industry-specific knowledge and soft skills. This need for hybrid skills is increasingly recognized across both crypto and fintech industries, highlighting the importance of adaptability and continuous learning.

Impact of Crypto Venture Capital Investments on Crypto Job Market

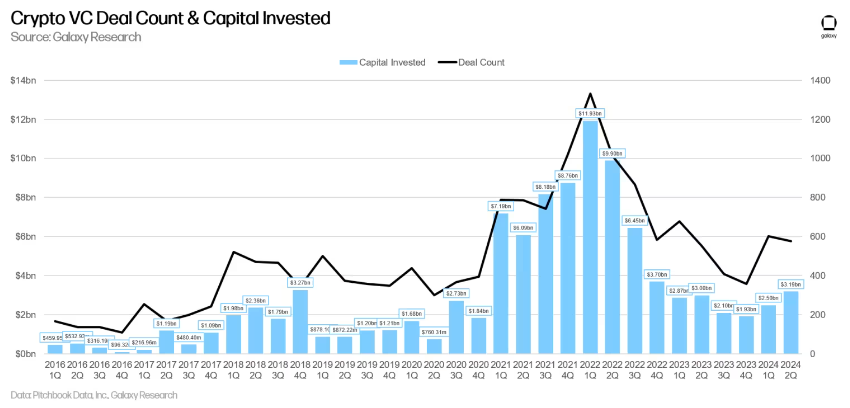

Venture capital funding is playing a key role in shaping the hiring trends within the crypto industry. In the first quarter of 2024, crypto-focused venture capitalists invested $2.01 billion, surpassing the total raised in 2023, according to PitchBook data. In Q2 2024, venture capitalists invested $3.194 billion into crypto and blockchain-focused companies across 577 deals, according to Galaxy Research. This marked a 28% increase quarter-over-quarter, despite the fluctuating performance of Bitcoin.

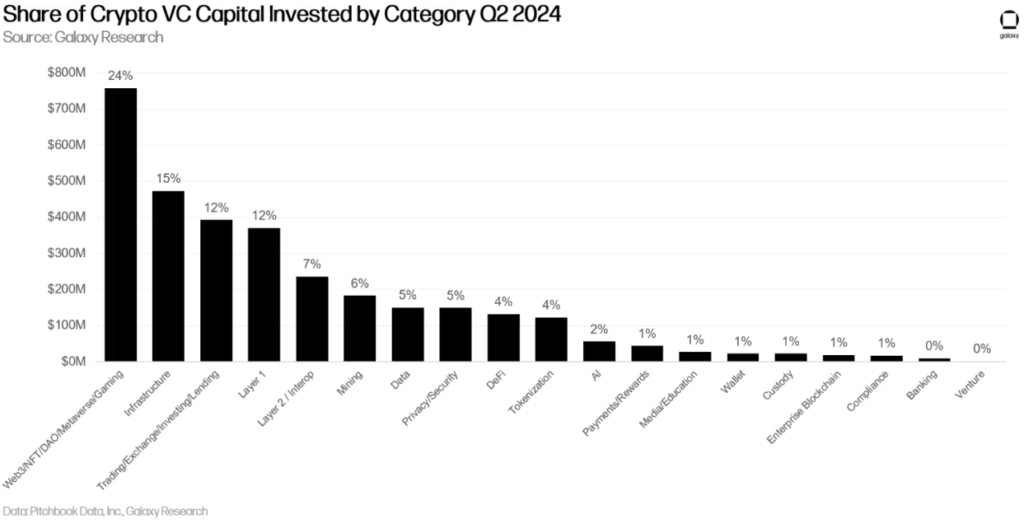

The crypto VC market’s gradual rebound signals strategic optimism, with early-stage startups becoming the new favorites of investors. Valuations are soaring to heights unseen since late 2021, particularly in sectors like Web3, NFTs, and gaming, which accounted for 24% of the total VC fundraising in Q2 2024.

This shift towards a broader ecosystem beyond the speculative frenzy of cryptocurrencies is driving a hiring frenzy, as companies seek to capitalize on the maturing market. Notably, 78% of the capital in Q2 2024 was allocated to early-stage companies, further underscoring the demand for fresh talent to innovate in these emerging sectors. Infrastructure, trading, and Layer 1 companies also attracted significant investment, with the market share of capital invested in Layer 1 projects increasing over sixfold due to high-profile deals like Monad and Berachain.

As funding continues to flow, companies are rapidly expanding their teams to meet ambitious goals, creating an intense demand for skilled professionals. As such refining recruitment strategies to attract and retain top talent will be crucial in navigating this rapidly evolving landscape.

UAE: Emerging VC Hub for Crypto and Blockchain Innovation

The UAE has solidified its position as a global hub for crypto and blockchain innovation, driven by progressive government policies and a conducive regulatory environment. This favorable climate has attracted thought leaders, industry figures, and a significant influx of VC investment, making the UAE a critical player in the global Web3 ecosystem.

Although the United States remains the dominant player in venture capital, securing 53% of all crypto VC investments in Q2 2024, the UAE is emerging as a notable contender. Despite its smaller scale, the UAE attracted 4.39% of the total capital, establishing itself as a competitive market for crypto talent.

Key developments in this landscape include Token Bay Capital’s expansion into the UAE. Token Bay, a leading crypto venture capital fund, recently received in-principle approval from the Financial Services Regulatory Authority (FSRA) in Abu Dhabi Global Market (ADGM). This approval allows Token Bay to manage token and equity investments in early-stage crypto startups, further solidifying ADGM’s status as a premier destination for blockchain and digital assets ventures.

Another key development is the launch of Falcon Gate, a $100 million Web3 innovation fund created by Gate Ventures and Abu Dhabi’s Blockchain Center. This fund aims to support high-potential blockchain projects across the Middle East, Asia, and beyond.

Building on this progress, Binance Holdings Ltd. is considering Dubai and Abu Dhabi as potential locations for its global headquarters. This underscores the UAE’s appeal as a prime destination for crypto and blockchain talent, further cementing the region’s status in the global digital asset ecosystem.

UAE’s Expanding Crypto Job Market

The latter initiatives are part of a broader trend of the UAE attracting top talent and investment in sectors like AI, gaming, and sustainability. With recent advancements such as the legal recognition of crypto payments for salaries, the UAE continues to enhance its appeal to crypto firms and investors. These developments contribute to the growing dynamism of the region’s crypto job market, making it one of the rapidly evolving ecosystems globally. The challenge remains in finding the right talents, particularly in specialized roles that require a hybrid skill set combining technical knowledge with industry-specific expertise.

The UAE’s diverse fintech sector, encompassing digital payments, blockchain, crypto exchanges, robo-advisory, and wealth management, has spurred a surge in employment, with thousands of job opportunities emerging. The blockchain and cryptocurrency market in the UAE is expected to grow at a 7.89% annual rate between 2024 and 2028, highlighting the rapid expansion and potential of the industry.

As the UAE continues to attract top talent and investment, the demand for skilled professionals—such as developers, cybersecurity experts, and legal specialists—is on the rise. Moreover, positions like Cryptoasset Analyst, Blockchain Compliance Officer, and AI-Based Investment Advisor are becoming increasingly prominent, reflecting the sector’s adaptation to emerging technologies and market needs.