New Theory on Bitcoin’s Future Price Sparks Debate, What Is It?

Bitcoin’s trajectory remains a topic of important discussion in financial circles, with veteran trader Peter Brandt proposing an intriguing theory that could disrupt traditional forecasts.

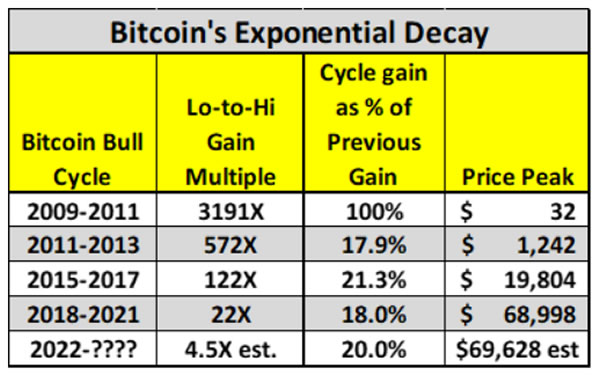

Brandt suggests that Bitcoin may have already reached its cycle peak at the $70,000 mark, citing an “exponential decay” pattern observed in previous market cycles.

This pattern, as Brandt outlines, entails each successive cycle peaking at around 20% of the previous cycle’s peak gain. If this trend holds, it could imply that Bitcoin’s current cycle may see a modest 4.5x gain from its low point of around $15,500, leading to a cycle top around $70,000. In fact, Bitcoin briefly surpassed this level in March, reaching prices exceeding $73,000.

Despite Brandt’s analysis, skepticism remains prevalent, with some experts challenging the validity of his theory.

Giovanni Santostasi, CEO and director of research at Quantonomy, counters Brandt’s claims with an alternate model based on long-term power law behavior, according to Cointelegraph. Santostasi’s analysis suggests a potential peak for this cycle around December 2025, with Bitcoin reaching approximately $210,000.

These differing perspectives highlight the complexity of predicting Bitcoin’s future trajectory, with various models and factors influencing market sentiment.

Pav Hundal, lead analyst at Swyftx, anticipates Bitcoin doubling in value by the next halving in 2028, projecting a price of around $120,000. Meanwhile, Laurent Benayoun, CEO of Acheron Trading, envisages a potential cycle top of $180,000.

Amidst these speculations, Fidelity Digital Assets recently revised its medium-term outlook for Bitcoin, highlighting the cryptocurrency’s changing valuation dynamics.

It is worth noting that the latest Bitcoin halving has been carried out smoothly this month, possibly affecting companies engaged in managing the cryptocurrency’s operations. This event, happening every four years, has halved the mining reward the payment miners receive for confirming transactions on the network.

Moreover, a remarkable moment occurred in the Bitcoin network’s history at block height 840,000 during the halving, with a remarkable 37.7 Bitcoin (equivalent to $2.4 million) paid to the Bitcoin miner ViaBTC. This marked the highest fee ever recorded in the network’s 15-year existence.