Crypto Venture Capital Activity Remains Quiet in Q3 2024, Galaxy Digital Reports

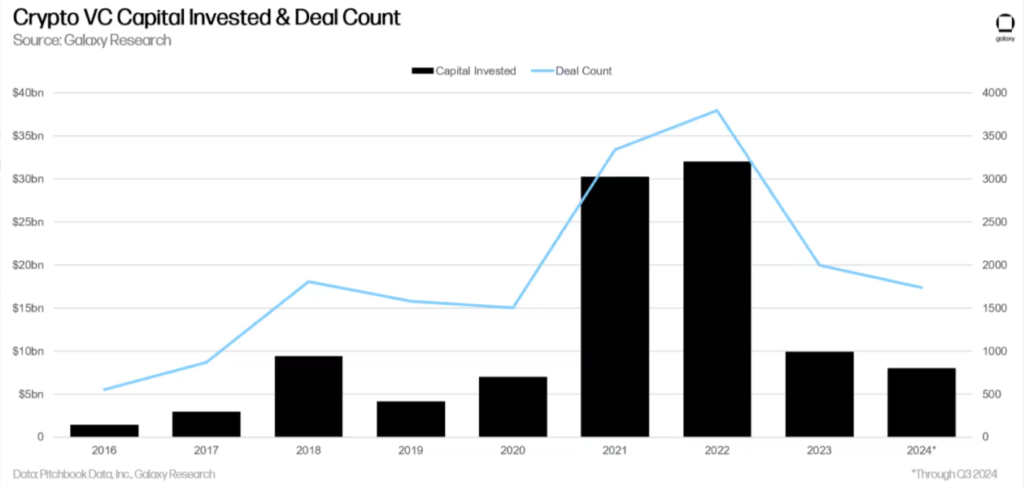

In its latest report, Crypto & Blockchain Venture Capital – Q3 2024, Galaxy Digital highlights a subdued venture capital landscape within the cryptocurrency sector. Venture capital activity has cooled significantly in 2024, particularly in the third quarter. With Bitcoin trading within a narrow range since March and major cryptocurrencies struggling to reclaim previous all-time highs, venture capital investments in cryptocurrency startups totaled $2.4 billion across 478 deals in Q3 2024, reflecting a 20% drop in funding and a 17% decrease in the number of deals compared to the previous quarter.

The current environment, characterized by high interest rates and new investment avenues like spot Bitcoin and ether ETFs, has made venture funds less attractive to investors. Additionally, the lingering effects of the industry’s various collapses in 2022 remain fresh in the minds of many stakeholders, contributing to the cautious approach in venture capital.

Despite the overall decline in investment, opportunities still exist, particularly as crypto-native managers lead deal activity. Early-stage firms garnered the majority of capital, capturing 85% of total investments, while later-stage companies—those with established products—accounted for only 15%. This marks the lowest share for later-stage deals since Q1 2020.

After experiencing a significant decline in valuations in 2023, the crypto sector saw a rebound in the second quarter of 2024, which has held steady in the third quarter. The median pre-money valuation across deals stood at $23 million, with an average deal size of $3.5 million.

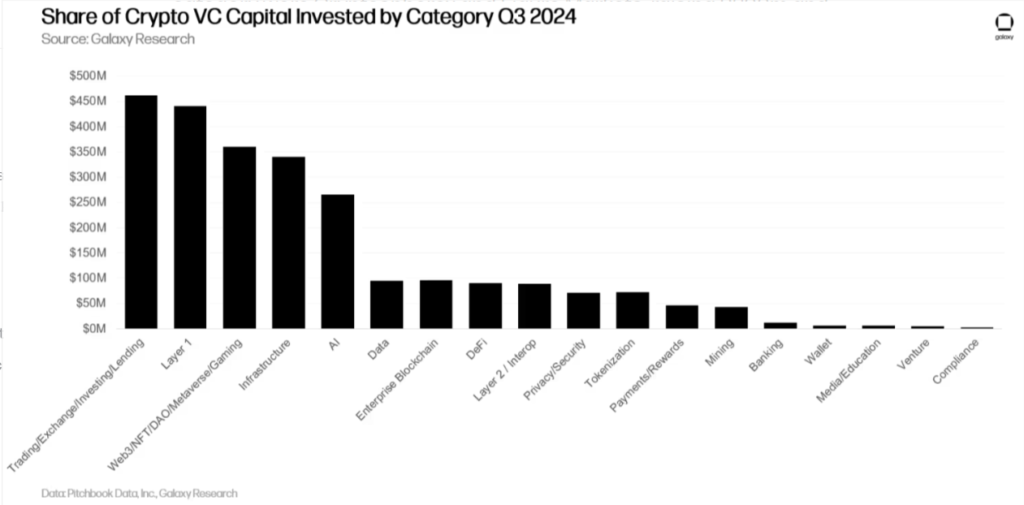

Certain sectors within the crypto ecosystem attracted more interest than others. Crypto exchanges, lending platforms, and trading services accounted for 18% of VC capital, amounting to over $460 million. Following closely were Layer 1 projects, which raised approximately $440 million, and Web3/Metaverse projects at around $360 million. Infrastructure projects also saw significant investment at about $340 million. Notably, projects that combined crypto with artificial intelligence (AI) raised around $270 million, a fivefold increase compared to the previous quarter.

The United States maintained its position as the leader in crypto venture capital, providing 56% of all capital and accounting for 44% of deals. The United Kingdom followed at a distant second, with 11% of capital and 6.8% of deals. Singaporean VCs contributed 7% of capital while executing 8.7% of all deals.

On the fundraising side, 2024 has proven challenging for crypto venture funds, with only $140 million raised across eight new funds in Q3. The report indicates that 2024 is shaping up to be the weakest year for crypto VC fundraising since 2020, with only 39 new funds raising $1.95 billion, significantly lower than the heights achieved during the 2021-2022 boom.

With a total of $8 billion invested in the first three quarters of 2024, the industry is poised to barely exceed or meet the funding levels seen in 2023. These figures are stark in comparison to the over $30 billion raised annually across 3,000 deals during the peak years of 2021 and 2022.

As the cryptocurrency market navigates these challenges, the report emphasizes the potential for renewed investment and growth in the coming quarters, contingent on external economic and regulatory factors.