DIFC Courts Leads with Innovation: The New Era of Digital Assets Inheritance

The DIFC Courts’ innovative Digital Asset Will service is officially live. This groundbreaking service is set to revolutionize the way digital assets are managed and inherited, offering both domestic and global users a secure, streamlined solution for managing and distributing their digital wealth. Unlock Blockchain is proud to release this comprehensive case study, following the service’s public launch, to provide readers with an in-depth understanding of how the DIFC Courts’ forward-thinking approach will impact the digital assets landscape.

A Visionary Path to Legal Innovation

The DIFC Courts’ journey toward offering the Digital Asset Will is part of a long-standing commitment to innovation and unlocking emerging technologies for government legal services. While the Digital Asset Will addresses the pressing need for distributing digital wealth, it builds on years of forward-thinking digital transformation that has positioned the DIFC Courts as a leader in court tech and innovation.

Rooted in common law, the DIFC Courts has consistently introduced solutions that respond to the evolving demands of the business community. Early on, the Court recognized the value of digitization and set a significant precedent by establishing the region’s first fully integrated eRegistry and online Court Management System (CMS). This initiative made legal services accessible remotely, a move that transformed how businesses and individuals interacted with the court’s portfolio of services. This early adoption of technology became the foundation upon which the DIFC Courts fast-tracked its rise to join the world’s leading commercial courts.

The launch of the tejouri service—a secure digital vault—further cemented the DIFC Courts’ reputation as a forward-thinking organization. tejouri allows users to securely store critical documents and multimedia files, providing a modern, efficient solution for document protection in a globalized, tech-driven world.

The introduction of the Digital Asset Will is not an isolated leap but the culmination of these forward-thinking steps. While it stands as a significant innovation in managing digital assets, it is the second major service by the DIFC Courts that capitalizes on distributed ledger technology (DLT). After research and cross-party discussions, the DIFC Courts moved cautiously, prioritizing security and trust in their choice of technology, including selecting Hedera Hashgraph as DLT provider for the services, rooting reliability and transparency at the core of these sensitive services.

“We are proud to be at the forefront of transforming government services with cutting-edge blockchain technology,” said Jesse Jarvis, CTO at Deca4 Advisory. “Integrating Hedera’s high-performance network into the DIFC Courts’ Digital Asset Will and Digital Notarization services demonstrates the practical impact of distributed ledger technology. This innovation ensures secure, tamper-proof records and streamlines complex legal processes. Hedera’s consensus service offers a secure and transparent way to manage digital assets, such as cryptocurrencies and NFTs, utilizing immutability and multi-signature capabilities for precise asset distribution and official notarized document provenance.”

DECA4 Advisory played an important role in guiding and mapping the DIFC Courts through this technological journey, ensuring that each step was taken with precision. From advising on the technological foundations to supporting the Courts’ gradual adoption of blockchain, DECA4 Advisory has helped shape the current offering, contributing valuable expertise to the project’s success.

Problem Statement: The Gap in Traditional Wills for Digital Assets

While the UAE is a global hub for foreign investment, its legal framework has traditionally followed Sharia law, posing challenges for non-Muslim expats in asset inheritance. These complexities are magnified when digital assets, such as cryptocurrencies, are involved.

Globally, as of 2024, over 580 million people own cryptocurrencies, a figure that has grown substantially with rising institutional and individual adoption. However, due to the nature of digital assets, significant portions are often lost permanently. It is estimated that approximately 20% of all Bitcoin—around 3.7 million BTC—is irretrievably lost, largely due to forgotten keys or inaccessible wallets.

The DIFC Courts’ Digital Asset Will helps fill this gap by providing a secure, clear, and streamlined method for managing digital assets.

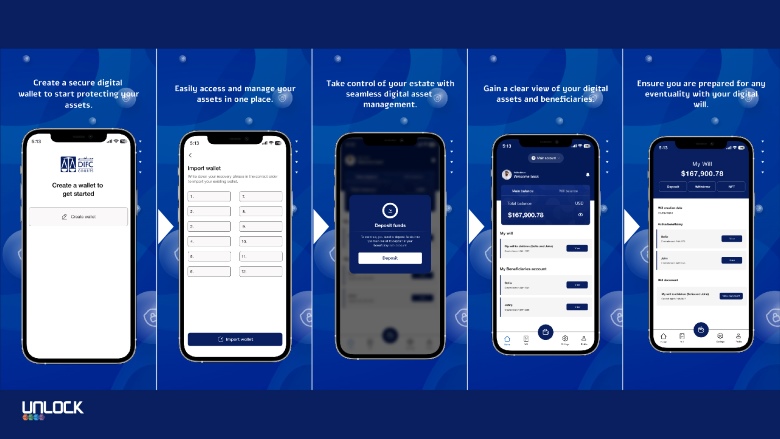

The DIFC Courts’ Digital Asset Will: A Revolutionary Solution

The DIFC Courts’ Digital Asset Will is a tailored solution specifically for managing digital assets, ensuring they are passed on securely and transparently to beneficiaries.

Key Features:

- Non-Custodial Wallet Integration: The non-custodial wallet system provides users with complete control of their digital assets, allowing them to manage, trade, or move assets during their lifetime, with automatic inheritance triggered upon their passing.

- Full Transparency and Traceability: A key advantage of the Digital Asset Will is the full transparency it offers to beneficiaries. Upon the passing of the asset holder, the transaction history for all assets in the wallet is made visible, enabling beneficiaries to see the movement of assets and trace any that may have been transferred to external platforms such as VASPs or trading platforms. This traceability is vital in helping beneficiaries identify and potentially claim assets they were previously unaware of. If needed, clients can draft additional Wills to provide credentials for accounts on these external platforms to ensure all assets are properly accounted for and passed on.

- Focused Digital Asset Coverage: The Digital Asset Will is specifically designed for digital assets and is not mixed with other types of assets like real estate, bank accounts, or company shares, which are covered by separate types of Wills by the DIFC Courts. At launch, the non-custodial wallet will accommodate the top 10 digital assets by market cap, with plans to expand to other digital assets in the future as market demand and regulations evolve.

- Remote Access and KYC Compliance: The entire Will process, including asset registration and KYC verification, can be completed online, making it accessible to investors globally, regardless of their location.

Technology Behind the Innovation

At the heart of the DIFC Courts’ Digital Asset Will service is Hedera Hashgraph, a leading DLT known for its security, scalability, and transparent governance. Hedera’s consensus and token services ensure that the Digital Asset Will can handle sensitive inheritance management processes with speed and reliability.

One of the key aspects that drew the DIFC Courts to work with Hedera is the platform’s governing council model, which includes major global institutions like banks and telecom companies. This structure guarantees transparent, predictable decision-making and ensures the platform’s long-term stability, aligning with the DIFC Courts’ need for a secure and sustainable solution.

Hedera’s advanced services bring several key advantages to the table:

- Governing Council Model: Hedera’s council-based governance model offers transparent and trusted oversight by globally respected organizations. This provides the DIFC Courts with confidence in the platform’s security and stability for inheritance management over time.

- Predictable Fees: Unlike many other blockchain solutions, Hedera provides predictable transaction fees, an essential feature for users managing digital assets who require transparency and consistency in their cost structures.

- Hedera Consensus Service (HCS): The HCS logs events with verifiable timestamping, enabling a decentralized and auditable record of transactions, which is crucial for ensuring trust and transparency in inheritance processes. This service also allows for high-throughput transaction processing with rapid finality, making it ideal for sensitive, time-bound applications like digital inheritance.

- Security and Scale: Built to handle millions of secure transactions per second, Hedera ensures a smooth, efficient, and scalable experience for the DIFC Courts, allowing them to handle large transaction volumes with minimal delays.

- Energy Efficiency: As a Proof of Stake blockchain, Hedera consumes significantly less energy than traditional blockchain systems, making it a more sustainable choice. This aligns with DIFC Courts’ commitment to using responsible, forward-thinking technology.

Micha Roon, Head of Engineering at The Hashgraph Association, noted, “Hedera Hashgraph offers three key services that enable developers to build powerful decentralized applications: Hedera Consensus Service (HCS), Hedera Token Service (HTS), and Smart Contracts. HCS provides a decentralized, auditable log of immutable and timestamped events, ensuring trust and auditability, high throughput processing of thousands of transactions per second, fast finality of transactions, and asynchronous Byzantine Fault Tolerance (aBFT) for robust security and network resilience with cost-effective messaging at $0.0001 USD per message.”

By combining these cutting-edge technologies with the DIFC Courts’ legal expertise, the Digital Asset Will offers users a highly secure and scalable platform for managing their digital inheritance in a transparent and responsible manner.

The Future of Tokenization and Regulation

Tokenization—the process of converting real-world assets into digital tokens—is expected to reshape global markets, but regulatory clarity is still evolving. As the world moves toward tokenizing assets like real estate, art, and securities, the DIFC Courts is positioning itself ahead of the curve with its Digital Asset Will. This service could play a significant role in the future of tokenized assets as global regulations catch up.

Additionally, the DIFC Digital Assets Law (DIFC Law No. 2 of 2024) provides a clear regulatory framework that complements the launch of the digital asset will service. This law enhances the DIFC’s position as a leading jurisdiction for digital asset management, aligning with broader efforts by VARA (Virtual Assets Regulatory Authority) in Dubai and ADGM (Abu Dhabi Global Market) in Abu Dhabi to create a robust ecosystem for digital asset growth. Together, these regulatory advancements provide a supportive environment for local and international clients to confidently manage their digital assets.

Use Case Examples

Scenario 1: Digital Asset Holders

An investor holding Bitcoin and other assets can securely manage these assets using the Digital Asset Will. The non-custodial wallet ensures full control during the investor’s lifetime, with automatic distribution to beneficiaries upon their passing. Beneficiaries can trace the transaction history, allowing them to uncover assets that may have been transferred to external platforms and take action to claim those assets.

Scenario 2: Uncovering Unknown Assets

A digital asset owner who actively trades on various platforms may not inform their family about all their accounts. Through the transaction history feature in the Digital Asset Will, beneficiaries can trace the movement of assets that were moved to VASPs or exchanges, giving them the opportunity to recover unknown assets. Clients can later draft additional wills to provide access credentials to these platforms, ensuring that beneficiaries can claim the remaining assets.

Scenario 3: Expanding Coverage in the Future

As the DIFC Courts expands the wallet’s digital asset coverage, new cryptocurrencies or assets may be added. This ensures that investors with diversified digital portfolios can register their assets without restriction, making the Digital Asset Will future-proof, as market demands evolve.

Stakeholder Reactions and Market Impact

Since the launch of its Digital Asset Will, the DIFC Courts has received praise for its forward-thinking approach. Legal professionals initially met the court’s push for digitalization with some resistance, especially regarding the move to paperless courtrooms. However, the success of the digital initiatives has since won over many skeptics, showcasing the value of innovation in the courts service space.

The introduction of the Digital Asset Will service reflects the DIFC Courts’ commitment to addressing the unique legal challenges of digital asset inheritance. This innovative service offers a secure, efficient framework for managing digital assets like cryptocurrencies, ensuring beneficiaries can claim and manage inherited digital wealth. By integrating this service, the DIFC Courts strengthen Dubai’s reputation as a progressive hub for digital innovation and legal technology, further supporting the UAE’s long-standing efforts to attract international investments and promote robust regulatory frameworks.

His Excellency Justice Omar Al Mheiri, Director, DIFC Courts, said: “In our new digitally driven societies, individuals and businesses are demonstrating increased desire for easily accessible public services. The strong growth momentum arising from the implementation of the Dubai Economic Agenda D33, and the Dubai Digital Strategy, has touched a diverse range of sectors, including government legal services. Our obligation is to deploy the latest emerging technologies to facilitate this growth and demand. Breaking down the boundaries of access to justice sits at the core of our operations and these new digital services provide ease of process across administrative tasks, such as notarization, to more complex matters involving alternative dispute resolution and inheritance. The DIFC Courts, together with its public and private sector partners, is proud to spearhead some of the UAE’s most progressive government legal services, supported by smart technology implementations.”

Building On This Momentum: Future Expansion Plans

Building on this momentum, the DIFC Courts plan to build on the success of its Digital Asset Will by introducing additional services such the Digital Notary Service and the Mediation Service Centre. These offerings will provide even more flexibility and convenience for individuals and businesses in the UAE.

Pioneering Legal Frameworks for Digital Asset Management

The DIFC Courts’ Digital Asset Will is a landmark achievement, offering a global, secure, transparent, and user-friendly solution for managing and distributing digital assets. By providing a reliable framework for inheritance, the DIFC Courts has not only addressed a critical gap in the market but has also set new standards for how government legal services can embrace technology to serve a global, digital-first community. This service demonstrates the DIFC Courts’ commitment to innovative legal frameworks, placing them at the forefront of digital asset management worldwide.

As the global regulatory landscape for digital assets continues to evolve, the DIFC Courts’ forward-thinking approach ensures that it remains a pioneer in court tech and innovation, continuously adapting to meet the needs of both domestic and international users. With the Digital Asset Will service, the DIFC Courts is paving the way for secure, transparent, and efficient digital asset inheritance—ensuring a legacy of leadership in the rapidly advancing field of digital assets.