Goldman is Aiming for a Wall Street Built on Blockchain

Goldman and JPMorgan are already processing some trades using the technology behind cryptocurrency markets.

Knowing that Wall Street’s biggest banks have largely avoided investing directly in cryptocurrencies, Goldman Sachs Group Inc. is already trading some bonds and other debt securities for clients on blockchain-based networks such as Ethereum, and the bank is building its own blockchain-based trading platform.

JPMorgan Chase & Co. already has a platform in place, called Onyx. Big Wall Street firms help make the economy run, connecting buyers and sellers of securities and lending money to businesses. However, their sophisticated trades are often run on creaky old systems.

Goldman and others hope they will be able to run faster, less-costly and ultimately more-profitable systems based on blockchains. Every participant operates off the same central ledger, but Blockchain-driven systems on Wall Street would be different in some aspects from the systems behind Bitcoin and other cryptocurrencies. In fact, they would be permissioned networks, meaning a central party—such as a bank or a consortium of banks—would decide who is allowed on them.

Outside of banking, Walmart Inc. has used blockchain for tracking its supply chains. In real estate, some title companies have used it for recording homeownership. Goldman and others say that using blockchain in trading platforms should lower the risk associated with trading partners. Backers also say it could make it easier for issuers to track who owns their shares or other assets.

“Blockchain technology is going to rewire all financial services,” said Tom Farley, former President of the New York Stock Exchange. That said, Wall Street firms have been experimenting with blockchain projects for at least the past five years. Nonetheless, despite the hype, few have had a widespread impact on how financial transactions take place. Others have given up. For instance, a group of European insurance companies formed a consortium called B3i in 2016 to explore blockchain uses in their industry. In July, the consortium shut down after failing to raise new capital.

Regulatory issues could also be a challenge, especially for multinational banks dealing with a host of overseers. Rules about risk management, custody and collateral are still being developed in the U.S. and overseas. For example, the International Basel Committee on Banking Supervision is developing a set of regulations that could require banks to set aside capital against what it called unforeseen risks arising from blockchain networks. Challenges aside, few banks want to run the risk of being left out of a potential new technology. The biggest are in a race to build competing platforms.

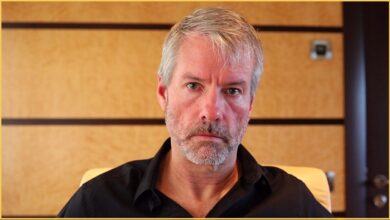

At Goldman, Mathew McDermott runs the digital asset group, which has about 70 full-time staffers specializing in areas such as engineering, compliance and legal and government affairs. Mr. McDermott said he was a skeptic when he first heard of the blockchain, but no more. The same is true for many top Wall Street bankers, who initially scoffed at the idea that Bitcoin or other cryptocurrencies were more than a fad.

“I’m not doing this just to satisfy my curiosity. Everything has a commercial driver”, said Mr. McDermott, who has worked at Goldman for 16 years and led the group since 2020. Goldman declined to disclose financial information about the group, including how much the bank has invested in it or whether it has turned a profit.

The firm expects the blockchain-based trading platform it is building to serve itself and its clients, but also possibly be used by other banks as well. Some rivals are also planning for wider platforms. JPMorgan’s Onyx platform, launched in 2020, can be used by other banks. Goldman, BNP Paribas and others have been using it to trade repos, or repurchase agreements. JPMorgan said Onyx has processed more than $350 billion of repo transactions, according to WSJ.

“They’re doing real trades,” said Yuval Rooz, the Chief Executive of Digital Asset, who counts Goldman and the Australian Stock Exchange among its clients. Still, he said, competition is tight: “There are the likes of Mat in every bank.”

Last year, Goldman arranged a $100 million, two-year bond issue for the European Investment Bank that was registered in France and handled on the Ethereum network. Normally, a bond sale like that would settle in five days. Mr. McDermott said it settled in just an hour. What that means in practice is that money that might otherwise be tied up for days between counterparties will be freed up. It also means there is far less time to worry about counterparty risk, the odds that one party or the other to a trade won’t hold up its end of the transaction.

The bank has more clients for such digital bonds, Mr. McDermott said, and expects to complete more sales.