Trump’s Win and the Crypto World: Will He Deliver on His Big Promises?

As Donald Trump nears a historic return to the White House, he brings with him a suite of promises aimed at boosting the U.S. cryptocurrency landscape. With a platform focusing on decentralized finance, pro-crypto legislation, and opposition to centralized digital currencies, Trump’s plans have caught the attention of crypto enthusiasts and investors worldwide. But with the challenges and complexities of the crypto ecosystem, many wonder: Can Trump deliver on these promises, or will they remain campaign pledges?

The Trump Effect on Bitcoin and the Markets

Upon early indications of a Trump victory, Bitcoin spiked nearly 10% to an all-time high of $74,139, showing investor enthusiasm for a leader who promises to make the U.S. a crypto-friendly hub. OKX Chief Commercial Officer, Lennix Lai shared his view on this surge with Unlock Blockchain, saying, “Today’s all-time high, driven by a likely Trump election win, signals that we are in the midst of a potential paradigm shift into the next phase of growth for crypto. As a candidate, Trump sent very bullish signals to the market about embracing the crypto industry and strengthening the United States’ status as a global, regulated crypto hub. If implemented, this will have broad repercussions globally.”

Lai went on to note that OKX will continue its global growth strategy, emphasizing responsible building, regulatory compliance, and innovation. “We hope forward-looking regulation that protects the industry, users, and cultivates crypto innovation in America becomes a bipartisan topic in the future. We stand ready to contribute however we can while maintaining the highest standards of compliance and security across all operations,” Lai added. He also cautioned about market volatility, saying, “The market had also priced in a Trump win, which has created short-term euphoria as we’ve seen with today’s all-time high, but retrenchments on the way to further all-time highs are likely.”

On the other hand, Talal Tabbaa, CEO of CoinMENA, offers a broader perspective on the situation with Unlock Blockchain, stating, “Bitcoin was destined to reach a new all-time high, regardless of the outcome of the presidential election. While Trump’s win may have had a short-term impact, Bitcoin’s true role is as a hedge against the ongoing debasement of fiat currency. No matter who sits in the Oval Office, the Fed will continue printing dollars to cover budget deficits. In this environment, assets will inevitably appreciate in dollar terms, and Bitcoin stands as the clearest indicator of that debasement.”

Trump’s Promises to the Crypto Community

Trump has laid out a detailed agenda that, if implemented, could revolutionize the U.S. crypto landscape. His pledges span from self-custody rights to a strategic Bitcoin reserve, creating a blueprint for a crypto-friendly America. Let’s explore the key promises and whether they are achievable.

1. Ending the “Anti-Crypto Crusade”

Trump’s campaign pledges included a promise to end what he called the “unlawful and unAmerican Crypto crackdown” by Democratic policies. At the 2024 Bitcoin Conference, he pledged that “the day I take the oath of office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over.”

Central to his vision is creating a regulatory environment that protects crypto operations. The Republican Party’s recent political platform emphasizes a commitment to stopping any future CBDCs (Central Bank Digital Currencies), defending Americans’ rights to mine and self-custody their digital assets, and resisting increased government surveillance of transactions.

2. Mining Companies: A Return to U.S. Shores?

A longtime advocate of American manufacturing and industry, Trump wants the U.S. to dominate Bitcoin mining. His call to keep “all remaining Bitcoin to be made in the USA” underscores this vision. Industry experts, however, note that the decentralized nature of Bitcoin mining may make this challenging.

To achieve dominance, the Trump administration would need to deliver on energy infrastructure improvements and reduce regulatory hurdles, making America an attractive environment for miners.

Yet, there are challenges. Trump’s call for exclusive domestic Bitcoin mining highlights a fundamental misunderstanding of what is beneficial for the Bitcoin network. The industry’s health relies on a diverse and global distribution of mining power. Concentrating mining in one country could expose the network to risks such as regulatory changes, energy crises, and geopolitical conflicts. These factors could destabilize the network, making it less secure and reliable.

Crypto enthusiasts are closely watching whether Trump will provide favorable energy policies that can support a booming mining sector. Trump’s plan to establish the U.S. as an “energy-dominant” country may involve increased investment in electricity infrastructure to support the power demands of crypto mining. Lower energy prices would be a key factor in positioning the U.S. as a viable, long-term hub for Bitcoin mining, especially as the industry continues to expand.

3. Self-Custody as a Right

Trump vowed to codify self-custody of crypto as a right, resonating with the popular crypto mantra, “Not your keys, not your coins.” This commitment is backed by the Keep Your Coins Act, proposed by Senator Ted Budd, which would protect Americans’ rights to hold their own crypto without regulatory interference.

The importance of this promise cannot be understated, especially as proposals like Democratic Senator Elizabeth Warren’s Digital Asset Anti-Money Laundering Act push for increased monitoring of self-custodial wallets. Trump’s stance reflects the priorities of privacy advocates and highlights his intent to safeguard individual rights in the digital asset space.

4. Building a Strategic Bitcoin Reserve

Trump’s administration could take steps to bolster America’s crypto presence by creating a strategic Bitcoin reserve to hedge against national debt. Senator Cynthia Lummis’s bill to establish such a reserve aligns with Trump’s vision, aiming to acquire a million BTC over five years. Although acquiring 100% of the Bitcoin in U.S. possession is unlikely, the potential for a national crypto reserve would signal America’s commitment to leading the digital currency economy.

5. Overhauling the SEC and Removing Gary Gensler

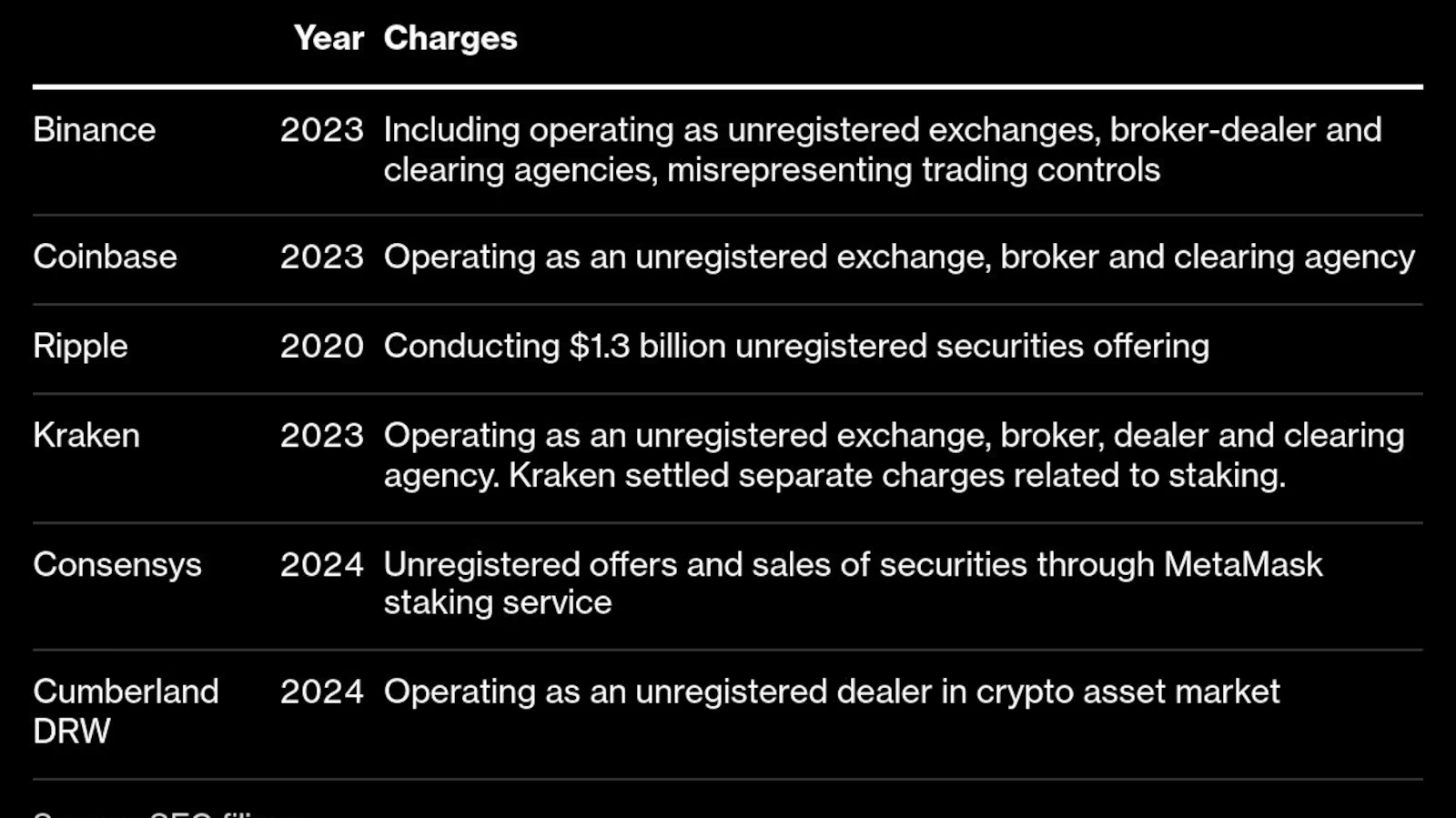

One of Trump’s boldest promises is to fire Gary Gensler, the current SEC chair, known for his aggressive stance on crypto regulation. Under Gensler’s leadership, the SEC has filed several lawsuits against major crypto firms, leaving the industry uncertain and reluctant to engage. Trump’s goal is to replace Gensler with someone more aligned with his crypto-friendly agenda.

Removing an SEC chair requires justification, as dismissals must meet “for cause” grounds such as inefficiency or neglect. Even with justifiable grounds, the process could take months, if not years. Thus, Gensler may still influence regulatory policies in Trump’s early term, potentially slowing the pace of pro-crypto reforms.

6. Opposing a Central Bank Digital Currency (CBDC)

Trump has expressed clear opposition to a CBDC, viewing it as a threat to financial privacy. At the Bitcoin Conference, he asserted, “There will never be a CBDC while I’m president.” His stance aligns with other Republican leaders like Florida Governor Ron DeSantis and Congressman Tom Emmer, who are similarly opposed to a digital dollar, citing concerns over government surveillance and control.

By prioritizing decentralized solutions, Trump hopes to prevent a future where the government can monitor every transaction. His strong anti-CBDC position has resonated with the crypto community, reinforcing his image as a defender of financial autonomy.

7. Creating a Crypto Advisory Council

Trump aims to establish a presidential advisory council for cryptocurrency, composed of industry leaders who understand the sector’s unique challenges. His intention is to shift regulatory oversight from agencies perceived as hostile to those actively supporting growth. This advisory council could help draft transparent, crypto-friendly regulations, potentially mitigating the regulatory ambiguities that have plagued the industry.

This council could help the U.S. better align with nations actively embracing digital assets and position itself as a leader in blockchain innovation.

The 2024 Election: A Turning Point for Stablecoins?

Following Donald Trump’s victory in the 2024 election, stablecoin regulation is poised to take center stage. As emphasized by Paxos CEO Charles Cascarilla, the newly elected administration must prioritize crafting clear, progressive regulations for stablecoins to secure the U.S.’s position as a global financial leader. Trump’s previous bullish signals on embracing crypto and positioning the U.S. as a hub for the industry are now critical to follow through, especially in light of growing competition from regions like the EU and UAE.

Stablecoins—digital representations of the U.S. dollar via blockchain—offer immense potential to modernize the financial system, increase accessibility, and enhance the global role of the U.S. dollar. Without clear regulations, however, U.S. firms like Paxos have been compelled to expand internationally, seeking jurisdictions with more stable and supportive frameworks.

In this context, Trump’s administration must strike a balance between fostering innovation and safeguarding consumers. Circle’s CEO Jeremy Allaire has already called for a regulatory framework that addresses fraud and volatility in the crypto space while encouraging technological development. For the industry to thrive under the new administration, clear, proactive stablecoin regulations are essential to ensure the U.S. remains at the forefront of global digital finance.

The next steps for the Trump administration will be crucial, and all eyes will be on whether the new president and Congress can craft policies that both support the crypto industry’s growth and protect U.S. financial interests in an increasingly digital world.

Trump’s Roadmap to a Crypto-Friendly America: Hurdles and Possibilities

While Trump’s vision appeals to the crypto sector, actualizing these plans will require navigating political, regulatory, and logistical challenges. Achieving his promises will demand bipartisan support, investments in infrastructure, and a delicate balance between innovation and security. Given Trump’s evolving views on crypto, some of his most ambitious goals—like a national Bitcoin reserve or firing the SEC chair—may be tempered by the realities of government structure and market dynamics.

Final Thoughts: What Lies Ahead for the Crypto World?

Trump’s victory could signal a shift in America’s stance toward digital assets, with potential to attract more crypto businesses, investments, and innovations to U.S. shores. Yet, only time will reveal the depth of his commitment to these promises and whether his administration will indeed become the pro-crypto haven many anticipate.

For now, Bitcoin and crypto markets remain optimistic, eagerly awaiting Trump’s next move. While his supporters champion the promise of a thriving crypto ecosystem, achieving this vision will hinge on his ability to turn campaign promises into actionable policies.