Unexpected Turns: Binance and Coinbase Net Flows Defy Expectations with Rapid Swings in Just One Day

In the face of the ongoing battle between regulatory authorities, it is evident that the crypto community remains steadfast in its convictions. Despite the legal actions taken by the SEC against Binance and Coinbase, there is no doubt that the crypto industry will continue to fight for what it believes in.

An encouraging sign of resilience is the fact that net flows, which many expected to plummet dramatically, have remained ‘relatively stable’. This demonstrates the unwavering commitment of the crypto community and its determination to navigate through regulatory challenges while staying true to its principles.

Nevertheless, it is crucial to highlight the distinction between the cases involving Binance and Coinbase to provide clarity. On one hand, Coinbase is currently facing accusations of selling unregistered securities, as their products were supposed to be registered but are not.

It is also important to note that Binance.US should be considered as a separate entity from Binance.

By recognizing and acknowledging these differences, we can gain a more accurate understanding of the unique challenges faced by both exchanges in navigating the regulatory landscape.

Binance and Coinbase Net flow of funds

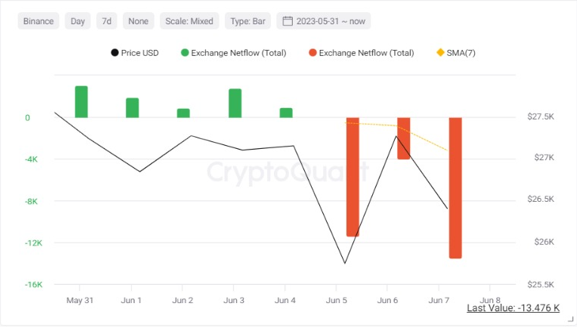

Regarding the the outflow of funds from both Binance and Coinbase, it is safe to say that it has reduced in a positive manner, compared to the situation observed 24 hours after Binance faced legal action from the SEC.

It is noteworthy that the net flow refers to the combined value of deposits and withdrawals made on an exchange. When the net flow of an exchange is negative, it signifies that the amount of assets being withdrawn exceeds the amount being deposited.

Conversely, a positive net flow indicates that more assets are being deposited into the exchange compared to the amount being withdrawn.

As seen in the visual above, the net flow of Binance is negative; however, the magnitude of this negative netflow, amounting to $750 million, is relatively insignificant compared to the overall scale of Binance’s operations and assets.

In fact, is not an unprecedented occurrence, as there have been previous instances of significant withdrawals, and it is probable that such situations will arise again in the future. For instance, in December of last year, Binance experienced net outflows exceeding $2 billion due to market apprehensions regarding solvency.

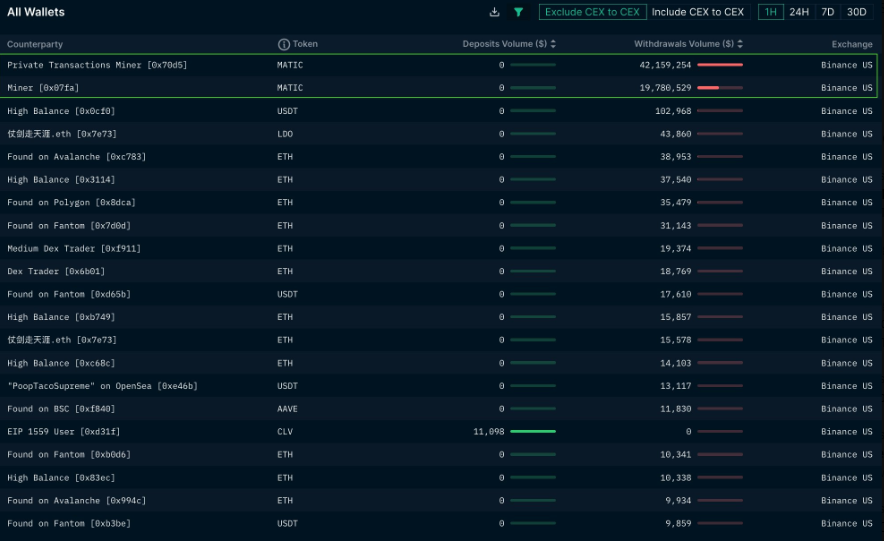

It is worth bearing in mind that the net outflow from Binance US was primarily driven by two substantial withdrawals of approximately $62 million in the form of MATIC tokens.

Nonetheless, according to data from Cointelegraph Markets Pro and TradingView, there has been a continuous recovery in the BTC/USD pair, reaching a price of $26,250 on the Bitstamp exchange.

In the past day, the pair had experienced a decline, reaching nearly three-month lows of $25,350. This drop was influenced by the news of the lawsuit against the cryptocurrency exchange Coinbase.

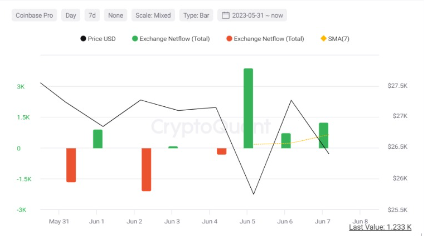

As for Coinbase, one can say that its situation was better, as it witnessed a rise in its activities. This raises the possibility that some users who were previously engaged with Binance may have shifted their attention towards Coinbase in response to the legal action.

This occurrence suggests a certain level of confidence and trust placed in Coinbase as a reliable alternative amidst the regulatory uncertainty surrounding Binance. It highlights the influence of regulatory actions on user behavior and the potential for shifts in market dominance within the cryptocurrency exchange landscape.

This means that the legal action against Binance, the largest crypto exchange, by the U.S. authorities on the previous day had a more significant impact on the cryptocurrency markets.

What do Traders Have to Say?

Ki Young Ju, the CEO of CryptoQuant, an analytics platform, highlighted that despite the SEC lawsuits, the outflows related to “unregistered securities” on Coinbase remained relatively small.

Some traders responded to the recent price movement of BTC with renewed optimism.

Michaël van de Poppe, the founder and CEO of trading firm Eight, suggested that the recent news could potentially mark the low point of the market correction.

Another trader and CryptoQuant contributing analyst, known as Maartunn, even announced buying BTC below the $26,000 mark.

In a tweet, Maartunn acknowledged the existence of potential risks such as the U.S. government selling BTC or a potential recession but expressed confidence that the bottom had been reached, with the price not likely to trade below $20,000. The trader felt satisfied with buying BTC close to the $20,000 level, as it seemed to be a favorable opportunity.

Legal Actions Affect CZ and Armstrong’s Wealth

On another note, the recent legal actions taken by the SEC have significantly impacted the wealth of Brian Armstrong, the CEO of Coinbase, and Changpeng Zhao (CZ), the CEO of Binance, resulting in substantial financial losses.

Within a period of 30 hours following lawsuits filed by the SEC against Binance on June 5 and Coinbase on June 6, Armstrong witnessed a reduction of $289 million in his net worth.

Similarly, Zhao experienced a staggering decline of $1.33 billion.

As a consequence of these legal proceedings, Zhao, who holds the position of the wealthiest individual in the cryptocurrency industry and ranks as the 54th wealthiest person globally, encountered a 5.1% decrease in his net worth, which now stands at $26 billion this week.

Despite a substantial increase of over 106% in the net worth of the Binance CEO throughout this year, he still remains considerably lower, down by more than 73%, compared to his peak net worth of $96.9 billion in January 2022.

Regarding Brian Armstrong who is ranked as the 1,409th richest person according to Forbes, the CEO suffered a more significant blow from the recent actions, resulting in an 11.8% decrease in his net worth, which now amounts to $2.2 billion. However, Armstrong has benefited from the market’s recovery this year, witnessing a notable 61% rise in his net worth during this period.

Although both Zhao and Armstrong experienced recent declines, their net worth has still seen substantial growth, surpassing the 9% year-to-date returns of other individuals on Bloomberg’s list of the wealthiest.

In conclusion, while Coinbase found itself in the regulatory spotlight, it is clear that Binance is the primary target of the SEC’s scrutiny. It is highly likely that Coinbase will successfully navigate the legal proceedings, eventually reaching a settlement and paying a fine. Subsequently, we can anticipate the introduction of new regulations following Coinbase’s case.

However, the consequences for Binance are anticipated to be more severe, potentially resulting in significant ramifications such as bank de-risking. This may necessitate the step-down of CZ, the dilution of his shares, and a substantial financial penalty.

The near future holds challenging times for Binance, but the main question remains: will Binance ever dominate the US market?