Sam Bankman-Fried’s Bankruptcy Narrative Uncovered, Shocking Documents Emerge

In a saga that highlights the evolving nature of the cryptocurrency world, Sam “SBF” Bankman-Fried, the erstwhile CEO of FTX, finds himself at the center of another legal storm.

United States prosecutors have laid bare Bankman-Fried’s post-collapse maneuvers in a bid to restore his tarnished image, illuminating a web of schemes and strategies aimed at reshaping public perception.

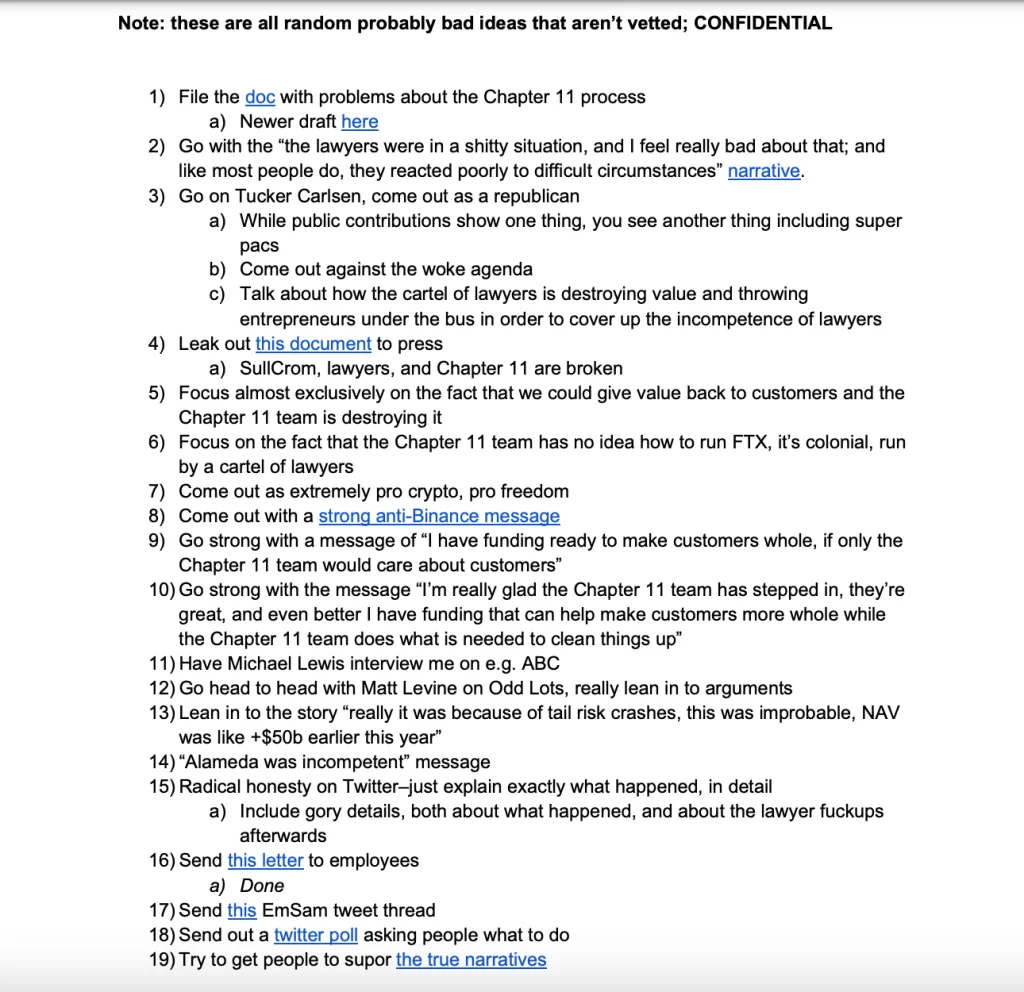

The revelation came through a series of documents submitted to the court, including a Google document from Bankman-Fried’s email account. In this document, Bankman-Fried outlined a series of 19 “random probably bad ideas” intended to orchestrate a narrative shift surrounding FTX’s downfall.

Among these were eyebrow-raising initiatives such as aligning himself with Republican ideologies, leaking documents to the press, and criticizing legal proceedings while positioning himself as an advocate for cryptocurrency freedom.

Source: U.S. District Court for the Southern District of New York

However, the sentencing memorandum is not the denouement of this legal drama. Bankman-Fried’s defense counsel fervently advocates for a considerably lighter sentence, positing that a term of fewer than seven years would be appropriate. Their plea is underscored by references to Bankman-Fried’s attempts to mitigate his actions, portraying them as errors or misunderstandings rather than willful misconduct.

This meticulous planning, as presented by prosecutors, serves as a cornerstone of their argument advocating for a sentencing ranging from 40 to 50 years for Bankman-Fried. They assert that his attempt for manipulation and disregard for legal boundaries make him a continued threat to society. Furthermore, they underscore Bankman-Fried’s musings about launching “Archangel LTD” as evidence of his willingness to perpetrate further frauds, should the opportunity arise.

The difference in views between the prosecution and defense underscores how serious the charges against Bankman-Fried are. His conviction for fraud and money laundering, decided by a jury, strengthens the idea that he was a respected figure who fell from grace due to arrogance and deceit.

The defense sees Bankman-Fried as imperfect but capable of change, while the prosecution sees him as a cunning manipulator who caused harm for his own benefit.

Adding fuel to the legal fire, prosecutors recommend a staggering penalty north of $11 billion, alongside forfeiture of assets, painting a picture of a man who not only deceived investors but also injected illicit funds into the political arena.

The scale of proposed penalties seeks to underscore the severity of Bankman-Fried’s transgressions and serve as a deterrent to others tempted by financial malfeasance.

As the sentencing date looms, the courtroom drama surrounding Sam Bankman-Fried encapsulates the complexities of modern financial crime and the enduring allure of redemption narratives.

Whether he will face the full brunt of the law or find clemency remains to be seen, but one thing is certain: the tale of SBF and FTX will reverberate through the annals of cryptocurrency history for years to come.