Mastercard Enables Non-Custodial Crypto Spending in Partnership with Mercuryo

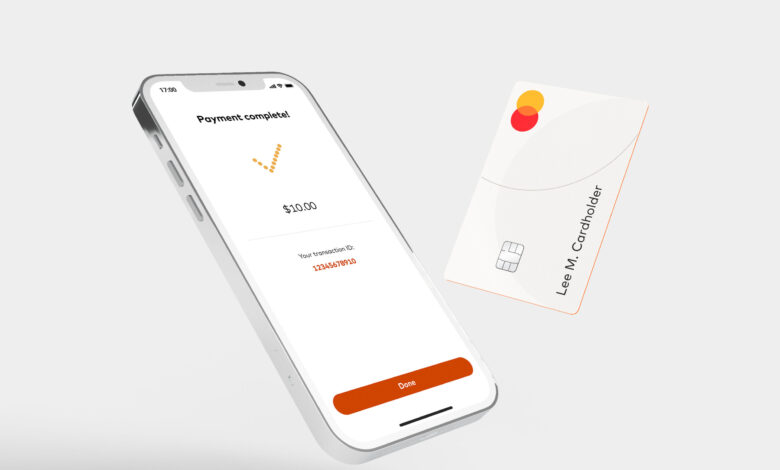

Mastercard is expanding its support for non-custodial cryptocurrency wallets through a new partnership that allows users to spend crypto while maintaining full control of their assets. Following its crypto debit card pilot with MetaMask in August, Mastercard has teamed up with European crypto payments provider Mercuryo to launch a euro-denominated debit card. This card enables users to spend cryptocurrencies like Bitcoin stored in self-custodial wallets at over 100 million merchants within the Mastercard network.

Self-custodial wallets give users complete control over their assets without relying on centralized platforms such as banks or exchanges. Christian Rau, Mastercard’s senior vice president for crypto and fintech enablement, emphasized the company’s commitment to improving the self-custody wallet experience.

“Through our collaboration with Mercuryo, we’re eliminating the traditional barriers between blockchain and conventional payments, providing consumers who want to spend their digital assets with an easy, reliable, and secure way to do so, anywhere Mastercard is accepted,” Rau said.

Mastercard has been expanding its presence in the crypto space since it first supported crypto on its network in 2021, collaborating with partners like Circle and Coinbase. Raj Dhamodharan, Mastercard’s head of blockchain and digital assets, noted that self-custody solutions aim to simplify the complex process of buying and selling crypto, which many users prefer to avoid through centralized exchanges.

However, Mastercard’s new Spend card by Mercuryo comes with associated costs, including a €1.60 ($1.80) issuance fee, a €1 ($1.10) monthly maintenance fee, and a 0.95% off-ramp fee charged by Mercuryo.