State Street Global Advisors Releases Report on Asset Tokenization in Capital Markets

State Street Global Advisors has released an insightful report exploring the transformative potential of asset tokenization in global capital markets. The report outlines how tokenization, the process of converting financial assets into digital tokens, could revolutionize market operations by making them faster, cheaper, more transparent, and accessible. However, it also emphasizes that widespread adoption will be gradual and vary significantly across asset classes.

The Promise of Tokenization

The report delves into the growing appeal of asset tokenization, noting its potential to streamline market processes. Some of the most promising benefits include near-instant settlement times, fewer intermediaries, reduced transaction costs, and improved market transparency. In addition, smart contracts, a key feature of tokenized assets, can automate complex financial processes like dividend payments or bond coupon disbursements.

Yet, despite these advantages, the report highlights that many of these benefits are dependent on a fully developed tokenization ecosystem, which will take time to materialize. Full adoption will require advancements in regulatory frameworks, technological scalability, and enhanced cybersecurity measures. Additionally, for investors and financial institutions, embracing tokenization means navigating significant operational and governance shifts.

Tokenization Across Asset Classes: Bonds Leading the Charge

One of the key takeaways of the report is the projection that asset tokenization will not impact all asset classes equally. Sectors such as bonds, money market funds, private equity, and commodities are expected to lead the transition. Private equity and bonds are forecasted to undergo the most significant transformation in the near term, with tokenization potentially reshaping their market structure and altering supply and demand dynamics.

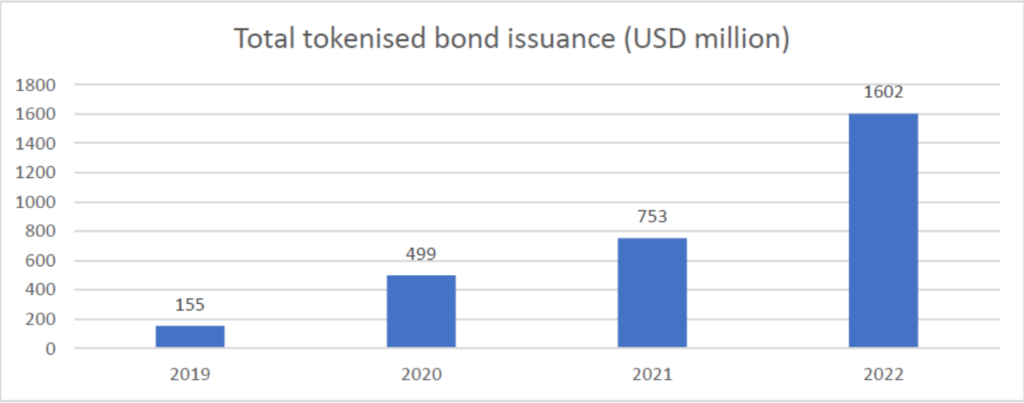

Tokenization in the bond market has already gained momentum due to its inherent competitive nature. Several financial institutions have partnered with blockchain administrators to manage cash flows more efficiently within their networks. This has laid the groundwork for a blockchain-based repo market, even though the challenge of integrating multiple blockchains remains.

Additionally, bond issuers are beginning to experiment with on-chain bonds. While these bonds may not yet be competitive with traditional bonds in terms of cost or speed, they offer other advantages, such as enhancing sustainability credentials through blockchain’s transparent and immutable ledger.

As of August 2024, over $15 billion in digital bonds have been issued across various sectors. Key examples include UBS (Switzerland), SBI (Singapore), and DBS (Japan) executing the world’s first live cross-border repo with a natively-issued digital bond in 2023, and the Hong Kong Monetary Authority’s record-setting $750 million digital bond issuance in 2024. Additionally, Quincy, Massachusetts, issued the first blockchain-native municipal bond in the U.S. in 2024, valued at $10 million. These examples highlight the increasing adoption of blockchain in bond markets globally.

Democratizing Access to Private Markets

Tokenization in private markets primarily aims to democratize access to an asset class traditionally reserved for institutional or high-net-worth investors, tapping into significant latent demand through improved back-office efficiency. Private market strategies encompass various products, including private equity, venture capital, hedge funds, and private credit. Key features of this asset class include high entry costs, low liquidity, and complex alternative strategies, which limit access primarily to wealthy investors.

Tokenization offers several benefits for fund managers and investors alike. For fund managers, it enables scalable distribution of shares to individual investors, reducing operational burdens and allowing for lower minimum investment amounts. This shift could expand the investor base and make private markets more accessible. For investors, tokenization can enhance liquidity through simplified ownership records and smoother settlement processes, potentially facilitating small transactions.

Current operational approaches to tokenization in private equity include tokenized feeder funds, hybrid funds, and DLT-native funds, the latter becoming more common as familiarity with distributed ledger technology grows. Despite the advantages, challenges remain, particularly around regulatory burdens and the risk of unsettling existing investors.

Limited Disruption and Niche Opportunities in Commodities Tokenization

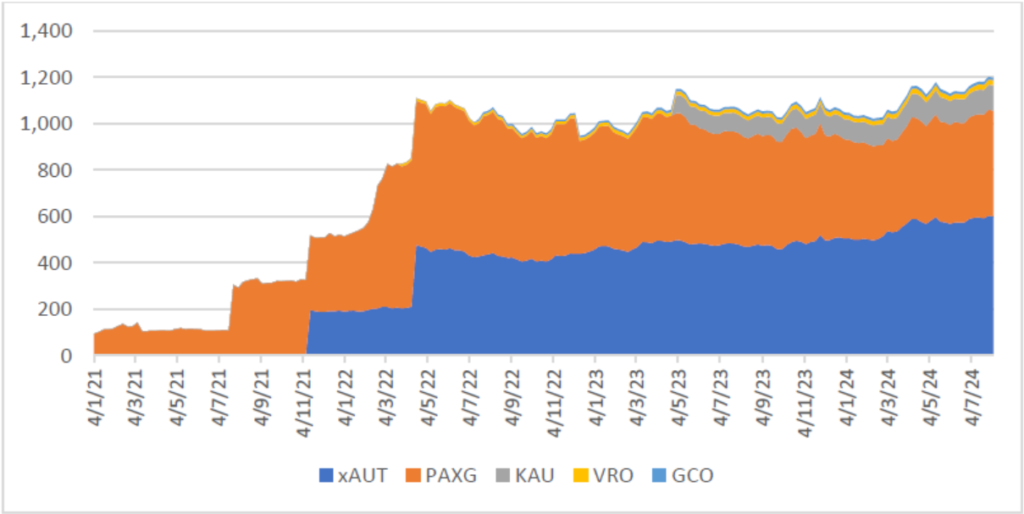

The commodities market, one of the oldest financial markets, depends on centralized exchanges for standardization. Tokenization is more likely to impact spot trading than derivatives, especially for hard commodities like gold, where tokens represent a physical asset. Gold tokens, already in use with over $1.2 billion in market capitalization, offer transparency and 24/7 trading, a potential alternative to ETFs.

For soft commodities, tokenization facilitates lending to agricultural producers by using digital tokens as collateral, improving access to capital in lower-income regions. While tokenized commodities could boost financial demand, broader adoption may be limited by regulatory challenges and systemic risks.

Tokenization in the commodities sector has seen various implementations, particularly in metals, energy, and agriculture. Examples include Paxos Gold, Tether Gold, and Perth Mint Gold Token, which are all physically backed at a 1:1 ratio in ounces. Similarly, DigixGlobal, GoldCoin, and Meld Gold provide physical backing in grams or fractions of ounces. In the energy sector, OILR is an oil-reserve-backed token that, although conceived in 2018, is still not live. In agriculture, Agrotoken serves as an agro-commodity token that can be used as collateral or for payments within a participant network. These examples illustrate the potential for tokenization in enhancing liquidity and efficiency within the commodities market.

Tokenization in Public Equity: Incremental, Not Transformative

Blockchain technology’s impact on public equity markets is expected to be gradual and modest, especially for larger companies. Key features of equities—such as indefinite maturity, relative simplicity, and poor collateral value—limit the transformative potential of tokenization. However, for smaller and midsize companies, tokenization could offer benefits like reduced issuance costs and the possibility of 24/7 trading with instant settlement.

Additionally, smart contract programmability may streamline corporate actions. While large stock markets operate efficiently in their current form, tokenization could create new opportunities for smaller companies to raise equity capital, though regulatory hurdles remain a significant barrier.

Tokenization in Real Estate: A Gradual Shift Toward Democratization

While the tokenization of real assets, such as real estate, is seen as revolutionary, the report suggests this shift may take much longer, particularly outside the fund structure. The complex legal and operational frameworks needed for fractional ownership of illiquid assets are likely to delay mass adoption in this space.

Tokenization in real estate aims to democratize access to the asset class, especially through passive investments like real estate funds. Real estate, with its high costs, non-standard properties, and intensive management requirements, makes tokenization more applicable to real estate funds than individual properties. Blockchain’s benefits—fractional ownership, enhanced transparency, and streamlined processes like registration—are more incremental than transformative.

Current progress includes tokenized real estate funds, crowdfunding for projects, and pilot initiatives in property registration. However, true fractional ownership of individual properties remains a distant prospect, requiring further technological and regulatory evolution.

Market Efficiency, New Models, and AI Integration

The report highlights how tokenization could lower barriers for issuers and investors, addressing inefficiencies that currently restrict market participation. This shift may lead to new economic models, such as expanded securitization of bundled assets and shorter-term bond market transactions, transforming capital markets.

In private markets, tokenization is expected to blur the lines between public and private assets, allowing for more agile asset allocation across geographies and asset classes. Additionally, the convergence of tokenization with AI could automate portfolio management and trading, enhancing efficiency, reducing costs, and improving productivity across the financial sector.

Despite the highlighted regulatory challenges and systemic risks associated with tokenization, like cybersecurity vulnerabilities and market over-concentration, the report remains optimistic that these challenges are surmountable with time and technological innovation.