One Billion AED value of trade settlements under MBridge CBDC Pilot

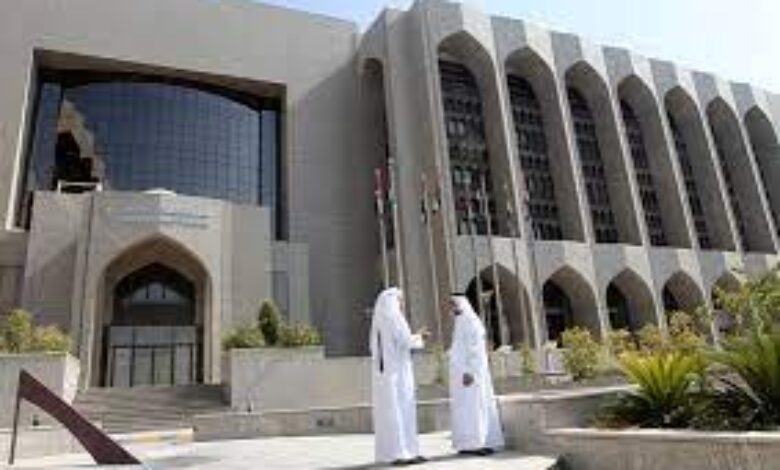

transactions were carried out with the participation of UAE FAB (First Abu Dhabi Bank) and Emirates Bank as well as the Central Bank of UAE.

During the Hong Kong Fintech week, CBDC Mbridge Projectwhich is includes BIS Innovation Hub and four Central Banks including UAE Central Bank, Bank of Thailand, The Digital Currency Institute of China, and the Hong Kong Monetary Authority, released the Mbridge brochure that showcased 15 use cases and 22 participants. The mBridge project aims to lower costs and improve the speed of international transactions using CBDCs.

The CBDC Mbridge steering committee gave priority to trade settlement. They believe it has the potential to lower costs and improve speed in the massive industry, according to the presentation. Trade between the four was more than $730 billion in 2019, the presentation noted citing World Bank data.

As per the report, when it came to International Trade Settlement pilot, through testing, the project team validated that the mBridge trial platform addresses the principle pain points of cross-border payments, including high cost, low speed, and operational complexities, while also ensuring that policy, regulatory compliance, and privacy mechanisms are appropriately integrated.

In terms of the amounts that have been traded during the CBDC Mbridge project, 1 Billion AED of trade settlement transactions were carried out with the participation of UAE FAB (First Abu Dhabi Bank) and Emirates Bank as well as the Central Bank of UAE. In addition 10 Billion Thai Baht worth of trade settlement transaction was traded, in addition to 2 billion RMB and 2 billion worth of HKD.

The trial included 11 unique industries including medical, apparel, and semi conductors.

According to project steering committee, the ultimate goal is to achieve a minimum viable product and, eventually, production-ready system that can support the full process of international trade settlement and, in due course, other potential use cases.

Mbridge announced in September 2021 that it would be starting its second phase with projects involving commercial banks.