Gold Hits Record Highs as Bitcoin Slides: Is the Digital Gold Narrative Losing Ground?

Gold and Bitcoin have long been compared in financial circles as competing stores of value—one a centuries-old haven, the other a digital upstart branded “digital gold.” But recent market behavior suggests the comparison may be breaking down, at least in the short term.

As gold surged to new all-time highs above $3,000 an ounce amid escalating geopolitical tensions and global uncertainty, Bitcoin has faltered. Down nearly 22% from its January peak of $109,000 to around $83,000 this week, Bitcoin appears to have lost its footing as a hedge against inflation and geopolitical risk.

The Geopolitical Spark That Ignited Gold’s Rally

Gold’s latest rally has been fueled by a resurgence in geopolitical risk. Renewed conflict in the Middle East—specifically Israel’s airstrikes on Gaza following the breakdown of a temporary ceasefire—has rattled global markets. In parallel, Russia’s intensified military actions in Ukraine and ongoing instability in the Red Sea shipping lanes have increased investor anxiety.

These events, combined with persistent inflationary pressures in key economies, have driven investors toward safe-haven assets. Gold, the oldest of them all, has reclaimed its throne.

- Gold prices surpassed $3,000 per ounce breaking previous records.

- Central bank purchases remain robust, with the World Gold Council reporting that central banks collectively added 1,045 metric tons of gold to their reserves in 2024, marking the third consecutive year in which purchases exceeded 1,000 tons. This trend of consistent central bank buying is further reflected in China’s increasing gold reserves in 2025. At the end of February, China’s gold reserves rose to 73.61 million fine troy ounces, up from 73.45 million at the end of January, as the central bank continued to purchase the precious metal for the fourth straight month, according to Reuters.

- Gold ETFs have seen net inflows in the past month, underscoring renewed institutional interest. saw In February, global physically-backed gold ETFs saw inflows totaling US$9.4B, the strongest since March 2022, according to the World Gold Council. In the United States, gold holdings in ETFs have climbed 68.1 tons, a gain of 4.3%, to 1,649.8 tons so far this year, as reported by Reuters.

U.S. retail investors have become increasingly wary of stock markets following recent sell-offs. The benchmark S&P 500 index experienced its biggest drop this year last week, further boosting demand for gold as a refuge from turbulence. Recent inflows into North American gold ETFs indicate that interest in gold as a hedge is also growing in the U.S.

Bitcoin Fails to Shine Amid Crisis

Meanwhile, Bitcoin has struggled to attract the same safe-haven demand. Instead of benefiting from global turmoil, the asset has shown a clear correlation to riskier assets.

- Bitcoin has fallen 22% from its January 2025 all-time high of $109,000 to $83,000 on Wednesday according to CoinGecko data.

- On-chain data from Glassnode highlights a 54% drop in exchange inflows from their recent cycle peak, signaling a lack of fresh capital entering the market.

- Bitcoin futures open interest has declined by 35%, falling from $57 billion at its peak to $37 billion, reflecting reduced leverage and speculative activity.

Despite headlines touting Bitcoin as “digital gold,” the market behavior says otherwise, at least for now.

Why Gold Is Winning the Hedge War

The divergence between gold and Bitcoin in recent months raises serious questions about Bitcoin’s role as an inflation and geopolitical hedge.

1. Institutional Behavior Favors Gold: ETF Dynamics Tell the Story

Central banks have no appetite for Bitcoin, but they are snapping up gold at unprecedented rates. In 2023 alone, over 20% of global gold demand came from central banks, according to the World Gold Council. Bitcoin, while now available through ETFs, hasn’t garnered the same level of commitment.

- Bitcoin spot ETFs have experienced significant outflows in recent weeks. BlackRock’s iShares Bitcoin Trust (IBIT) recorded a single-day outflow of $418.1 million on February 26, marking its largest withdrawal to date, according to data from Farside Investors. In February, Bitcoin ETFs saw their biggest monthly outflow since they were launched, with $3.3 billion pulled out from the funds, according to the Dow Jones Market Data. The lack of consistent institutional inflows has added to selling pressure and exacerbated Bitcoin’s recent declines.

- On the other hand, in January 2025, global physically backed gold ETFs experienced significant inflows, with European funds leading the way. European funds added approximately $3.4 billion during that month, marking the largest monthly inflow since March 2022, as per the World Gold Council.

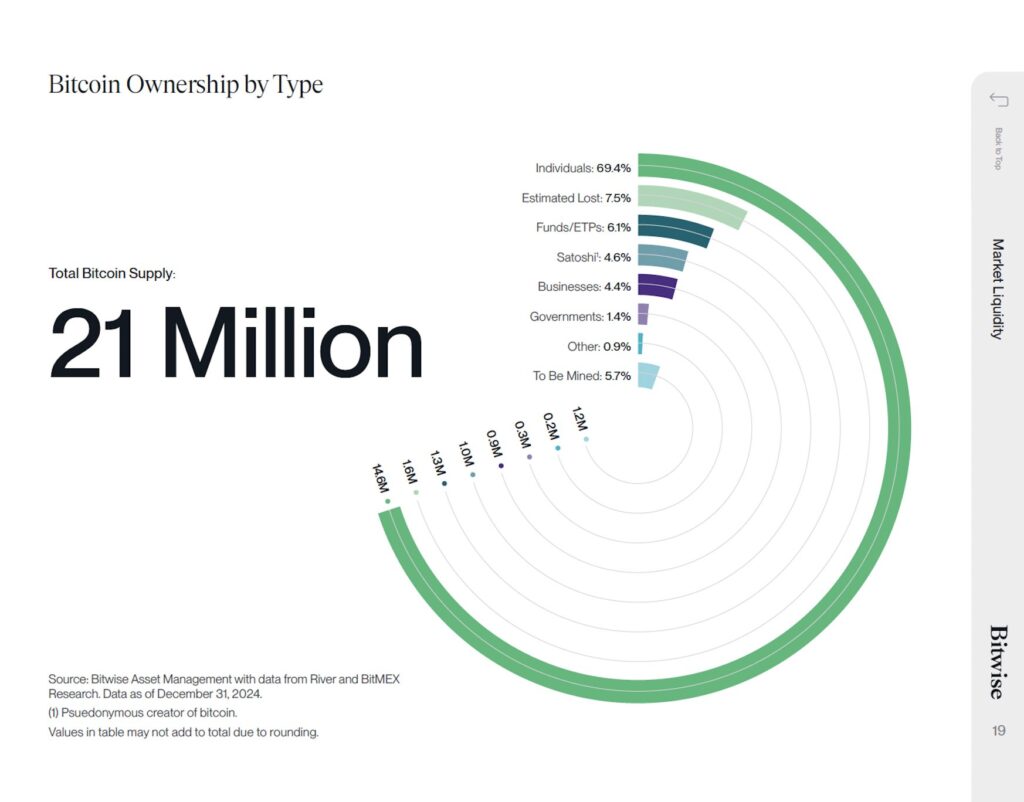

2. Market Maturity and Participant Base

Gold enjoys broad, mature market participation from central banks, sovereign wealth funds, and pension funds. Bitcoin, while increasingly held by institutional players, still shows a significant concentration among individual holders, who account for 69.4% of its total supply, as of December 2024, according to data from Bitwise Asset Management. Funds and ETPs represent a smaller share, holding just 6.1% of the supply. This relatively narrower and less diversified investor base, compared to gold, makes Bitcoin more susceptible to sharp price movements, particularly during periods of reduced liquidity.

3. Correlation With Risk Assets

Bitcoin has shown an increasing correlation to risk assets like equities, particularly tech stocks. In contrast, gold retains its non-correlated, safe-haven appeal.

- Bitcoin’s 30-day correlation with the Nasdaq 100 index increased since the end of 2024, reaching a two-year peak of 0.77 on December 31, 2024, and 0.70 on January 17, 2025. This surge underscores Bitcoin’s behavior as a high-beta tech proxy rather than a hedge.

- Gold’s correlation with equities remains near zero or negative. A 2025 report by Citi Private Bank notes that gold has been negatively correlated with most major asset classes, including equities, over the past several decades, reinforcing its role as an effective portfolio diversifier.

4. Cash-and-Carry Trade Unwinding

A key reason for Bitcoin’s recent decline lies in the unwinding of the cash-and-carry trade. Traders previously profited by arbitraging Bitcoin’s price premium in CME futures over spot prices. As this trade unwound:

- Leverage in Bitcoin’s futures markets dropped. A significant reduction in leverage within the futures markets has led to a substantial decrease in open interest. Between December 2024 and March 2025, Bitcoin futures open interest declined by approximately $10 billion, marking a 35% drop from its peak, according to Coinglass data.

- Similarly, in the altcoin market, open interest plummeted by 60%, shedding $23.9 billion in speculative trading activity. These changes are indicative of a broader market deleveraging, where traders unwound leveraged positions, leading to reduced open interest across various futures contracts. The reduction in leverage amplified price volatility and accelerated the sell-off.

Long-Term Bitcoin Fundamentals Still Intact

Despite short-term headwinds, Bitcoin’s core value proposition remains unchanged for long-term holders.

- Long-Term Holders have barely moved their coins, showing conviction amid price volatility. “Long-Term Holder activity remains largely subdued, with a notable decline in their sell-side pressure,” according to a March 18 Glassnode report.

- Institutional adoption, while paused, is not reversed. Large players like BlackRock and Fidelity still maintain significant BTC exposure, and ETF structures provide future entry points. BlackRock’s iShares Bitcoin Trust (IBIT) has gathered $46.5 billion in assets, showing continued faith in Bitcoin’s long-term potential.

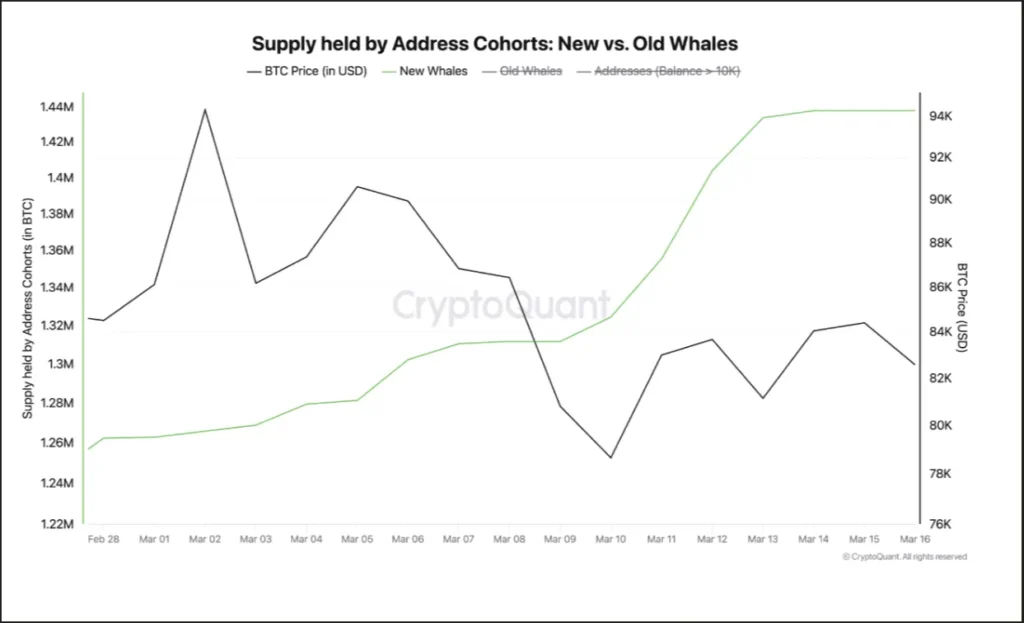

- Whale Accumulation: A significant shift is occurring among new Bitcoin whales who are aggressively accumulating Bitcoin. According to CryptoQuant, these whales have collectively acquired over 1 million BTC since November 2024. Their pace of accumulation has accelerated, with more than 200,000 BTC added in just the past month. This suggests strong conviction in Bitcoin’s long-term outlook, driven by institutional investors or high-net-worth individuals positioning themselves as major players in the market.

Is the Digital Gold Narrative Dead?

Not quite—but it’s being tested.

In the short term, Bitcoin is behaving less like digital gold and more like a speculative asset caught in the broader macroeconomic crossfire. Gold’s rally during times of crisis demonstrates that investors still see the yellow metal as a time-tested hedge. Bitcoin has yet to earn that level of trust from institutions or the average investor.

But as the market matures, regulatory clarity improves, and generational wealth shifts toward digital-native assets, Bitcoin’s long-term “digital gold” thesis could find new life.

Bitcoin’s role as digital gold is under scrutiny in 2025. Gold’s performance has been a masterclass in safe-haven demand, while Bitcoin struggles with liquidity, leverage unwinding, and a risk-off environment. Still, the long-term game for Bitcoin isn’t over. This is a test—one it may ultimately pass, but not without growing pains.