Ethereum’s Burn Mechanism: Over $9 Billion in ETH Removed From Supply

Ethereum (ETH), the second largest cryptocurrency by market cap, implemented a token burn mechanism through the Ethereum Improvement Proposal (EIP) 1559 upgrade on August 5, 2021.

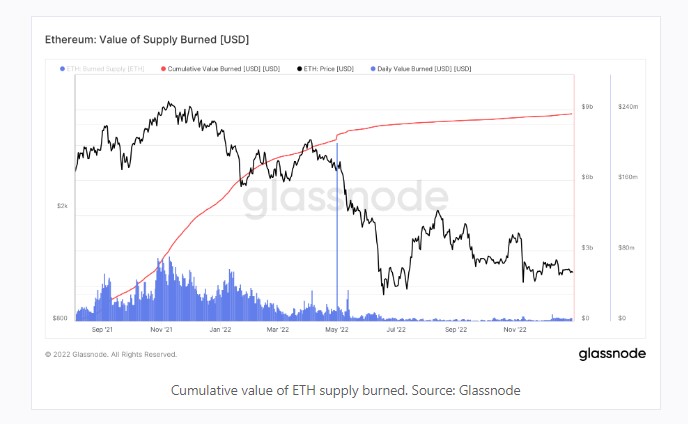

Since then, approximately $9 billion worth of tokens have been burned, according to data from Glassnode, and a total of approximately 2.8 million ETH tokens have been removed from the supply since the burn mechanism was introduced, according to data from ultrasound.money.

As seen in the chart, the blue line above represents the daily amount of ETH burned at the spot price, while the red line represents the cumulative value of ETH burned over time. CryptoSlate’s analysis of the Glassnode data suggests that the daily burn rate for Ethereum has significantly decreased and has almost stalled since the collapse of Terra-Luna in May 2022.

In fact, during the 2021 bull market, the daily burn rate for ETH ranged from $20 million to $75 million. This has decreased to around $2 million to $4 million worth of ETH burned daily in December 2022.

Data from ultrasound.money shows that 1,896.30 ETH, worth approximately $2.2 million, was burned in the past day. Nevertheless, it is important to note that the decrease in the daily burn rate of Ethereum is a direct result of the decrease in Ethereum activity during the current bear market.

The ETH burn

Token burning involves sending tokens to an address from which they cannot be retrieved. This process, also known as destroying tokens, reduces the asset’s circulating supply and ultimately contracts the overall supply over time. The burning mechanism was implemented in order to regulate Ethereum’s gas fees, which are the fees paid for conducting transactions on the Ethereum network.

Before the burn mechanism was implemented, Ethereum users had to estimate the fees they needed to pay to have their transactions included in the blockchain. This led to significant volatility in Ethereum gas fees, particularly during times of high network traffic.

In response to the millions of users who were frustrated with high gas fees, the Ethereum network implemented the token burn mechanism. Under the EIP 1559 upgrade, users are required to pay a base fee and a tip. This is similar to paying a base fee for a delivery service and a tip to the delivery person for timely delivery. The network burns all base fees, while the tip is given to the miners as a reward.

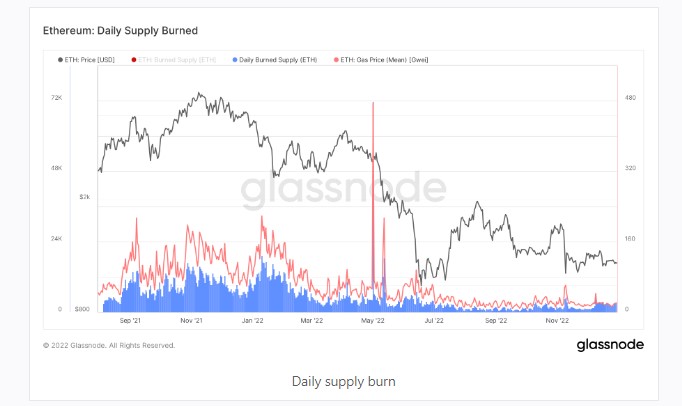

An analysis of daily ETH supply burned and gas fees data from Glassnode shows that the average gas fee has significantly decreased to around 15-20 Gwei from around 100 Gwei before the implementation of EIP 1559.

For example, the average gas fee was between 100 and 200 Gwei from January to April 2021, but it spiked above 200 Gwei during times of network congestion. This means that Ethereum’s average gas fees have decreased by approximately 80% since the burn mechanism was put in place.

According to Cryptoslate, the average Ethereum gas fee was 20.55 Gwei on December 30. Additionally, data shows that the average Ethereum gas fees were 16.2 Gwei over the past 30 days.

The ETH burn mechanism was also introduced to exert deflationary pressure on the token. In other words, the burn mechanism reduces the supply of ETH, which can potentially cause the price of ETH to rise over time. This is because the price of any asset is influenced by the law of supply and demand, which states that a decrease in supply leads to an increase in price.

According to data from ultrasound.money, Ethereum’s inflation rate, or net issuance rate, is currently 0.013% per year. If Ethereum had not adopted a proof-of-stake (POS) consensus mechanism, its issuance rate would be 3.588% per year. By switching to POS, Ethereum’s inflation rate has dropped significantly below that of Bitcoin (BTC), which has an issuance rate of 1.716% per year.

Also, estimates indicate that approximately 1.9 million ETH tokens are expected to be burned each year, while only 622,000 ETH tokens are expected to be issued annually.

At the moment, Ethereum’s price is facing challenges during the current cryptocurrency market downturn. As a matter of fact, ETH is trading at $1,196.52, representing a 67.88% decline for the year. However, the token burn mechanism could make ETH deflationary, which could potentially drive up its value in the long run.

This being said, there is no doubt that the Ethereum Network has truly worked on improving this past year; from The Merge to all the tests and experiments that followed, one can say that the ETH team never ceases to disappoint.