65 of Top 100 global public companies are using blockchain

Hyperledger most preferred DLT used by top 100

BlockData recently published a report on the rise of blockchain implementations in the corporate evironment According to the report corporate interest in blockchain has been obvious over the last few years. Major banks and institutions are opening up to the idea that blockchain and cryptocurrencies will improve their traditional systems.

BlockData did an extensive research into the top 100 public companies using blockchain. As per the research interest in blockchain by coroporations started as early as 2014.

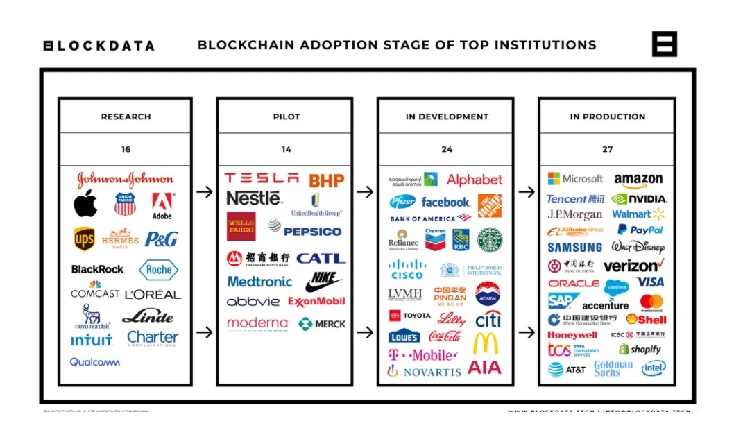

As of September 2021, 81 of the top 100 public companies are using blockchain technology. This includes those who are in a research phase (meaning they are exploring opportunities and deciding on which technologies they could use for their blockchain initiatives). However, if research phase is removed, the research found that there are still an impressive 65 companies who are actively developing blockchain solutions.

These solutions have ranged from successful pilots, to major projects currently in development, and live in-production services that are being used by employees, partners and clients today.

From those 65 companies implementing blockchain Hyperledger is the most preferred DLT used by the top 100 institutions. The research showed that there are 30 different blockchain technologies used by the top institutions.

Out of the 30 technologies , Hyperledger Fabric is the most preferred DLT of choice by the top 100, with 26% of them currently using the technology. This is followed by Ethereum with 18% , and Quorum with 11%. 8 percent use Corda, 3 percent are using Mediledger, another 3 percent are using AXCore

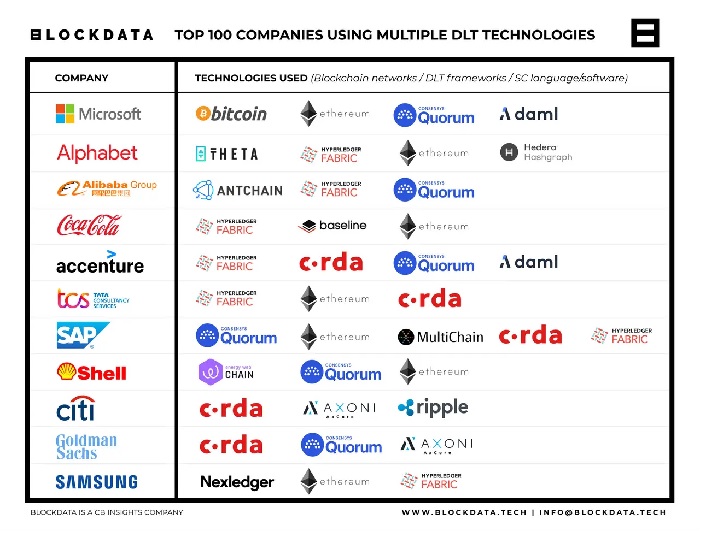

Using multiple technologies for the right solutions11 of the top 100 public companies are working on multiple solutions with different blockchain technologies. Some of them are using different technologies because they are better suited for the use cases, others are simply testing the waters to see which technologies work best.

A great example is Samsung Group, which is currently working on a number of blockchain initiatives with various technologies. Its subsidiary Samsung SDS provides blockchain security and tech solutions to Samsung’s customer base.

Most corporations appear interested in permissioned chains or frameworks that allow them to build customized, private solutions. Popular frameworks like IBM’s Hyperledger Fabric and Sawtooth are modular frameworks and the de facto standard for enterprise blockchain platforms. They have advanced privacy controls so only the data you want shared gets shared among a “permissioned network of participants”.

As per the research, 16 percent of companies are in research phase, 14 percent are in pilot phases, 24 percent are in development phase and 27 percent are in production phase. Out of the 81 companies that are currently working with blockchain technology, 51 of them are past the pilot stage and are either in development or have full production services.

As a lot of information is also confidential, it is difficult to tell whether or not a number of these companies decided to continue further post pilot-phase. Hence, moving past this is considered a strong metric for blockchain matury as it must provide tangible business value to be moved into production.

The main use cases currently being developed by the top 100 public companies are:

Blockchain infrastructure services / BAAS platforms.

These companies are building infrastructure that helps other companies build blockchain solutions. They aim to either provide coding support or hosting solutions.

Supply chain / Traceability / Provenance

With supply chains being very complex, companies are looking to modernize their supply chain solutions using blockchain. They do this by using blockchain as a ‘trusted single source of truth’ that allows companies to better track products throughout the supply chain and verify their identity.

Clearing & settlements

When making transactions of financial assets, be that bonds, equity or other financial instruments in capital markets a lot of parties have had to be involved to complete and ‘settle’ those transactions. When using blockchain, it can reduce the cost of settlement thus transactions can be cleared quicker.