McKinsey Forecasts $2 Trillion Tokenized Financial Market by 2030

In recent years, asset tokenization has emerged as a transformative trend in the financial sector, leveraging blockchain technology to digitize traditional assets. This shift promises to revolutionize how financial institutions operate, offering enhanced efficiency, transparency, and liquidity across various asset classes. McKinsey & Company’s recent report explores how tokenization is moving from experimentation to scalable deployment, offering insights into its benefits, challenges, and future projections.

Tokenization involves creating digital representations of assets on blockchain networks, enabling programmability and composability. This innovation allows financial institutions to streamline operations, reduce costs, and tap into new revenue streams through innovative use cases. Early adopters are already realizing these benefits, with the first at-scale applications transacting trillions of dollars monthly in tokenized assets.

Current Adoption and Market Projections

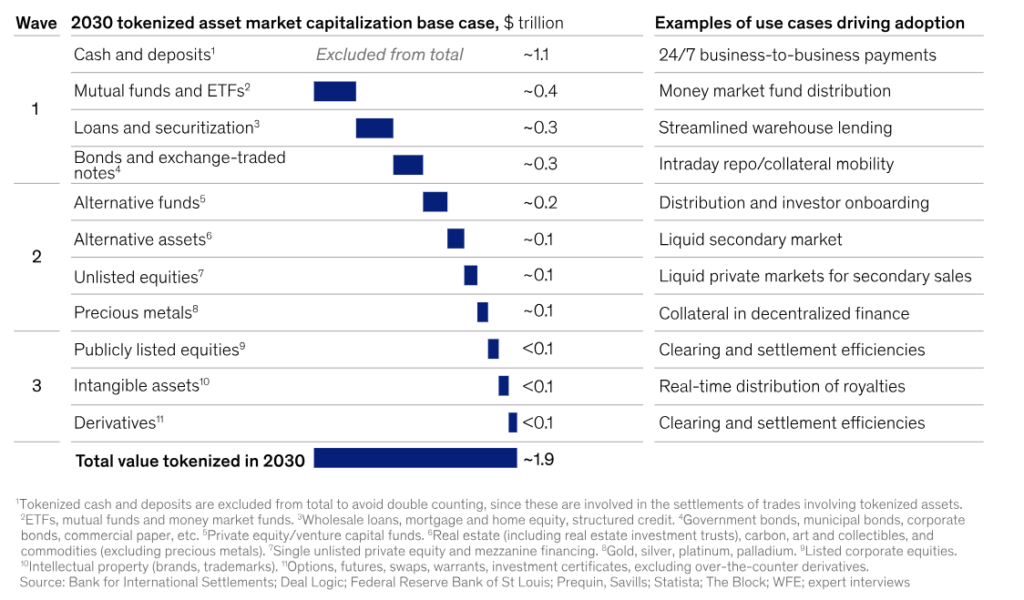

As of now, the tokenization of financial assets is gaining momentum, with early adopters leading the charge. McKinsey forecasts that the total tokenized market capitalization could soar to approximately $2 trillion by 2030. This estimate excludes cryptocurrencies and stablecoins, underscoring the robust growth anticipated in mutual funds, bonds, exchange-traded notes (ETNs), loans, and securitization. Optimistic scenarios suggest this figure could double to $4 trillion, highlighting the transformative impact of tokenization across diverse asset classes.

Challenges and Roadblocks

Despite its promise, broad adoption of tokenization faces several challenges. Modernizing existing infrastructure, especially in highly regulated financial sectors, poses significant hurdles. Coordination among stakeholders, regulatory clarity, and technological integration remain crucial for scaling tokenized solutions securely and compliantly. Overcoming these challenges will require concerted efforts and innovative solutions.

In light of this, McKinsey expects that tokenization will unfold in distinct phases: initially propelled by use cases demonstrating clear return on investment and existing scale. Subsequent phases will encompass asset classes with smaller current markets, less obvious benefits, or necessitating solutions to more intricate technical obstacles.

Sector-Specific Applications

Mckinsey report highlights sectors where tokenization is expected to have the most profound impact:

Mutual Funds and ETFs:Tokenized money market funds have attracted over $1 billion in assets under management, signaling demand from investors with on-chain capital in a high-interest-rate environment. Investors can choose from funds managed by established incumbents, such as BlackRock, WisdomTree, and Franklin Templeton, as well as Web3 natives such as Ondo Finance, Superstate, and Maple Finance. Tokenized money market funds will likely see sustained demand in a higher-interest-rate environment, potentially offsetting stablecoins as on-chain stores of value. Other types of mutual funds and ETFs could offer on-chain capital diversification to conventional financial instruments.

Loans and Securitization: Blockchain-based lending is in its early stages, but innovators are beginning to achieve notable success in this field. Figure Technologies, a major nonbank lender for home equity lines of credit (HELOC) in the United States, has originated billions in loans. Similarly, Web3 platforms like Centrifuge and Maple Finance, in collaboration with Figure and others, have overseen the issuance of over $10 billion in blockchain-based loans. Mckinsey expects wider adoption of tokenization in lending, particularly in areas such as warehouse lending and the securitization of on-chain loans.

Bonds and ETNs: The issuance of tokenized bonds has streamlined capital market activities, enabling faster issuance, fractional ownership, and global investor participation. Worldwide, the total notional value of tokenized bonds issued in the past decade exceeds $10 billion, a fraction of the $140 trillion in outstanding notional globally. Recent prominent issuers include Siemens, the City of Lugano, and the World Bank, alongside various corporations, government entities, and international organizations. Furthermore, blockchain-enabled repurchase agreements (repos) have gained traction, contributing to trillions of dollars in monthly transaction volume across North America. The issuance of digital bonds is expected to persist due to their promising scalability and minimal current barriers, fueled in part by the desire to stimulate capital market growth in specific regions.

Future Outlook and Recommendations

Looking ahead, McKinsey emphasizes the importance of strategic planning and collaboration among financial institutions, technology providers, and regulators. Establishing interoperable blockchain networks and addressing regulatory uncertainties are critical steps toward broader tokenization adoption. Early adopters stand to benefit from competitive advantages, including market share expansion and operational efficiencies.