Bitcoin Reaches Highest Peak Since November … Will BTC Rise or Fall Again in 2023?

The trading volume of BTC was around $21.6 billion in the last 24 hours, showing an increase of 26.86% from its low of $16,496 on January 1st.

Bitcoin hit a new record high of $21,000, with investors expressing optimism that the asset may have reached a bottom and that inflation may have hit its peak. This is the first time that Bitcoin has surpassed $20,000 in over two months.

Nevertheless, other leading crypto assets also experienced gains. For example, Shiba Inu increased by 6.3%, and Polygon, Dogecoin, Cardano and XRP also showed positive trading performance.

Shivam Thakral, CEO of BuyUcoin, explained to The Economic Times, “The crypto market cap has crossed the $1 trillion mark, thanks to an over 20% jump in Bitcoin and Ether prices in just seven days. This is a strong sign that bulls are returning to the market with US central banks successfully bringing down the inflation and saving the economy from slipping into recession. The current market momentum is expected to continue if the macroeconomic factors remain favourable.”

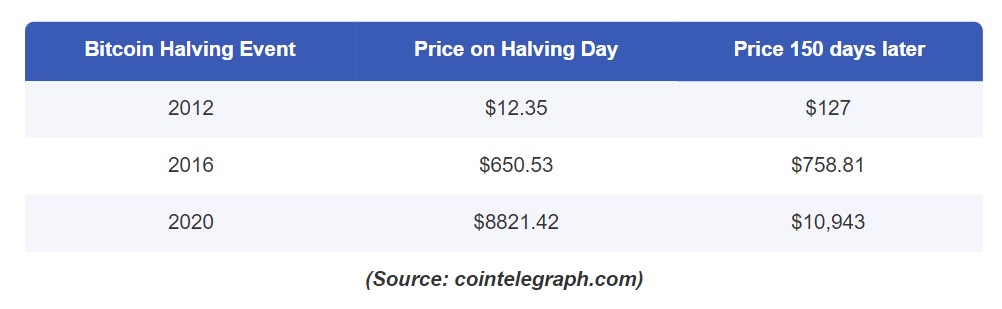

In addition to that, experts are optimistic about Bitcoin’s future due to an upcoming event called the Bitcoin Halving, which is set to occur in 2024. The halving happens every four years, and involves a reduction in the rewards given to Bitcoin miners, cutting the payout to 3.125 BTC.

This event is commonly viewed as a positive for Bitcoin’s price, as halving helps to decrease the supply. Historically, halving has been a strong indicator for increasing momentum in Bitcoin’s value. So now it is a good time to buy Bitcoin.

As a matter of fact, if we take a closer look at historical data, past Bitcoin halving events have had a strong impact on establishing long-term bullish drivers for the price of Bitcoin. The halving event is directly linked to the cryptocurrency’s deflationary nature, which reduces its supply and helps to drive up the price of BTC. Since Bitcoin is a decentralized currency and cannot be printed by governments or central banks, the total supply is limited.

Another factor that may contribute to Bitcoin’s rally in 2023 is the US Federal Reserve’s interest rate negotiations. This may help maintain Bitcoin’s upward trajectory and make it outperform other asset classes.

Additionally, large investors known as “Bitcoin Whales” have begun accumulating Bitcoin once again. Data from on-chain aggregator Santiment shows that these big investors are holding between 1,000-10,000 BTC in their wallets, indicating that they are filling up their wallets with a lot of Bitcoin, which could be a sign of recovery in the cryptocurrency’s price.

Bearish view

However, opinions remain divided regarding the fall of Bitcoin, as another group of investors, companies and major institutions who hold a negative outlook on the cryptocurrency, are convinced that it may decrease in value in the near future. As a matter of fact, they consider this current surge in value as a significant “bull trap” rather than a “bull run.”

Prominent global investor Mark Mobius, the founder of Mobius Capital Partners, has already predicted a significant drop in 2022 and stated that Bitcoin could even decrease to the $10,000 range. Similarly, Matthew Sigel, head of digital assets research at VanEck, a global investment management firm, predicts that Bitcoin will fall to $12,000 levels, citing higher energy prices.

Additionally, global bank Standard Chartered has made a surprising prediction that Bitcoin could drop to $5,000 levels in 2023. Experts believe that rising interest rates and tighter monetary policy will not allow Bitcoin to rebound sharply in the near future, as in uncertain markets, investors tend to avoid risky assets like Bitcoin.

Those who currently hold BTC may also sell their positions, which could put further pressure on the markets.

With this in mind, one can say that the future of Bitcoin remains unpredictable. Nonetheless, there is no doubt that the market is constantly evolving and changing, and with that comes new opportunities for growth.

So, let’s keep our heads held high and our eyes on the prize- the long-term potential of the market.