CBDCGlobal News

Trending

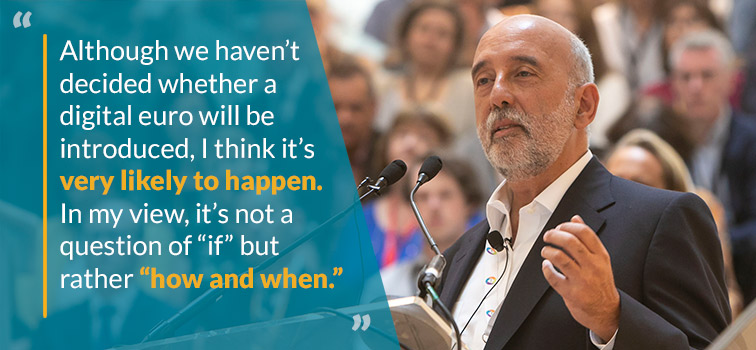

Central Bank of Ireland Governor says digital Euro is a question of how and when

In a recent Blog post by the Central Bank Governor of Ireland, Mr. Gabriel Makhlouf, he states that a digital Euro will be likely as it is not a question of if but how and when. He notes that a key objective of our work will be to preserve the public good that the euro currently provides to citizens (costless access to a simple, universally accepted, risk-free, trusted means of payment) while being ready for change in view of the decrease in cash usage and increased digitalisation.

He differentiates between digitization of oney and actual digital currencies noting that the introduction of a digital Euro would represent a fundamental shift in the financial architecture of the euro area (a blog from the IMF earlier this year gives a nice overview of some of the implications that could come with the introduction of digital currencies).

When it comes to crypto currencies he believes that the characteristics of money dont exist in Bitcoin. For him crypto has sub categories that include tokens, coins, stablecoins. As he states, “First, the anonymity they (tend to) offer has made them attractive to criminals (see the recent cyberattack on the Health Service Executive (HSE) in Ireland). Of course, cash also offers anonymity but it is much more difficult to manage large quantities of physical money than it is to transact in crypto. Second, there are well-documented concerns around the energy consumption used in the creation of some types of crypto. And third, there are also concerns around financial stability and consumer protection, which I will discuss in greater detail in a moment.”

He adds the negatives of crypto outweigh the beneits. But states “we shouldn’t ignore the positive elements of the underlying technology. Distributed Ledger Technology (DLT) is essentially a secure, decentralised record of information stored across a network and is a key piece of architecture for some types of crypto. It has the potential to reduce transmission costs in the financial system as it could eliminate the need for intermediaries in some transactions. It could also have applications for “smart” contracts, speeding up the specified actions in a contract once the agreed criteria are met. The use of DLT has increased in recent years – it certainly has potential – although it remains to be seen how widespread that will be.”

Risks are increasing as individuals consider putting some of their money into crypto (although at the moment it remains of limited relevance for the majority of the public). Aside from the risk of losing their money given the inherent riskiness of crypto, people may also be exposed to scams and fraud given the opaque nature of the products. The European Commission has proposed new legislation (Markets in Crypto Assets (MiCA)) which should provide greater legal certainty and consumer protection (and support financial stability). At the moment, there is no regulatory protection for consumers in the world of crypto.

He concludes, ” The financial landscape is changing and central banks are adapting to the change. Our work on a digital euro, the ongoing developments in the EU regulatory framework and wider international developments will help us to better understand the benefits and risks from introducing “real” digital currencies. More generally, as public policymakers, we have a responsibility to ensure that innovation serves the public interest, by providing clear rules to the innovators while at the same time engaging with a wide range of stakeholders – households, businesses, and the payments industry in particular – as we consider how the financial system of the future can operate in the best interests of the wider economy.”