MicroStrategy’s Meteoric Rise: Bitcoin Bets Propel Company into Top 100 US Public Firms

MicroStrategy (MSTR), the self-proclaimed Bitcoin development company, has made headlines yet again, with its remarkable ascent into the top 100 U.S. publicly traded companies. Currently ranked 97th, the company’s success is largely attributed to its aggressive Bitcoin (BTC) strategy, which has propelled its stock performance into the stratosphere.

The Bitcoin Treasury Leader

MicroStrategy’s stock surged 12% on Tuesday, pushing the share price to $430 and marking a significant 29-place jump in the rankings. The company’s stellar performance coincided with Bitcoin reaching new all-time highs above $94,000. MicroStrategy has been one of the standout success stories of 2024, with the company’s stock soaring over 500% year-to-date, mirroring Bitcoin’s impressive 100% surge in the same period.

In fact, in the last five years, MicroStrategy has outperformed NVIDIA (NVDA) by an impressive margin. Since adopting Bitcoin as a treasury asset in August 2020, MicroStrategy’s stock has risen by a staggering 2,739%, while NVIDIA has seen a 2,688% increase. As of November 18, 2024, MicroStrategy holds 331,200 Bitcoin, making its Bitcoin stash worth over $30 billion.

Convertible Notes and Future Growth

Adding to the excitement, MicroStrategy has recently announced the upsizing of its convertible senior note offering. Initially set at $1.75 billion, the company increased the offering to $2.6 billion, fueled by high demand. The 0% coupon convertible notes, maturing in 2029, are being priced at a 55% conversion premium, with an additional $400 million greenshoe option. These funds will be used to further bolster MicroStrategy’s Bitcoin holdings, underscoring the company’s continued commitment to its Bitcoin investment strategy.

There is also anticipation surrounding the potential oversubscription of this offering, which could increase the total amount raised to $2 billion. The company’s ongoing efforts to expand its Bitcoin reserves reflect a clear long-term commitment to the digital asset.

In addition to MicroStrategy’s own announcement, other crypto companies, such as Mara Holdings (MARA), have also been active in raising capital to purchase more Bitcoin. Both companies issued 0% coupon convertible notes, signaling a broader trend of Bitcoin-focused companies securing funds to expand their holdings.

Expanding the Case for Bitcoin: Microsoft in Focus

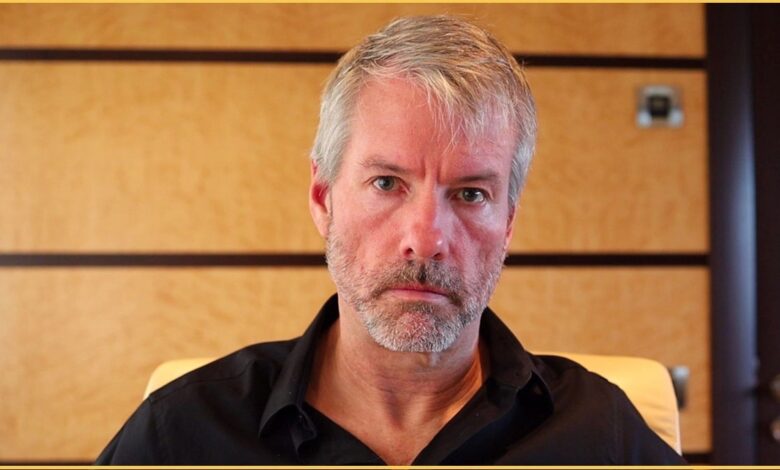

At the helm of this Bitcoin strategy is Michael Saylor, MicroStrategy’s founder and a vocal Bitcoin advocate. Saylor is not just content with leading his own company’s Bitcoin efforts; he’s taking his message to some of the largest tech companies in the world. In a November 19 VanEck-hosted X Space, Saylor revealed that he would present a Bitcoin investment strategy to Microsoft’s board of directors. The presentation, which will be limited to just three minutes, comes on the heels of Saylor’s bold offer to help Microsoft generate a trillion dollars using a Bitcoin-based treasury strategy.

Microsoft shareholders are scheduled to vote on a proposal to consider adding Bitcoin to its balance sheet on December 10. Top shareholders like Vanguard Group, BlackRock, State Street, and Fidelity Management & Research will play key roles in this pivotal decision.

Saylor’s proposal to Microsoft follows a growing conversation in corporate circles about Bitcoin as a superior alternative to traditional cash reserves. He has argued that companies like Apple and Google could benefit from allocating a portion of their reserves to Bitcoin, projecting substantial long-term growth. “If Apple bought $100 billion of Bitcoin, it would likely grow to $500 billion,” Saylor has stated, emphasizing the immense potential that Bitcoin holds for tech giants with large cash reserves.

Saylor’s advocacy for Bitcoin is not just limited to his own company’s holdings but extends to his broader vision of transforming corporate treasury strategies.

Why MicroStrategy’s Success Matters

MicroStrategy’s ascent underscores the growing integration of cryptocurrencies into mainstream financial strategies. Its success serves as a blueprint for other corporations considering Bitcoin as a treasury asset. The company’s aggressive moves continue to challenge conventional thinking and push boundaries, with Saylor championing Bitcoin as a transformative financial tool for institutional adoption.

MicroStrategy’s historic rise and relentless Bitcoin acquisition strategy highlight the increasing convergence between crypto-native ecosystems and traditional finance—a trend that shows no signs of slowing down.

As Bitcoin continues to break new records and attract institutional interest, MicroStrategy’s role in this space is likely to grow, potentially inspiring other companies to follow suit.