Bitcoin Smashes Hash Rate Record, as Miners Navigate Profitability Plunge

In the world of Bitcoin mining, Christmas Day marked a significant milestone as the network’s computing power, known as the mining hash rate, surged to an all-time high of 544 exahashes per second (EH/s).

This monumental achievement, confirmed by Blockchain.com and Cointelegraph, reflects an extraordinary 130% increase in hash rates since the year began.

A visual representation of Bitcoin’s hash rate trajectory throughout 2023 mirrors the asset’s price surge, which soared over 150% from January 1, 2023. However, while this surge in computational power underscores the robustness of the Bitcoin network, it poses challenges for miners battling a slump in profitability amid the record hash rate.

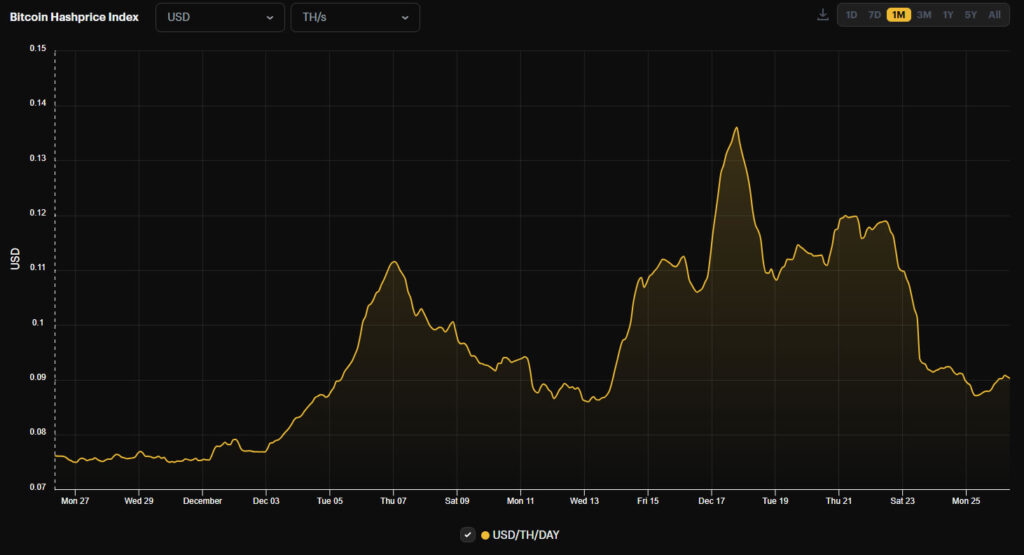

Source: Hashrateindex

Reflexivity Research co-founder Will Clemente highlighted the hash rate’s trajectory on a logarithmic scale, noting the resilience of the network despite hurdles.

Clemente’s commentary reflects on the monumental China mining ban of summer 2021, suggesting it barely impacted Bitcoin’s decentralized and secure network. Yet, this surge in hash rate doesn’t resound well for miners who now face intensified efforts to secure the next block, raising operational challenges.

The hash price, a key metric indicating profitability, has dipped to $0.09 per terahashes per second per day, marking a significant decline from its peak earlier in 2023. This 34% drop since December 17 reflects the cooling of the BRC-20 ordinal inscription fervor, impacting miners’ profitability.

This dip in hash price, often associated with heightened demand and transaction fees, signals a challenge for miners navigating sustained pressure on profitability.

Moreover, Glassnode analyst “Checkmatey” observed a prolonged period of elevated fee pressure, nearly a year without fully clearing Bitcoin mempools, highlighting sustained challenges in transaction validation and processing.

This confluence of factors showcases the complex landscape miners must navigate, balancing heightened computational requirements against dwindling profitability, signaling a challenging yet resilient phase for the Bitcoin mining community.