Tether’s Market Dominance and a Strategic Rise through USDT Minting

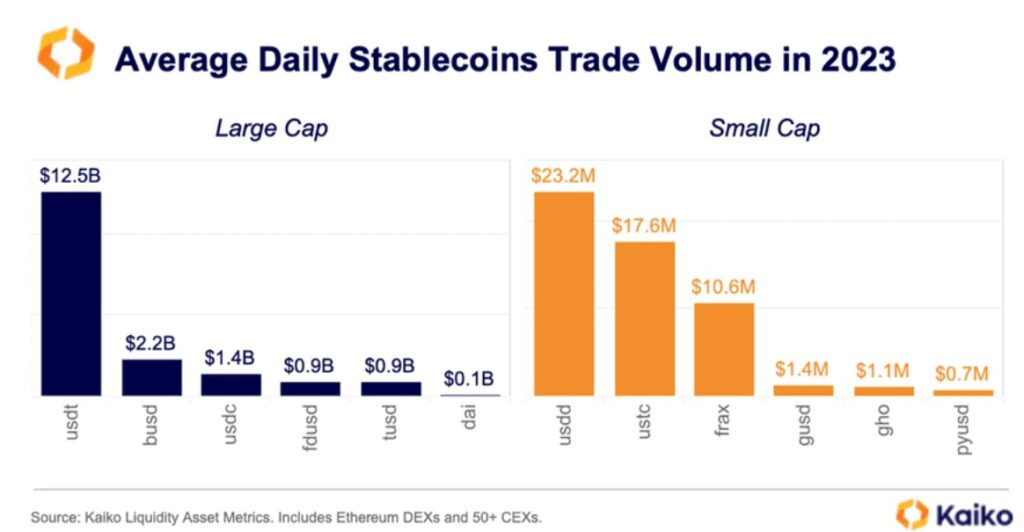

In the ever-evolving stablecoin market of 2023, Tether (USDT) has emerged as a standout performer. Traditionally serving as a reserve and settlement currency for international crypto exchanges, Tether’s CEO, Paolo Ardoino, disclosed that a substantial 40% of USDT demand now comes from store of value and payment use cases, especially in developing nations.

With 99% of the worldwide stablecoin market remains tied to the U.S. dollar, the prevailing regulatory challenges faced by the leading U.S. digital dollar (USDC) pave the way for USDT on Tron to establish itself as the premier cryptocurrency payment network globally.

In the dynamic landscape of 2023, Tether’s strategic USDT minting takes center stage, addressing the increasing demand for stablecoins amidst heightened anticipation for the Bitcoin spot ETF, with a remarkable $2 billion minting occurring in early 2024.

Contractions in 2023 and Tether’s Drive Towards Recovery

The stablecoin market experienced a contraction phase from May 2022 to September 2023 due to a bearish trend in most cryptocurrencies. Competitors like USDC and DAI witnessed a decline in market capitalization during this period. USDC witnessed a decline of more than $18 billion in market capitalization, with a modest rebound observed in December. Similarly, DAI experienced a loss of approximately $400 million during the same period.

However, a notable shift occurred in October, marked by increased market volumes and anticipation surrounding the Bitcoin spot ETF narrative, leading to a surge in demand for stablecoins on various trading platforms.

Tether has played a pivotal role in driving the recovery of the broader stablecoin market, witnessing significant growth over the past 14 weeks. With a market capitalization surpassing $90 billion, USDT has become a dominant force, constituting approximately 74% of the stablecoin market.

It is widely acknowledged that USDC has consistently witnessed a decline in its market share of dollar-backed stables throughout the year, contrasting with the upward trajectory of USDT. The notable volume differential (9x), significantly surpassing the outstanding dollar differential (~3.75x), underscores the distinct roles these tokens play, as Rob Hudik, general partner at Dragonfly, notes.

Traders beyond the purview of regulated US/UK firms, especially those in emerging markets, are increasingly adopting USDT as a transactional mechanism. Meanwhile, USDC’s predominant use appears to revolve more around preserving value and seeking refuge within U.S.-based entities that prefer avoiding the complexities associated with moving funds on/off the blockchain.

Proactive Tether: Printing and Expansion

Tether’s proactive approach is evident in its consistent printing of USDT since October, reaching an all-time high market capitalization of $91.74 billion on January 2, 2024. This indicates strong investor demand for stablecoins and the growth of USDT’s use in the digital economy. This trend is expected to continue, especially with the approval of the Bitcoin spot ETF by the SEC.

Last week, a significant on-chain market alert unfolded as Tether executed a $2 billion printing spree in a single day. The question arises: do new capital inflows herald an imminent market surge? Two billion U.S. dollars were transformed into USDT, challenging the assumption that it will remain as stablecoin. Capitalized players are getting involved and substantial Tether mints consistently propel prices upward.

Investors should ponder the destination of this influx of USDT and strategically identify the cryptocurrencies poised for growth before the impending surge. Liquidity is expected to initially favor major assets, then flow into mid-cap altcoins, culminating in small caps. Armed with this knowledge, investors gain a significant advantage.

Simultaneously, the growth of Tether extends to its expansion on the Ethereum blockchain, where the issuance of 1 billion USDT stablecoins has propelled its market capitalization to a surpass $93 billion. This strategic move signifies Tether’s commitment to dominating the digital currency landscape anchored to the US dollar.

With the recent approval of the Bitcoin spot ETF, traditional market investors are redirecting their focus towards crypto sector assets. Consequently, the demand for USDT is anticipated to surge further, potentially achieving the historical milestone of a $100 billion market capitalization.

Recent Tether Whale Deposit

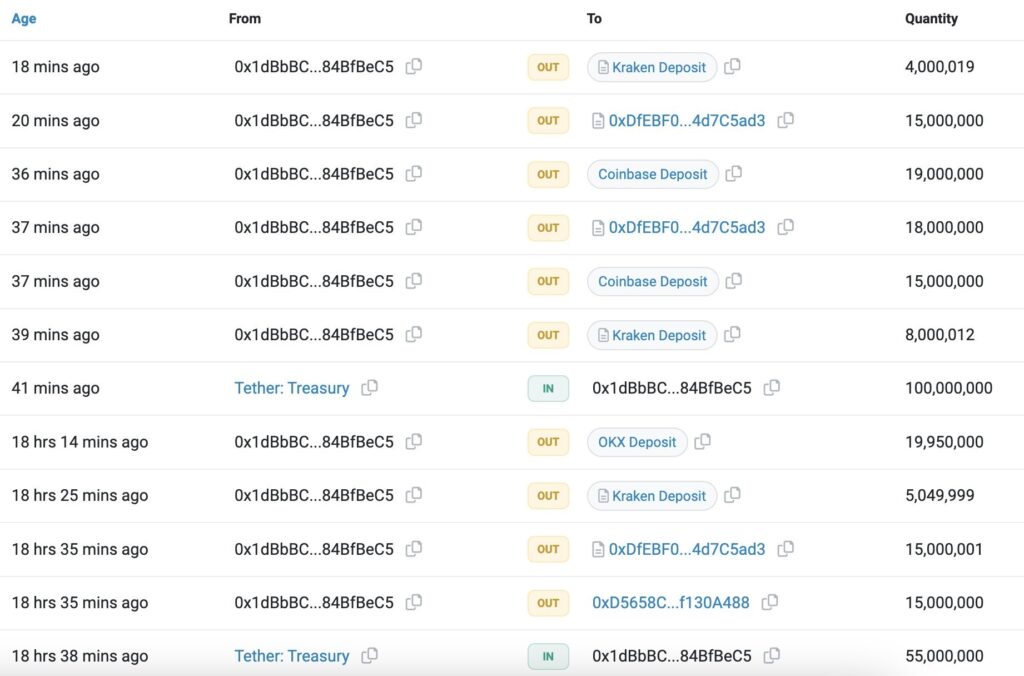

A recent development involves a Tether whale depositing $239 million into crypto exchanges on January 10, contributing to a total liquidity injection of almost $2.9 billion in the past three months. The reasons behind these transactions are speculative, ranging from acquiring cryptocurrencies for future profits to market-making purposes.

The recipient of funds, identified by the wallet address beginning with “0x1dBb,” received funds from the Tether Treasury and subsequently distributed them to OKX, Kraken, and Coinbase, according to Lookonchain.

The motives behind these transactions remain undisclosed, giving rise to speculations. Firstly, there is conjecture that Cumberland may be deploying USDT on exchanges to acquire cryptocurrencies, anticipating future profits amidst the current market hype. Alternatively, the firm might be strategically acquiring select digital assets for market-making purposes.

Irrespective of the specific intent, the common practice in the crypto space involves participants transferring USDT and other stablecoins to exchanges when planning to purchase virtual currencies. This behavior typically signifies a bullish sentiment in the market, indicating an expectation of higher prices.

Some commentators on Twitter speculated that the whale involved could potentially be BlackRock. Industry insiders speculate that the firm would flood the market with $2 billion as it stands as the largest asset manager to operate a spot Bitcoin ETF. The infusion of additional USDT liquidity could potentially aid ETF issuers in buying and selling the Bitcoin backing their ETF shares, as parties willing to exchange BTC for fiat or stablecoins are crucial to minimizing risk.

Looking Ahead: Tether’s Continued Influence

As Tether’s USDT maintains its lead in the stablecoin market, a dynamic landscape introduces new challenges. Competitors, particularly USDC, are gaining ground, as indicated by Circle’s recent IPO filing, suggesting potential market shifts.

Governance concerns persist around Tether, with historical reserve discrepancies and transparency issues. Recent actions, such as freezing wallets for U.S. authorities, prompt the question: What risks accompany Tether’s dominance amidst these complexities?

Investors must assess USDT’s susceptibility to financial, legal, and security risks. Tether Limited’s aspirations to be a “world-class partner” to the U.S. add layers of complexity, while Circle’s IPO filing injects a competitive edge.

In this fluid scenario, investors must consider: How do governance issues impact Tether’s role? What’s the significance of Tether’s collaboration with U.S. authorities? Circle’s USDC IPO—how might it reshape the stablecoin market, and what does it mean for Tether? Additionally, why has PayPal’s stablecoin not gained substantial traction yet?

Addressing these questions is essential for investors navigating the evolving stablecoin landscape and making informed decisions in the crypto market.