Gary Gensler to Step Down as SEC Chair on January 20

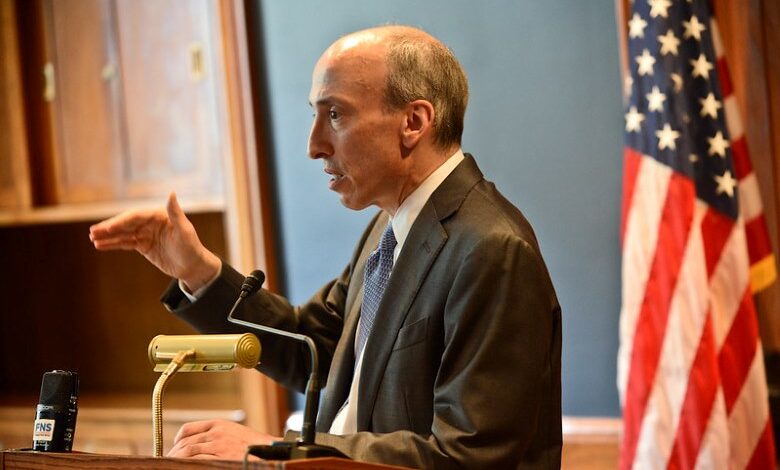

Gary Gensler, the 33rd Chair of the U.S. Securities and Exchange Commission (SEC), will officially step down on January 20, 2025, at 12:00 pm. Appointed in April 2021, Gensler led the agency during a critical period, overseeing significant initiatives aimed at bolstering the integrity, efficiency, and resilience of U.S. capital markets.

Reflecting on his tenure, Gensler expressed gratitude to his colleagues and President Biden for the opportunity to lead the SEC, emphasizing his dedication to investor protection and market stability throughout his term.

Legacy and Career Highlights

Beyond his leadership at the SEC, Gensler’s career has been marked by notable achievements. He previously chaired the Commodity Futures Trading Commission (CFTC) and played a key role in drafting the Sarbanes-Oxley Act. During the Obama administration, he led reforms of the $400 trillion swaps market, one of the most significant post-financial crisis regulatory overhauls.

As the SEC transitions to new leadership, Gensler’s regulatory reforms are expected to leave a lasting impact on market transparency, corporate governance, and investor protection.

Gensler’s Stance on Cryptocurrency

A defining aspect of Gensler’s tenure was his hardline approach to cryptocurrency regulation. Describing the crypto market as the “Wild West,” Gensler consistently pushed for stringent oversight to safeguard investors and uphold market integrity.

Under his leadership, the SEC initiated numerous enforcement actions against crypto entities for alleged violations such as unregistered securities offerings and fraud. High-profile lawsuits against major exchanges like Coinbase and Binance underscored Gensler’s uncompromising stance on compliance within the digital asset space.

These actions, while aimed at protecting investors, sparked significant backlash from the crypto industry and raised questions about the clarity of the regulatory framework. Despite criticism, Gensler maintained that the SEC’s enforcement actions were essential to ensuring the law was applied equally, regardless of the asset class.

The Future of Crypto Regulation

Gensler’s departure may signal a shift in the SEC’s approach to cryptocurrencies. A new chair could potentially adopt a more balanced perspective, prioritizing innovation-friendly policies alongside investor protections.

This leadership transition presents an opportunity to address the industry’s calls for clearer regulatory guidelines and a more collaborative relationship between regulators and the crypto ecosystem. As the crypto sector continues to evolve, the next SEC chair’s stance will be pivotal in shaping the future of digital asset regulation in the U.S.

Gary Gensler’s resignation marks a significant turning point for the SEC and its oversight of the cryptocurrency market. While his tenure brought heightened scrutiny and legal actions against crypto entities, it also amplified the conversation around regulatory clarity and investor protection in the digital asset space.

As the SEC prepares for its next chapter, the trajectory of U.S. crypto regulation remains a focal point for industry stakeholders, investors, and policymakers alike.