The Promising Future of NFTs Remains in a State of Certainty

NFTs have exploded in 2021, with tens of billions of dollars worth of cryptocurrency invested in the asset class. In fact, it is hard to wrap one’s mind around paying thousands of dollars for a JPEG. However, enthusiasts do it for a reason.

According to Binance half-year report, NFTs have enabled the possibility of digital ownership and supported the evolution of Web 2.0 (a read-write economy) to Web 3.0 (a read-write-own economy). The ability to verify scarcity of digital assets for the very first time has the potential to spearhead a generational shift from physical to digital ownership.

Market Review

There is no doubt that there was an undeniable decline in trading this year. Nevertheless, the NFT market was resilient enough to face these harsh market conditions.

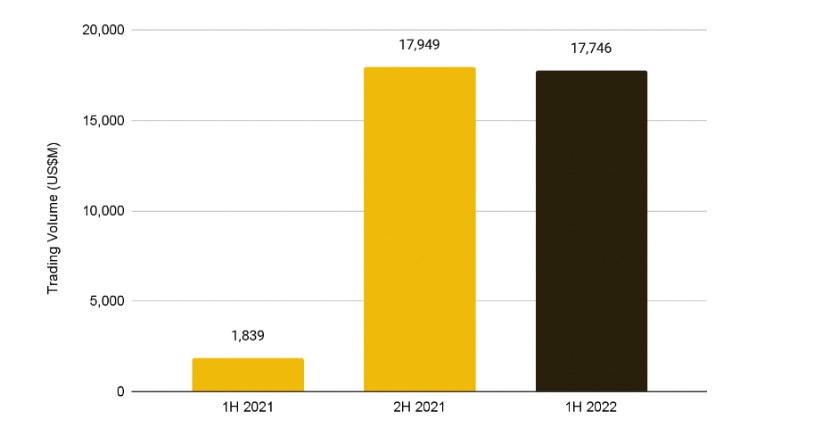

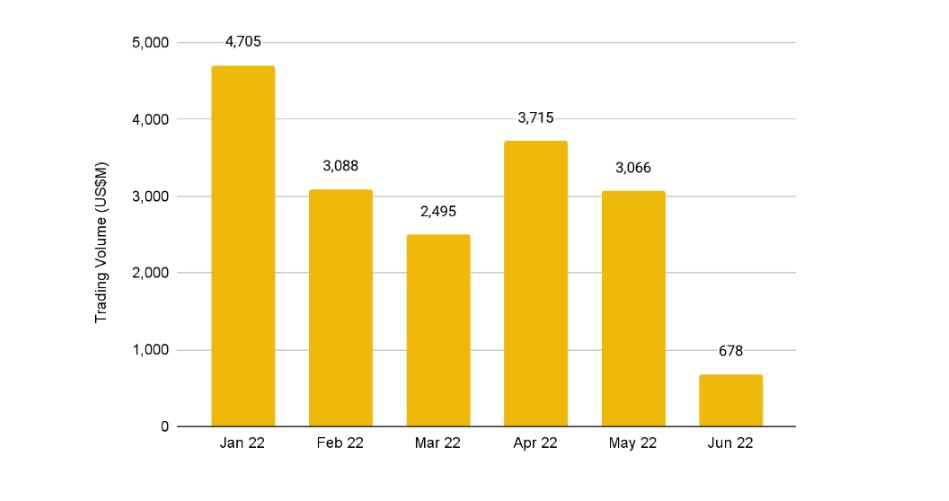

NFT sales recorded approximately US$17.7B in first-half 2022 (excluding wash trades), which is similar to sales recorded in second-half 2021. This is also a nearly 10x growth on a year-on-year basis when compared to first-half 2021. The bulk of the trading volume was front-loaded, with most sales being logged between January and May. Trading volume in June was approximately US$678M, a sharp drop of over 80% compared to the average monthly trading volume of US$3.4B from January to May, based on Binance report.

Looking at the graphs, one can notice that the first half did grow when it comes to unique buyers and number of transactions. However, there was a drop in average sale price, which is understandable, knowing that all cryptocurrency prices have hit rock bottom. This has affected the price of NFTs, but the market still seems promising.

NFT price performance

Based on Binance’s report, NFTs had a negative performance when measured in USD terms due to a fall in ETH prices. Yes, not all NFTs are based on Ethereum, yet the top 500 Ethereum NFT collections could give us a glimpse of this topic (>80% of secondary trading volume).

For the first half of 2022, the NFT-500 index returned -69.0% in USD terms, which is caused by the fall in ETH prices by -71.0% in the same period. Isolating the effects of the fall in ETH price, the asset class returned +8.3% when denominated in ETH. This is noteworthy considering the overall bearish market environment. This means that, if you had put your ETH to work by investing in NFTs instead of holding ETH, NFTs would have offset some of the losses of your portfolio.

However, NFT events in the second half of June such as the NFT.NYC conference, in addition to different acquisitions and fundraisers, helped in the increase of performance of the NFT index.

Some of these events include:

- Jan 2022: OpenSea acquired DeFi Wallet Firm Dharma Labs for an undisclosed sum.

- Mar 2022: NFT-scaling platform Immutable raised US$200M in a Series C round led by Singapore state investment fund Temasek at a US$2.5B valuation.

- Mar 2022: Yuga Labs acquired CryptoPunks and Meebits from Larva Labs for an undisclosed sum.

- Mar 2022: Yuga Labs raised a US$450M round from Andreessen Horowitz at a US$4B valuation.

- Apr 2022: Rario, a NFT platform for cricket, raised a US$120M Series A round led by Dream Capital.

- Apr 2022: OpenSea acquired NFT marketplace aggregator Gem for an undisclosed sum.

- Jun 2022: Immutable launches US$500M fund to finance projects building web3 games and NFT-focused companies.

- Jun 2022: Magic Eden raised US$130M at a valuation of US$1.6B

- Jun 2022: Uniswap acquired NFT marketplace aggregator Genie for an undisclosed sum.

- Jun 2022: eBay acquired KnownOrigin, a NFT marketplace for an undisclosed sum.

- Jun 2022: 1 confirmation launched a US$100M NFT fund.

NFT Aggregators

NFT aggregators have been on the rise for quite some time now. They basically allow traders to buy and sell NFTs across different marketplaces from a single platform. In other words, NFT aggregators are able to capitalize on such user behaviors by consolidating listings across different marketplaces and presenting the listings in one unified interface. They also bring additional value when it comes to allowing traders to buy a bunch of lowest-priced NFTs without having to visit every single marketplace individually.

The top aggregators Gem and Genie have seen significant growth with over 511,000 ETH in trading volume so far this year. That represents an approximately 21x increase compared to 2021. Market share of NFT aggregators has also grown from slightly over 1% at the end of 2021 to around 5%.

There is no doubt that NFT aggregators are still new, nevertheless, given the better user experience and ease of finding the cheapest NFTs all through one platform, the shift to using NFT aggregators is likely to continue. However, this shift might take some time to play out, as most NFT listings today originate from a small number of marketplaces (e.g. OpenSea, X2Y2, LooksRare), and it does not take much for a trader to check one or two exchanges before executing the trade.

NFTs and Ethereum

Yes, a multi-chain future is possible. Given the size and long-term growth potential of NFTs, it is not incomprehensible for more than one blockchain to succeed. Nonetheless, given the network effects of Ethereum, it is expected to remain the dominant blockchain for the foreseeable future. The advantage of a bustling NFT ecosystem with a large number of traders and high newsflow would likely put Ethereum in the shortlist for project teams that are looking to build the next blue-chip NFT project.

The security and decentralized nature of the Ethereum blockchain would also likely be an important consideration for teams that are looking to stay in the ecosystem in the long-run.

NFT minting

Minting NFTs has become a popular way to invest money in the last few months. According to an analysis by CryptoMonday, over 1 million unique wallet addresses spent 963,227 Ether (ETH), worth $2.7 billion, minting NFTs on the Ethereum blockchain in the first half of 2022. The majority of minting took place on OpenSea.io.

In the same period, $107 million worth of NFTs were minted on BNB Chain and $77 million on Avalanche. The two blockchains produced a total of 263,800 unique wallet addresses during NFT minting.

The number of unique NFTs is up significantly. Sixty-nine new NFT collections were launched on May 22 alone, resulting in a daily minting volume of over 120,000 ETH. During the first six months of the year (January 1 to June 30), 28,986 distinct NFT creations and sales were recorded. More than two-thirds of NFT projects raised less than 5 ETH, with 140 collections raising over 1,000 ETH. The top five NFT collectives on Ethereum accounted for 8.4% of overall minting. Pixelmon-Generation 1, Moonbirds, VeeFriends Series 2, Genesis Box, and World of Women Galaxy are just a few examples.

It is important to note that the cost of creating a regular NFT may range from $1 to $1,000. The price can be even higher for more sophisticated or popular NFTs, says TradingPlatforms.

NFT overflowing with believers

Chief Marketing Officer for Gate.io, Marie Tatibouet, just like many others, is optimistic about the growth prospects of NFTs in the future, according to TradingPlatforms.

During the Paris Blockchain Summit, she agreed with Kevin O’Leary of the television show Shark Tank on his belief that the NFT market has the potential to outperform Bitcoin (BTC) in market cap.

She said, “Absolutely. I believe this with 100% certainty because the NFT market can be so many different things. I really do think that, for example, all the art pieces will have NFTs or fractionalized NFTs as well associated with them. However, this might not happen right away, but sometime in the next ten years, I am almost certain it will.”

Andy Jassy, the CEO of Amazon Inc., also explained that the e-comm giant was not considering introducing crypto as a payment mechanism. Yet, he claims he might consider a future in which Amazon starts selling NFTs.

With the harsh market conditions at the moment, it is not surprising that NFT trading has dropped. However, when talking longer-term, the future of NFTs seems promising regarding digital ownership and the adoption of blockchain technologies, by covering different sectors of the real economy. This being said, every crypto and blockchain enthusiast is waiting for the market to recover, for bright days are yet to come.