Crypto traders chasing high returns in decentralised applications

The crypto markets have gained popularity for traders in their search for assets with positive returns in a negative real-rate environment. This is despite the large drawdowns in the crypto markets and the heavy energy consumption associated with running the larger crypto ecosystems. The crypto market is turning from being dominated by short-term traders who want to ride the speculative trends to longer-term investors who value the technical capabilities of the different blockchains, challenging Bitcoin’s market dominance. Some of these crypto traders are locking their cryptos in various blockchain-based applications with the promise of high returns—despite the lack of a regulatory framework around investor protection.

Anders Nysteen, Senior Quantitative Analyst, Saxo Bank

The “2021 crypto trader”

The number of global crypto users has doubled in the first half of 2021, with a lot of new players in the game. Some of the new traders have a very high risk appetite with highly leveraged positions, vulnerable to even minor market downtrends. The flash-crash on September 7 saw more than $3.5bn of these positions liquidated in the crypto derivatives market within 24 hours. Despite aggressive trading in parts of the crypto community, a recent survey shows that fewer crypto traders are buying cryptos as a gamble in 2021 than in 2020, and more see crypto as an alternative to mainstream investments. The primary reason for buying cryptocurrencies is still to make a profit, both in the short and long term, as shown in Figure 1. But some of the buyers want to employ cryptos for other things such as transfers, payments and decentralised applications, and these additional features of cryptocurrencies have really started getting traction this year.

Figure 1: Survey by the digital asset marketplace Bakkt for investors in H1 2021. Why do they buy?

Large inflow into blockchain applications

Comparing 2021 to 2017, the inflow this year into the crypto market is more diverse, both within different cryptocurrencies and different use cases for the crypto tokens within the blockchain space. These cases include the value storage narrative, decentralised finance, non-fungible tokens (NFTs), gaming and stablecoins. The store of value narrative, particularly for Bitcoin, has intensified upon the increasing inflation, considering companies like MicroStrategy, Tesla and Square have added Bitcoin to their balance sheets.

The increasing risk appetite has not only affected Bitcoin, but has also impacted blockchains supporting smart contracts such as Ethereum. Smart contracts allow functionalities in addition to the classical transfer of value, and they have a variety of use cases in protocols operating on these blockchains. One major application is within decentralised finance (DeFi), which in the beginning of the year was rather unknown to the majority of crypto investors. The overall scope of DeFi is to facilitate classical banking services such as lending on a blockchain, removing the need for a potentially costly middleman to facilitate the service.

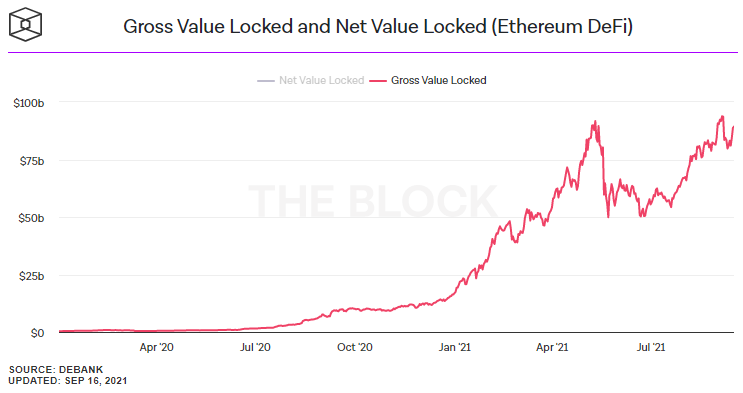

Since September 2020, the value locked in DeFi protocols on Ethereum has grown from $8bn to $84bn (see Figure 2), and other similar blockchains have seen comparable growth in value locked in DeFi. The value is mostly locked in protocols concerning trading, lending and stablecoins. By locking crypto tokens in decentralised protocols, investors are promised yields of up to 10% yearly, compared to the often negative interest rate of keeping fiat in a bank account. This is however not without risk, as when lending on decentralised protocols the lender covers the smart contract risk associated with hacking and errors, as well as the risks of a decentralised system such as forgetting the credentials to the wallet.

Figure 2: Amount of ETH locked in DeFi protocols. Source: The Block & Debank

Coming almost completely out of nothing is another big use of smart contracts. The hype for trading digitalised versions of arts, videos and illustrations has been booming this year. Trading of these so-called non-fungible tokens (NFT) are carried out on blockchains to ensure the uniqueness of the digitalised assets, with Ethereum being the largest right now. Trading of NFTs peaked in February when the previously unknown artist called Beeple sold an NFT for $69m. In August and continuing into September the trade volume of NFTs heated up. In particular, NFTs like CryptoPunks consisting of 10,000 unique characters have sold for millions each. It shows an increasing appeal for investors to diversify their portfolio by holding unique tokens, but more significantly an expectation that the market can solely go up.

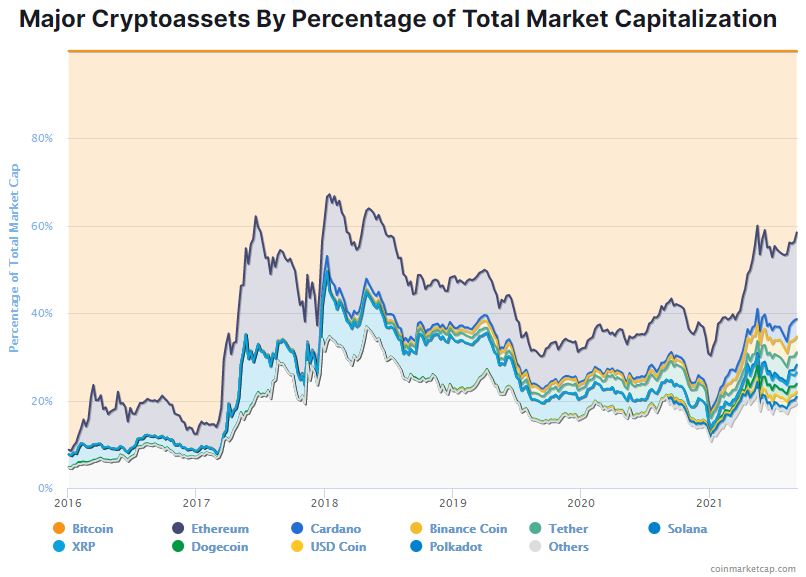

Bitcoin’s market dominance challenged once again

With the rapidly evolving applications for smart contracts, Bitcoin is again challenged as the dominating cryptocurrency since it was challenged for the first time during the initial coin-offering boom in 2017. The market capitalisation fight has several combatants: Bitcoin as the first mover with its status of “digital gold” and renown as store of value; Ethereum as technically superior to Bitcoin and a first mover among the cryptos with smart contracts, although with scalability limitations in its current version; and newer generations of cryptos as they are technically superior when it comes to scalability, the green agenda and interoperability-wise, although many of these are still in the rollout/development phase. It is way too early to call a winner in this battle, but the tendency this year has clearly been in favour of the new generations of cryptos, as shown in Figure 3.

Figure 3 – Source: Coinmarketcap.

As we see it, the rest of 2021 will be driven by the expectation of smart contract applications and decentralised protocols. We expect an increased risk appetite for decentralised protocols in the hunt for large returns, and this will add value to the amount locked in DeFi protocols. However, investors in the crypto market should keep an eye on several risks. The big moves in the crypto market and particularly in the minor cryptocurrencies may not be driven by an underlying boost of fundamentals; it may merely be bubble-like movements where traders are buying solely to ride the price uptrend. On the regulation side, the decentralised protocols are lacking a regulatory framework and there’s no lawful protection of the investor; a single hacker attack can wipe out the whole investment. Many government agencies are pushing for increased regulation of DeFi, and it may have a significant impact on Ethereum and other DeFi blockchains, while Bitcoin should be less affected. On the other hand, an additional focus on the global green agenda may prove a drawback for Bitcoin due to the large power demands for running the Bitcoin blockchain, whereas only a minor impact may be seen in the less power-demanding, “greener” cryptocurrencies.