FlowBank SA Declares Bankruptcy: FINMA Steps In to Protect All Clients, Including Crypto and Forex Investors

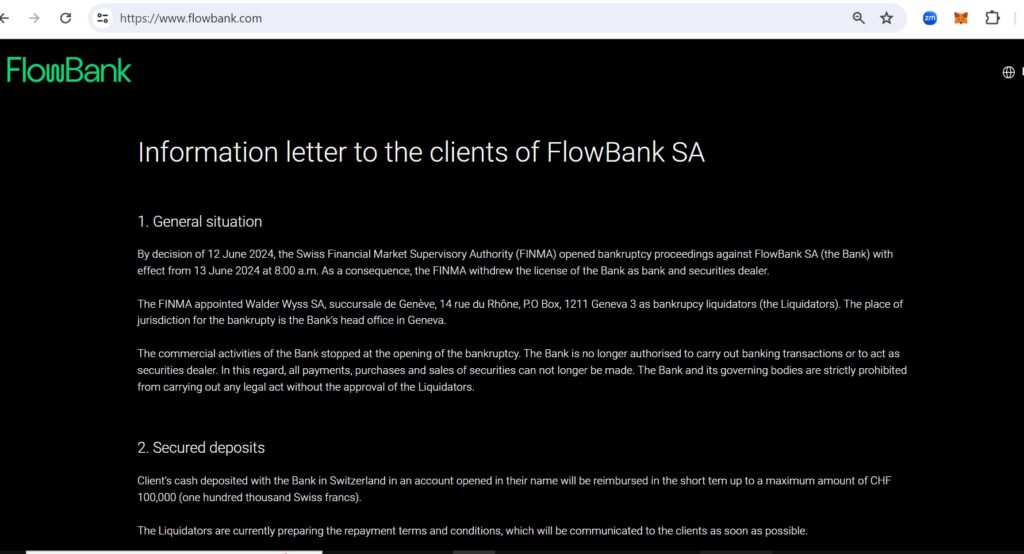

The Swiss Financial Market Supervisory Authority (FINMA) has initiated bankruptcy proceedings against FlowBank SA as of June 13, 2024. This drastic measure follows the bank’s failure to meet the required minimum capital for its operations, coupled with concerns of over-indebtedness. FINMA’s intervention aims primarily to protect depositors, ensuring that privileged deposits can be repaid in full using the bank’s available funds.

Background of FlowBank SA

FlowBank SA, headquartered in Geneva with subsidiaries in London and the Bahamas, has been a notable player in online brokerage and trading since its founding in 2020 by CEO Charles Henri Sabet. Despite its rapid expansion and innovative approach, the bank’s operations have been marred by significant regulatory breaches.

Regulatory Breaches and Enforcement Actions

Since October 2021, FINMA has been closely monitoring FlowBank SA due to serious breaches of supervisory law. The issues primarily revolved around non-compliance with capital requirements, inadequate organization, and poor risk management. Despite FINMA’s enforcement actions and the appointment of an independent auditor and later a monitor, FlowBank SA continued to fail in rectifying these deficiencies.

In June 2023, further enforcement measures were necessary due to ongoing breaches of the capital ratio and deficiencies in the bank’s organization. Additionally, FlowBank’s bookkeeping and financial reporting were found to be inaccurate and incomplete, and the bank entered into numerous higher-risk business relationships without proper due diligence, exacerbating its financial instability.

FINMA’s Intervention and Bankruptcy Proceedings

The decision to initiate bankruptcy proceedings was catalyzed by FlowBank’s inability to restore compliance with the law and the recent discovery of its significantly worsened financial situation. Despite previous efforts, the bank failed to carry out an eligible capital increase within the required timeframe, leading to a breach of minimum capital requirements as of the end of April 2024.

Uncertainty Surrounding Open Trading Positions and Leveraged Assets

A major concern for FlowBank’s clients is the status of their open trading positions, including leveraged assets and crypto trading investments. With the bank’s platform and all associated social media channels and applications currently inaccessible, clients are left in the dark about the fate of their investments. It is unclear whether these positions are lost or only partially recoverable. This lack of access and information has heightened anxiety among clients who rely on FlowBank for trading and brokerage services.

Protection of Depositors and Asset Repayment

FINMA’s primary focus during these proceedings is the protection of depositors. The appointed liquidator, Walder Wyss AG, will oversee the repayment of privileged deposits, up to CHF 100,000 per client. According to current assessments, these deposits can be fully covered by the bank’s available funds, negating the need for intervention by the Swiss deposit insurance scheme (esisuisse).

Client custody accounts will also be segregated from the bankrupt estate and transferred back to their respective owners, following the determination by the liquidator. The process of identifying custody accounts and transferring securities is expected to take several weeks.

Impact on Crypto Investments

FlowBank’s clients have raised concerns regarding their cryptocurrency investments. Whether these assets will be classified as custody assets to be segregated and returned, or treated as claims on the bank, will be determined by the liquidator on a case-by-case basis. The handling of these assets will follow the same procedures as other securities, ensuring that client ownership is verified and respected.

Conclusion

The bankruptcy of FlowBank SA underscores the critical importance of stringent regulatory compliance in the banking sector. FINMA’s decisive actions aim to mitigate the impact on depositors and ensure a systematic wind-down of the bank’s operations. As the proceedings unfold, the emphasis remains on safeguarding client assets and maintaining transparency throughout the process. However, the uncertainty surrounding open trading positions, leveraged assets, and crypto trading investments poses significant concerns that need urgent clarification to reassure affected clients.