Stablecoins: Historical Parallels, Regulatory Trends, and Market Growth

UAE's Central Bank Takes Steps in Regulating Payment Tokens, with an Anticipated Framework Impacting Local and Foreign Stablecoins

In January, the total market capitalization of stablecoins rose by 2.45% to $134 billion, marking the highest end-of-month market cap since February 2023. Notably, this surge marked the fourth consecutive month of increase. Concurrently, the market capitalization dominance of stablecoins fell to 7.78% in January, representing its lowest market share since December 2021.

Furthermore, according to CCData and DefiLlama, the trading volume for stablecoins on centralized exchanges (CEXs) witnessed a substantial 27.6% rise to $995 billion in December, marking the highest point in 2023. As of the 10th of January, volumes are on track to set a higher total for the month, with $579 billion traded on CEXs.

Remarkably, Tether reported a record-breaking profit of $2.85 billion in the fourth quarter of 2023, countering legal uncertainties.

Amidst these statistical developments, a recurring trend is noted—the proliferation of an investment product that mirrors the one that led to widespread disaster in the cryptocurrency market in 2022. This product entails the creation of a stablecoin designed to track the US dollar one-to-one while offering competitive yields to investors, a concept that sounds simple on paper.

Understanding the Historical Parallels: Euro Dollars and Stablecoins

In a discussion on the future of stablecoins, Nic Carter, General Partner at Castle Island Venture, emphasized the historical parallels between stablecoins and Euro dollars during TOKEN2049 Singapore 2023. The Euro dollar market emerged in the 1950s as a response to U.S. banking restrictions, mirroring the current challenges faced by stablecoins.

The Euro dollar market, driven by the desire to transact in dollars offshore, now surpasses the domestic dollar market. Similarly, stablecoins, typically dollar-denominated liabilities issued outside the U.S., circulate on public blockchains. Notably, about 75% of stablecoins are tokenized Euro dollars, highlighting a historical connection.

Both Euro dollars and stablecoins offer flexibility and reduced transactional restrictions, making them desirable for transacting on a global, open, and interoperable transactional space. Euro dollars were created due to the fear of U.S. asset seizures. Likewise, stablecoins originated from Bitfinex’s banking challenges and the need for efficient transactions with crypto exchanges, according to Nic. Both innovations stemmed from concerns about U.S. interference in the settlement process.

In the 1960s and 1970s, Euro dollars experienced rapid growth due to higher yields in European banks. Likewise, stablecoins surged in 2021-2022, driven by superior crypto yields compared to traditional finance. The growth parallels underscore the attractiveness of these instruments in their respective eras.

U.S. Regulatory Hostility and Jurisdictional Opportunities

In 2023, the U.S. increased regulatory hostility towards stablecoins. The denial of the custodia application in January, coupled with major U.S. financial regulators advising banks to avoid stablecoins set a negative tone. The SEC’s actions against Paxos in February and the banking crisis in March further intensified the challenges. The destruction of fiat clearing infrastructure, namely Signature’s Signet and the Silvergate Exchange Network (SEN), severely impacted stablecoin liquidity.

With the SEC considering some stablecoins as securities, interest-bearing stablecoins are going offshore to jurisdictions with more supportive regulations. Similar to how Euro dollars provided a significant opportunity for specific financial hubs to enhance their standing, stablecoins present an opportunity for particular jurisdictions to expand their influence in the crypto realm. Jurisdictions like Singapore, Hong Kong, Bermuda, and Dubai are capitalizing on this opportunity to thrive within the crypto space.

The UAE remains at the forefront of significant developments within the digital asset space and could play a leading role in the global development of progressive and efficient stablecoin regulation. Late last year, we have seen VARA’s efforts to regulate foreign issued payment stablecoins in Dubai, while the Central Bank of the UAE is likely to issue their framework this year, which might treat local and foreign issued stablecoins differently. This is an exception to what other global jurisdictions have adopted so far.

Additionally, Paxos obtained in-principle approvals (IPA) from the Financial Services Regulatory Authority (FSRA) in the Abu Dhabi Global Market (ADGM) for the necessary Financial Services Permissions to issue US dollars and other currency-backed stablecoins.

In 2023, Singapore enacted stablecoin regulations, paving the way for the issuance of dollar stablecoins. Hong Kong has also indicated plans to introduce stablecoin regulations in 2024. The U.S. already has a stablecoin, First Digital, operating in Hong Kong and experiencing rapid growth. Additionally, Bermuda recently granted the first digital asset license for an interest-bearing dollar stablecoin.

While having regulatory frameworks in place is important, it is critical to harmonize these frameworks globally and recognize the broader role of payment stablecoins in the economy at large.

Stablecoin Crossroads: The U.S. Government’s Dilemma

Foreign private investors are increasingly purchasing U.S. Treasuries, while central banks, traditionally price-insensitive buyers, are reducing their holdings. This shift may impact the market by potentially leading to a rising ‘term premium,’ reflecting the uncertainty and risks associated with long-dated bonds. Fed and Treasury data for the first 11 months of 2023 show that on a valuation-adjusted basis, overseas investors’ Treasury notes and bonds holdings rose by $428.4 billion. Of that, central banks accounted for only $31.9 billion, as reported by Reuters.

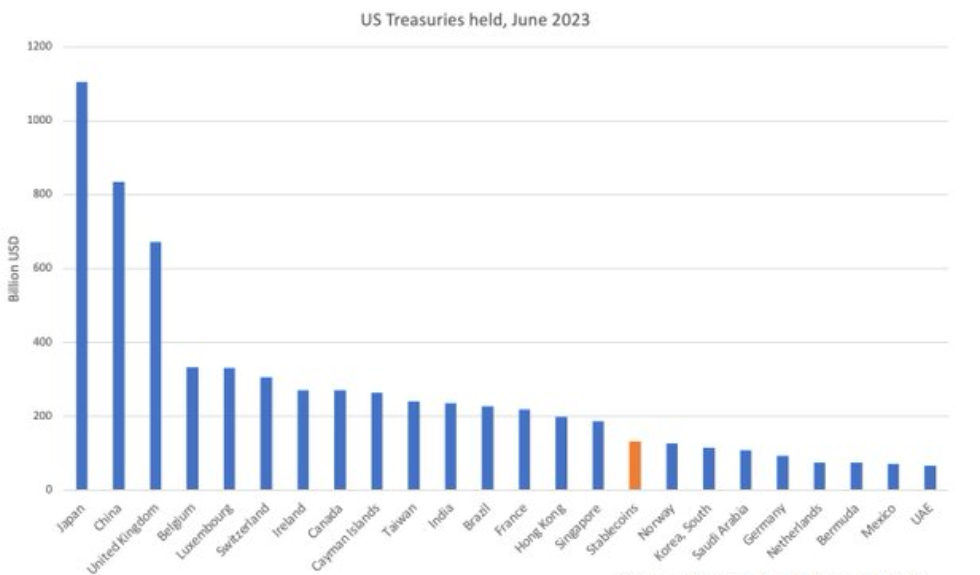

Despite U.S. resistance, stablecoins have become a substantial holder of U.S. treasuries, currently holding around $120 billion, positioning them as the 16th largest sovereign holder globally, according to Will Clemente’s analysis using The Block’s data. Japan and China, the largest two foreign holders of U.S. treasuries, have been diminishing their holdings.

Amid apprehensions regarding the “cash and cash equivalents” of stablecoin reserves during the current Bitcoin cycle, issuers such as Tether started transitioning to U.S. Treasuries as a strategy to minimize the risk exposure of their reserves. Notably, of the $2.85 billion net profit made by Tether in Q4 of 2023, approximately $1 billion stemmed from net operating profits, primarily from US Treasuries. The firm set new records in direct and indirect ownership of US Treasuries, boasting an $80.3 billion exposure. Upholding its commitment to transparency, Tether issued tokens backed by Cash and Cash Equivalent at an impressive 90%, emphasizing liquidity within the stablecoin ecosystem.

Hence, stablecoins, largely denominated in dollars, have become a vital buyer of U.S. debt, potentially offering creative solutions to mitigate interest rate hikes for the U.S. government. As the crypto industry flourishes and crypto balance sheets expand, stablecoins, which are often dollarized, may play an increasingly crucial role in stabilizing U.S. debt rates.

The offshore movement of stablecoins is becoming more pronounced, fueled by interest-bearing stablecoins being offered to retail investors and more accommodating jurisdictions. As such, the U.S. government faces a pivotal choice: embrace onshore stablecoins for maintaining control or witness the continued growth of offshore stablecoins, potentially leading to marginalization in the global capital markets. The decisions made by Washington will shape the future of stablecoins.

Yield-Bearing Products Gain Traction

Amid the renewed interest in stablecoins, crypto players are exploring yield-bearing products, with some offering interest rates exceeding 20%, according to a Bloomberg report. However, concerns have arisen about the stability of these tokens, as seen with the collapse of TerraUSD, and potential implications for U.S. securities regulations.

Interest-bearing stablecoins are gaining popularity in Latin America, addressing the need for stable currencies in regions with limited access to US banking accounts and other savings options. Mountain Protocol, domiciled in Bermuda and regulated by the country’s monetary authority, launched its USDM coin in September, offering interest rates of around 5%. It has become the 12th-largest stablecoin by market capitalization, as per DefiLlama.

Some startups, acknowledging regulatory uncertainty, hesitate to classify their products as interest-bearing stablecoins. Ethena, based in Portugal, transitioned from marketing its USDe currency as a stablecoin to now preferring the term “synthetic dollar.” The company, which recently raised $6.5 million, plans to publicly launch the token at the end of the month and offers yields through a related app. Yields for USDe reached 26% in December before stabilizing in the high teens this month, CEO Guy Young told Bloomberg.

Why Stablecoins will Continue to Grow

Stablecoins exhibit resilience even during market downturns. Despite crypto market fluctuations, stablecoin connectivity remains robust, with monthly users rising independently of market cycles. This shows that stablecoins exhibit unique utility, diverging from speculative crypto market activities. Notably, their settlement volumes, reaching about 9 trillion dollars in 2023, approach Visa’s 10 trillion dollars. In 2022, stablecoins on various layer 1 networks reached a transaction volume of $6.87 trillion, overtaking traditional payment giants like Mastercard and PayPal.

In just six years, stablecoins have evolved into a major global financial settlement network, highlighting their rapid ascent to prominence. They have evolved into a global financial backend, powering NeoBank activity, remittances, and fintech in emerging markets.

As Circle Internet Financial Ltd. progresses towards an initial public offering, and Tether Holdings Ltd. accumulates substantial reserves, the stablecoin market is gaining attention from venture capitalists, founders, and customers.

Venture capitalists and founders are increasingly recognizing the importance of having a presence in the growing stablecoin sector. Martín Carrica, CEO of Mountain Protocol, emphasized the emerging significance of this category, stating, “It is starting to become a category where you have to have a horse in the race.”

Stablecoins hold a significant share in the crypto market, peaking at 20% and settling at 7.8%. However, in terms of transactional volume on public blockchains, stablecoins dominate, comprising 70-80% of all settlements. Currently, the U.S. is cautious and seeks to restrain stablecoins, but as stablecoins grow to a substantial scale, the US will have no choice but to accept and embrace them.