Michael Saylor to Microsoft: The Case for HODLing Bitcoin

Microsoft Cannot Afford to Miss the Bitcoin Wave

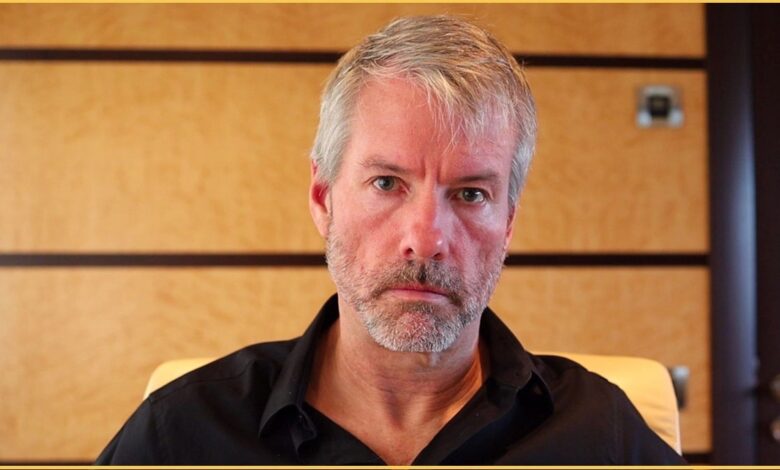

Michael Saylor, Executive Chairman of MicroStrategy, has issued a bold challenge to Microsoft: embrace Bitcoin or risk missing out on the next major technology wave. In a compelling presentation, Saylor explained why Bitcoin represents the greatest digital transformation of the 21st century and why Microsoft Bitcoin adoption must become a strategic priority. This call to action coincides with MicroStrategy’s latest milestone—boosting its Bitcoin holdings to 402,100 BTC, acquired at an average price of $58,263 per Bitcoin.

Bitcoin as the Evolution of Capital

Saylor positioned Bitcoin as the evolution of capital itself, transforming traditional assets into a superior, decentralized form of wealth. He described Bitcoin as “digital capital,” noting its economic and technical advantages over conventional financial instruments like bonds or stock buybacks.

According to Saylor, Microsoft Bitcoin adoption would enable the company to move beyond outdated financial strategies, positioning itself as a leader in this financial revolution.

Investors, he argued, are increasingly turning to Bitcoin to protect their wealth from inflation and devaluation—risks that currently erode trillions of dollars in capital annually. By embracing Bitcoin, corporations like Microsoft can join the growing wave of digital transformation.

A Strategic Opportunity for Microsoft

In his presentation, Saylor argued that Bitcoin is the best asset Microsoft could hold to drive shareholder value and outperform competitors. He highlighted that stock buybacks and bonds, while traditional, fail to address long-term financial risks or maximize growth potential. “It makes a lot more sense to buy Bitcoin than to buy your own stock back or to hold bonds,” Saylor asserted, emphasizing the need for Microsoft Bitcoin adoption to mitigate risks and unlock growth.

He encouraged Microsoft to evaluate its strategic options by integrating Bitcoin into its balance sheet. By converting cash flows, dividends, and debt into Bitcoin, Saylor suggested that Microsoft could unlock trillions in enterprise value, add hundreds of dollars to its stock price, and reduce shareholder risk.

MicroStrategy Leads by Example

Saylor’s vision is exemplified by MicroStrategy’s own commitment to Bitcoin. The company recently acquired 15,400 BTC for $1.5 billion, bringing its total holdings to 402,100 BTC. These investments have generated impressive returns, with Bitcoin yields reaching 38.7% quarter-to-date and 63.3% year-to-date.

Saylor’s leadership at MicroStrategy demonstrates the transformative power of Bitcoin as a strategic asset. He argued that Microsoft, with its scale and influence, has an even greater opportunity to capitalize on Bitcoin’s potential and lead the digital capital revolution.

The Broader Momentum Behind Bitcoin

Public support for Bitcoin is stronger than ever, with institutional investors, Wall Street, and even political figures recognizing its potential. Saylor pointed out that Bitcoin’s unique position as an asset “without counterparty risk” makes it a cornerstone of future financial systems. He also referenced discussions surrounding a U.S. Bitcoin Strategic Reserve, signaling Bitcoin’s growing integration into global economic frameworks.

By championing Microsoft Bitcoin adoption, the company could align itself with the future of capital markets. This strategic move would not only secure Microsoft’s place as a leader in financial innovation but also catalyze a broader shift toward digital capital globally.

A Critical Decision for Microsoft’s Future

Saylor’s message to Microsoft was clear: embrace Bitcoin as the cornerstone of your financial strategy or risk falling behind in the next wave of innovation. With Microsoft holding $78.42 billion in cash and cash equivalents, the potential impact of even a partial allocation to Bitcoin would be transformative. A move of this magnitude could trigger a domino effect, inspiring other global corporations to follow suit and driving Bitcoin’s adoption to unprecedented levels.

If Microsoft began buying Bitcoin, it would not only solidify its position as a forward-thinking leader in technology but also reshape the digital asset market, sending a powerful signal to the financial world. The question is no longer whether Bitcoin has a place in corporate treasuries—but whether Microsoft is bold enough to lead the charge. Will Microsoft seize this opportunity to define the future of digital capital?