Stablecoins Hold 2.5% of U.S. T-Bills: America’s Role as the Bank of the World Expands to Digital Assets

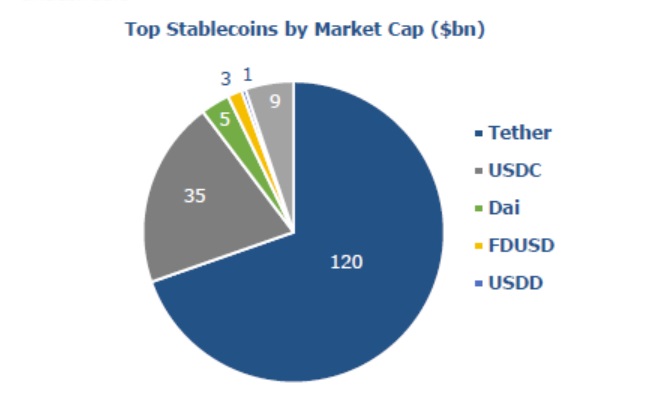

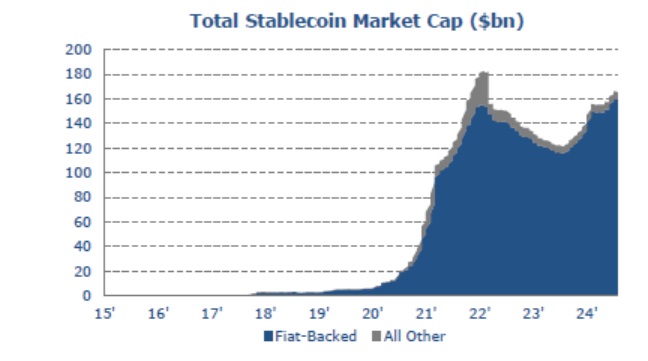

Stablecoins, digital assets pegged to traditional currencies, are rapidly transforming from niche cryptocurrencies into integral components of the global financial system. According to the October 2024 Treasury Presentation to the Treasury Borrowing Advisory Committee (TBAC), stablecoins now hold about 2.5% of U.S. Treasury bills (T-bills)—around $120 billion. This demand signals not only the growing intersection of digital and traditional finance but also how America’s historical role as the bank of the world is extending into the digital asset space.

How Stablecoins Strengthen America’s Financial Influence

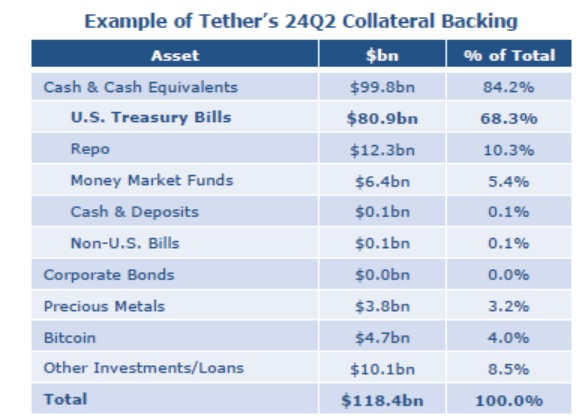

Stablecoins are designed to maintain a stable value by being backed by highly liquid assets, primarily U.S. dollars and Treasury bills. Fiat-backed stablecoins like Tether (USDT) and USD Coin (USDC) use T-bills to ensure stability, mirroring how foreign governments and financial institutions use U.S. dollar reserves. The October TBAC report highlighted that this demand for T-bills reflects how dollar-backed stablecoins are extending the U.S. dollar’s influence into new financial ecosystems, reinforcing America’s status as the world’s financial anchor.

Today, stablecoins are involved in more than 80% of crypto transactions and act as a key liquidity source in the decentralized finance (DeFi) world. By holding T-bills, stablecoin issuers help stabilize their assets and fulfill the needs of a rapidly growing market, linking America’s Treasury market with digital finance in a new way.

Implications of Stablecoin Holdings on the U.S. Treasury Market

- Increased Demand for Short-Term Debt

Stablecoin issuers purchasing T-bills as collateral provide steady demand for short-term U.S. debt. As stablecoin usage grows, this demand could increase, influencing Treasury issuance strategies and potentially encouraging more issuance of short-term debt to meet market needs. - Financial Stability Risks

While stablecoin demand supports the Treasury market, it also introduces risks. If a major stablecoin experiences a “run” due to a loss of confidence, issuers may be forced to liquidate T-bills quickly, potentially destabilizing the market. This interconnectedness could magnify market disruptions in both digital and traditional finance during periods of financial stress. - Reinforcing U.S. Dollar Dominance in Digital Finance

The TBAC presentation highlighted how stablecoins are reinforcing the dollar’s supremacy, not just in traditional markets but also across digital finance platforms. Dollar-backed stablecoins provide non-U.S. markets with a digital means to access dollar liquidity, reinforcing the U.S.’s role as the bank of the world. This influence could grow as more nations engage in the digital asset space, increasing reliance on dollar-pegged stablecoins for financial transactions.

Challenges Facing Stablecoin Markets and the Path Forward

As stablecoins become more entwined with the U.S. financial system, maintaining transparency and stability becomes crucial. Some of the primary challenges outlined in the October TBAC study include:

- Regulatory Uncertainty: The stablecoin market exists in a regulatory gray area in the U.S., prompting the need for a comprehensive framework to oversee these assets. Recent proposals highlight the U.S. government’s aim to mitigate risks while promoting innovation.

- Transparency and Consumer Protection: Transparency about reserve holdings is essential to maintain public trust in stablecoins. Inconsistent reporting across issuers could undermine confidence, prompting calls for stronger consumer protections and auditing requirements.

Future of Stablecoins and America’s Role in Global Finance

As stablecoins become a bridge between digital and traditional finance, they further solidify the U.S. dollar’s position in global finance. The TBAC report suggests that if stablecoin adoption continues to expand, this may influence both Treasury market dynamics and global perceptions of the dollar as a safe-haven asset. As the U.S. explores regulatory options, it must strike a balance between maintaining stability in both stablecoin and Treasury markets, all while embracing the opportunities stablecoins offer for global dollar accessibility.