Grayscale Beats SEC in Court Clearing the Path for a Thrilling Bitcoin ETF Launch

Grayscale, an asset management company, has secured a significant legal victory against regulatory authorities in the United States.

The firm aims to introduce a bitcoin-linked exchange-traded fund (ETF) that will be listed on a US exchange. In fact, a federal appeals court in Washington DC ruled that the Securities and Exchange Commission (SEC) erred in its decision to decline Grayscale’s request to transform its primary investment vehicle, known as the Grayscale Bitcoin Trust, into an ETF.

This ruling exerts substantial pressure on SEC Chair Gary Gensler, who has aggressively pursued enforcement actions against various participants in the cryptocurrency sector throughout this year.

Following the court’s ruling, the value of bitcoin witnessed an approximately 6 percent surge on Tuesday. Year-to-date, bitcoin has appreciated by 65 percent. Simultaneously, shares of Coinbase experienced an increase of over 13 percent.

The lawsuit brought by Grayscale centered on the specific matter of whether the investment firm could introduce an ETF tied to the real-time price movements of bitcoin. While the SEC has previously approved ETFs based on bitcoin futures contracts, the regulator contended that bitcoin trades on unregulated exchanges and is susceptible to market manipulation.

Judge Neomi Rao, writing on behalf of a three-judge panel within the District of Columbia Circuit Court of Appeals, stated, “The SEC’s denial of Grayscale’s proposal lacked a consistent rationale and was made without adequate explanation for treating similar products differently.” This led to the panel overturning the SEC’s decision to block the creation of the real-time bitcoin ETF.

The SEC expressed its intention to review the court’s ruling. The regulator retains the option to appeal to either the full federal appeals court or the Supreme Court. However, the course of action it will ultimately choose remains uncertain.

Despite the SEC’s firm stance on the cryptocurrency industry, the demand for a real-time bitcoin ETF has grown. Traditional financial entities, including BlackRock, WisdomTree, and Fidelity, have also sought to enter this space with proposals for similar ETFs. Presently, the SEC is evaluating approximately six other proposals for real-time bitcoin ETFs.

Jeremy Senderowicz, a representative from the law firm Vedder Price, remarked, “Considering the court’s verdict, the SEC’s previous reasoning against allowing these products to launch has suffered a severe blow. Should this judgment stand, it would repudiate the fundamental basis the SEC has employed to reject all real-time bitcoin ETFs over the past few years.”

According to the Financial Times, Grayscale spokesperson Jennifer Rosenthal conveyed, “This legal decision marks a monumental advancement for American investors, the broader bitcoin ecosystem, and all those who have advocated for exposure to bitcoin through the safeguards provided by an ETF structure.”

The events of today hold significance for two major reasons. Firstly, the emergence of ETFs carries importance due to its ability to expand the pool of individuals participating in cryptocurrency investments through a conventional and well-regulated route.

Secondly, akin to the ruling involving Ripple in July, the recent decision by the U.S. Court of Appeals emphasizes that the SEC does not hold absolute authority as the final determinant of matters concerning the cryptocurrency realm.

Congressman Urges Dismissal of SEC Chair

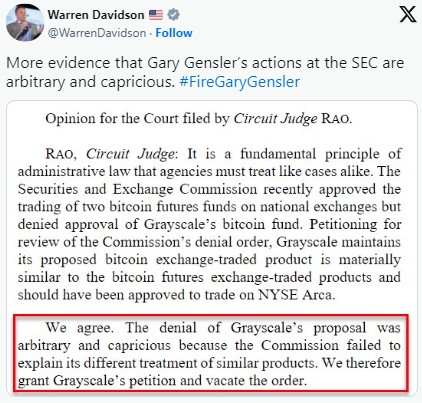

On another note, US Representative Warren Davidson from Ohio has taken a stand, urging the SEC to oust its current chair, Gary Gensler, as indicated in a recent statement on his X account.

In fact, Congressman Davidson references a judicial opinion penned by Circuit Judge Rao, stating that the court concurs with the view that the SEC’s rejection of Grayscale’s ETF proposal lacked a logical basis and was inconsistent. The opinion points out the Commission’s failure to justify the dissimilar treatment of comparable products. Consequently, the court endorsed Grayscale’s plea and invalidated the SEC’s directive.

This marks not the first instance where US Congressman Davidson has voiced his dissatisfaction with SEC Chair Gensler and called for his dismissal. Back in July, he introduced a legislative proposal aimed at restructuring the SEC and removing its chair.

Davidson referred to Gensler as a “dictatorial chairman” who necessitates congressional intervention to safeguard the markets.

Just last month, Davidson expressed, “The time has come for substantial reform and the removal of Gary Gensler from his role as Chair of the SEC.”

This call for a leadership change has remained consistent, primarily driven by concerns about the potential ramifications of the SEC’s actions on the industry, potentially leading to a diminishing digital asset ecosystem in the United States.