Roland Berger, crypto mining to transform energy sector

There can be little doubt that the crypto economy is here to stay. With it come a variety of interesting new areas for investment funds, private companies and public authorities to explore. Crypto mining is one such avenue. This is the proof-of-work process used to create new coins and validate transactions via a powerful computer system, or “mining rig,” dedicated to solving algorithmic puzzles.

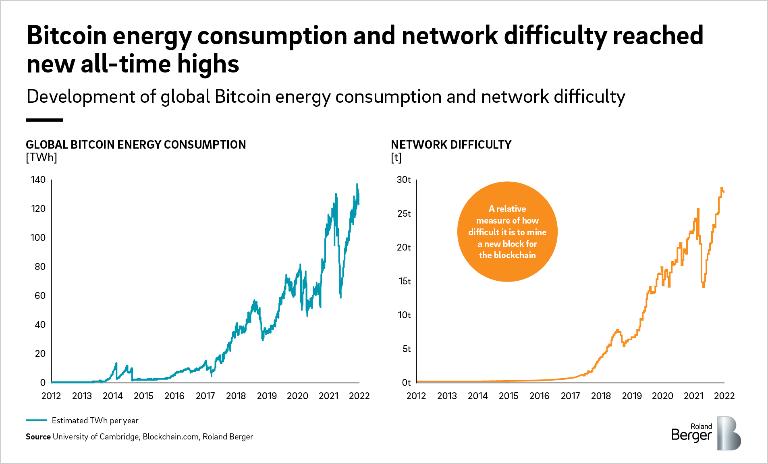

It is an energy-intensive procedure: According to the University of Cambridge, the total annual power consumption of Bitcoin, the most widespread cryptocurrency, is currently 145 TWh, which is approximately 0.32% of total global energy consumption.

Just half a decade ago, crypto’s impact on the world’s energy grids was negligible. But in the past five years, Bitcoin’s energy consumption has grown from 11.8 to 120.5 TWh per year; the equivalent of adding 2,400 wind turbines to the grid every year. For context, the United States has installed an average of around 3,000 wind turbines a year, according to the USGS. And this could continue to rise rapidly: NYDIG, a Bitcoin financial services company, estimates that electricity consumption from Bitcoin mining could grow to 706 TWh by 2027.

Crypto mining and the push to grow green

Crypto’s rapid growth in energy use is attracting questions over its sustainability . Currently, 57% of the energy used for crypto mining comes from renewable sources (hydro, wind, solar, nuclear, geothermal and carbon generation with carbon offsets as defined by the Bitcoin Mining Council Q3 2021 Report). However, given the inherent incentive for miners to minimize energy costs, and the fact that clean energy is now the cheapest source of power in some countries as “available” energy, we expect the share of green energy to grow quickly. This is especially true for countries with a strong policy push for decarbonization.

While this is good news for the environment, it does present an additional challenge to the electricity sector, which is already facing increased demand as other industries transition from fossil fuels.

How crypto miners can benefit grid operators

Crypto mining operations may share similar usage characteristics to other types of data centers, but their business model and output create a distinctive set of customer attributes.

With energy representing the vast majority of their operating costs, crypto miners are extremely price sensitive. They are also able to operate from a variety of locations, and often look to strike deals with utilities and power plants to work on site and avoid grid costs. Crucially, miners can work flexibly, too: Mining rewards are gained in sprints not marathons, and they are not bound to a specific time of day. This can help balance short-term energy supply and demand.

These characteristics present three potential benefits for grid operators.

1. New revenue streams and asset optimization

Thanks to its geographic flexibility, crypto mining can be located close to the source of energy generation. This provides a unique opportunity to obtain value from under-utilized generation capacity. Generators constrained by transmission availability can find new outlets for their power. In the US, nuclear facilities are beginning to use crypto mining to increase their sales and improve their economics as they compete with lower-priced generation. And crypto mining can also benefit generators of renewable energy: It could enable a value stream for solar power projects in long interconnection queues, for instance, or specific areas with too much solar power. Ultimately, this additional revenue can accelerate the expansion of renewable energy infrastructure.

2. Demand response and load balancing

Dynamic customer involvement in balancing short-term power supply and demand is a megatrend in the utilities sector. As both the share of fluctuating renewable energy sources and demand for electricity increase, flexible tools are becoming increasingly important.

Rather than adding new supply resources to meet peak demands, it is often less costly to recruit customers who are willing to reduce their electricity usage at certain times in return for a discount or payment. This form of “demand response” saves money for both the utility and its customers.

Crypto mining can take demand response to a new level, enabling large loads to quickly be curtailed for a fee. It can help provide a seasonal balance in hot climates, where energy-hungry operations like air conditioning units and water desalination plants create seasonal load patterns. Innovative utilities such as Black Hills Energy are already developing flexible tariffs to accommodate this new use case.

3. System control and planning

Crypto mining also has the potential to assist local utilities with distribution management. Given the locational flexibility of crypto miners, a utility can strategically place a mining operation where it benefits the system most. Crypto mining can help balance distributed generation by absorbing excess power and enabling a grid to operate more smoothly.

The potential challenges of embracing crypto mining

The intense power usage of crypto mining can cause reliability and equipment problems for grids that don’t have the capacity to handle increased loads. Some countries have already banned or significantly regulated crypto mining, including China, Iran and Turkey.

If servicing crypto miners requires grid operators to invest significant amounts in new infrastructure, this could also affect other utility customers. Cryptocurrencies can be a volatile market, and miners are likely to be reluctant to commit to long-term purchase obligations. In other words, the utility and its other customers risk stranded generation or transmission costs should the crypto miners leave before their cost responsibility is discharged.

Utilities can mitigate these risks via prepayments or obligations from crypto miners before investing on their behalf. A staged interconnection process with growing levels of financial commitment could improve the credibility of new service requests.

In-depth industry knowledge can bring positive results

The rise of the crypto economy and proof-of-work mining activities undoubtedly hold major implications for global energy systems. It is worth noting that the challenges mentioned above are much smaller if a system already has capacity to serve the new crypto mining loads, or if the mining operations are not connected to the grid.

Handled with the right regulatory and commercial approach, crypto mining can lead to positive opportunities for governments and utilities, including an indirect acceleration of renewable energy growth. An in-depth understanding of the industry’s mechanics is vital and must be connected to national energy strategies.